- Peter Thiel sold his entire Nvidia stake as worries grow over an overheating AI market.

- Bitcoin ETFs are seeing major outflows, and crypto momentum is weakening.

- Bitcoin miners are shifting to AI and high-performance computing to stay afloat amid losses.

Billionaire investor Peter Thiel has sold all of his Nvidia shares, making one of the biggest pullbacks from the AI boom this quarter. His exit comes as worries rise that the AI market may be overheating.

At the same time, Bitcoin ETFs are seeing some of their worst withdrawals this year. As crypto markets lose strength, even Bitcoin miners are shifting toward AI and high-performance computing to stay afloat.

Thiel’s Exit Raises Questions About the AI Trade

New filings show that Thiel Macro LLC sold all 537,742 of its Nvidia shares in the July–September quarter, a holding that once made up 40% of the fund’s entire portfolio.

It also sold its 208,747 shares of Vista Corp, cutting its stock holdings from $212 million down to just $74.4 million. Tesla is now the fund’s biggest remaining position.

Nvidia has been the star of the AI boom, becoming the world’s first $5 trillion company in October and reporting a 56% jump in revenue to $46.7 billion. But concerns are growing that the AI market is overheating.

Others share this skepticism. Michael Burry, known for predicting the 2008 housing crash, has taken bearish positions linked to about 1 million Nvidia shares.

Related: Michael Burry Shorts Stock Market With $1.6 Billion Worth Put Options

In another unexpected move, SoftBank liquidated its entire $5.8 billion Nvidia stake to redirect funds into OpenAI. This adds to doubts about whether Nvidia’s valuation has run too far.

The Risk-Off Contagion: Bitcoin ETFs Bleed $1.1B

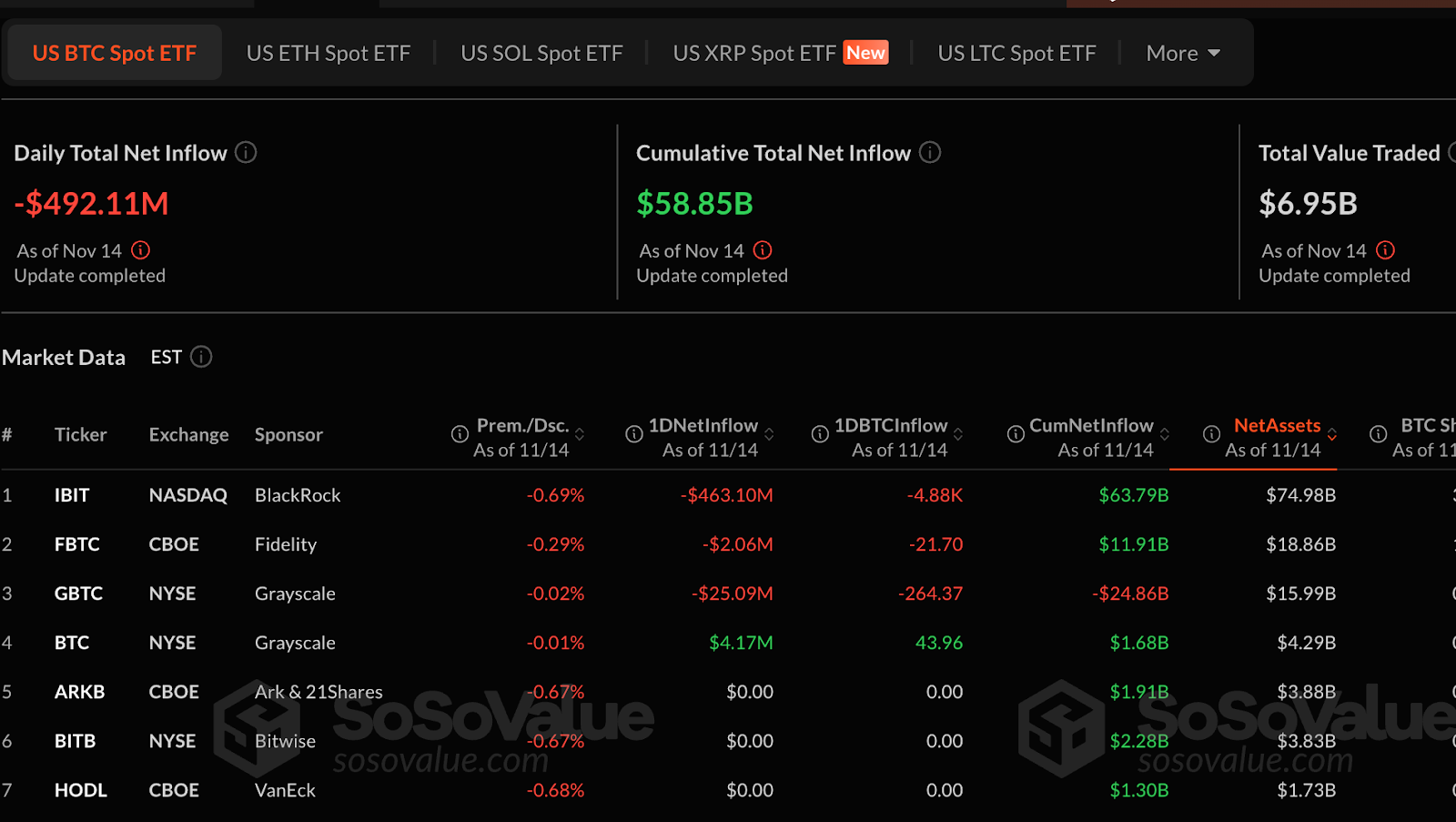

Notably, Thiel’s Nvidia exit comes as momentum in the crypto market is weakening. U.S. spot Bitcoin ETFs just saw $1.1 billion in withdrawals, their third straight week of outflows and the fourth-largest weekly drop ever.

Bitcoin fell nearly 10% over the past week to around $92,900, and Matrixport now warns the trend looks like the early stages of a “mini bear market.”

Their view is that weak ETF demand, long-time holders selling, and a lack of major macro catalysts leave Bitcoin stuck in place until the Federal Reserve’s next policy update.

Ethereum ETFs also saw significant outflows, but Solana stood out as the exception. Specifically, Solana ETFs have posted 13 straight days of inflows, even though SOL dropped 15% over the week.

Bitcoin Miners Flee to AI as Thiel Exits

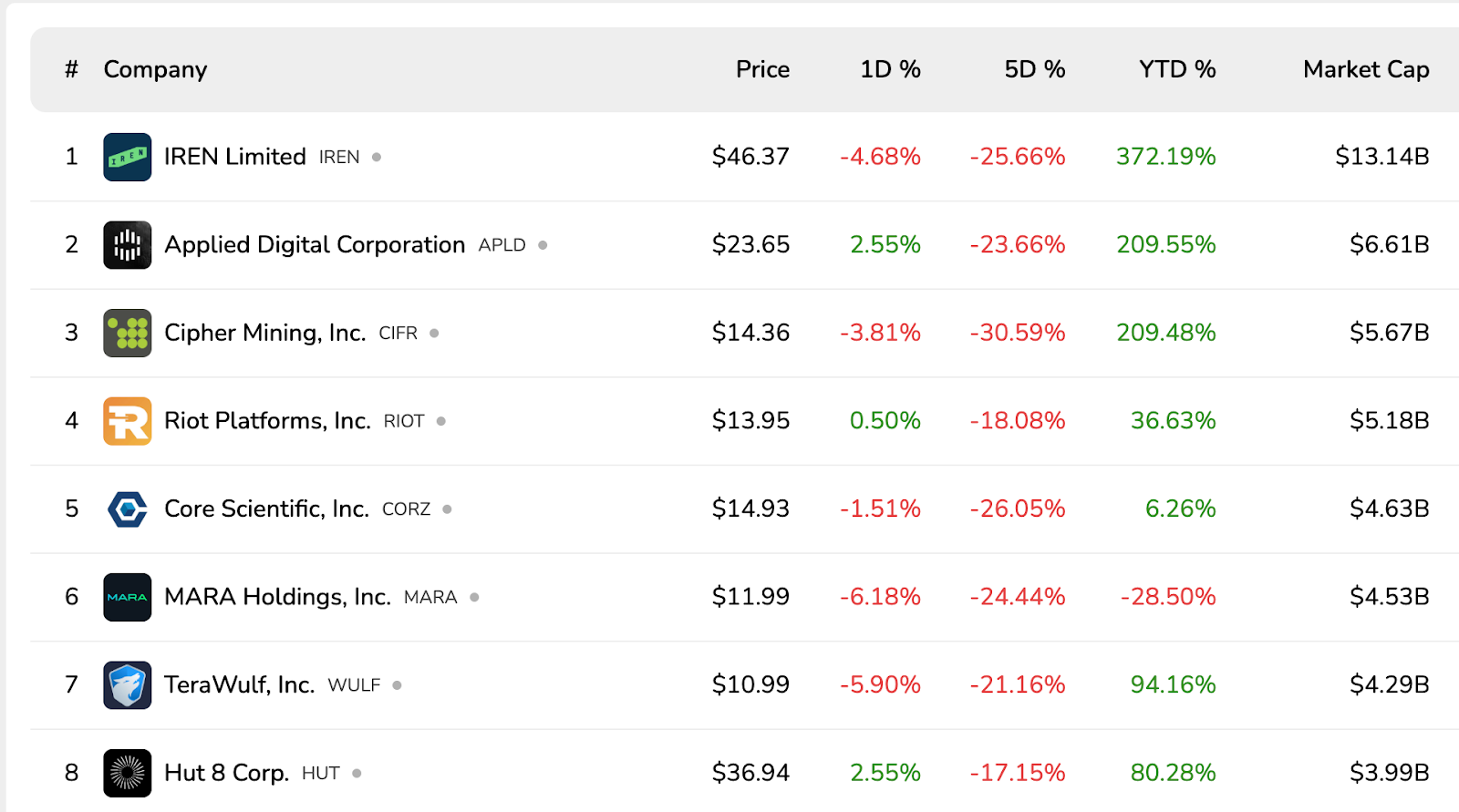

Public Bitcoin miners are in one of their toughest periods this year. Shares of companies like Cipher, Applied Digital, Bitdeer, and CleanSpark have fallen 23%–52% in a week. More than $20 billion in market value has been wiped out in a month.

The squeeze is accelerating miners’ shift into AI and high-performance computing. Bitfarms plans to end Bitcoin mining within two years and convert its sites to AI data centers.

Core Scientific landed a $3.5 billion AI cloud deal, and IREN secured a five-year, $9.7 billion agreement to host Nvidia GPUs for Microsoft. As miners lean on AI to survive, amid rising fears of an AI bubble, Thiel’s Nvidia exit looks timely.

What It Means for Crypto and AI Tokens

Thiel’s move doesn’t directly target crypto but signals a cooling of risk appetite across AI and digital assets. As confidence in AI mega-caps continues to wane, capital may rotate elsewhere or stay on the sidelines.

For AI-themed crypto tokens, rising demand for AI infrastructure is a positive, but concerns about frothy valuations could spill over. For Bitcoin, ETF outflows indicate softening institutional demand.

While bearish sentiment remains high, industry leaders like Tom Lee remain extremely bullish.

Related: End of “Free Money”: Rising Japanese Yields Threaten Global Markets and Crypto

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.