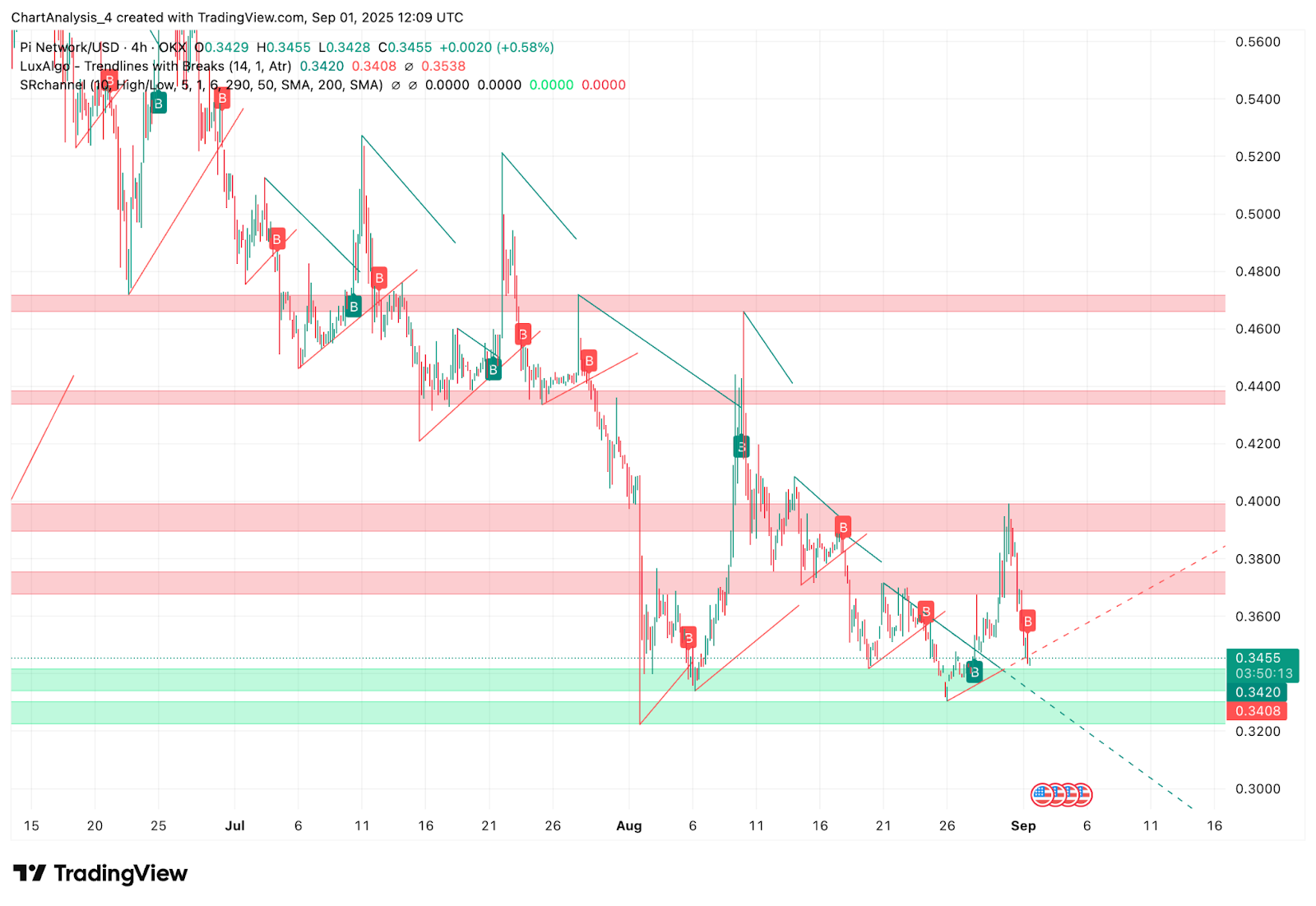

Pi coin is trading near $0.345 at the start of September, down after failing to hold above $0.38 last week. The PI price today sits at a pivotal zone, with tightening volatility and overlapping resistance zones signaling a decisive move may be nearing. Bulls are attempting to stabilize the token above the $0.34–$0.35 region, while bears continue to cap momentum at $0.37–$0.38.

Pi Price Prediction for September 2025

The broader monthly structure shows Pi coin locked in a descending trend since early summer. Every attempt to climb above the $0.40 barrier has resulted in swift rejection, with sellers defending aggressively at each rally. On the downside, the $0.32–$0.33 zone has emerged as a key demand block, cushioning declines across July and August.

This compression within lower highs and flat support has created a narrowing channel, suggesting that volatility expansion could soon dictate direction.

Related: Official Trump (TRUMP) Price Prediction for September 2025

EMA and Bollinger Bands highlight pressure zones

Pi trades below its short- and long-term exponential moving averages. The 20 EMA at $0.359 and 50 EMA at $0.363 are immediate barriers, while the 100 EMA near $0.380 and 200 EMA close to $0.398 reinforce higher resistance. Until bulls reclaim at least the 20/50 EMA cluster, upside conviction will remain fragile.

Bollinger Bands on the 4H chart are narrowing again, with price hugging the lower band at $0.336. This often precedes a breakout move. A reclaim of the mid-band near $0.36 could allow a retest of the upper band at $0.38–$0.39, while further rejection keeps $0.33–$0.32 in focus.

Related: Cardano (ADA) Price Prediction for September 2

Supertrend and DMI point to cautious sentiment

The daily Supertrend indicator prints bearish, holding firm resistance at $0.40. Any rally stalling below this level risks keeping sellers in control through September.

Meanwhile, the DMI shows a muted setup. ADX sits weak near 19, suggesting momentum is low. The +DI at 24.9 remains above -DI at 14.0, hinting at slight bullish bias, but the lack of strong trend signals traders are hesitant to commit to larger positions.

What to expect from Pi price this month

If Pi coin holds above $0.34 in early September, a recovery toward $0.36–$0.38 is possible. A breakout above $0.38 would be the first meaningful sign of bullish control, opening room toward $0.40 and $0.42.

However, repeated failures at $0.37–$0.38 could invite sellers back, dragging the price into the $0.33–$0.32 demand block. If that level breaks, deeper losses toward $0.30 cannot be ruled out.

Related: Ethereum (ETH) Price Prediction and Analysis for September 2

Can Pi coin price hit $0.40 this month?

Yes, Pi coin could retest $0.40 if bulls secure a close above $0.38 and reclaim the 50/100 EMA cluster. This would confirm buyer strength and potentially trigger a short-term rally to $0.42.

Still, the probability hinges on market sentiment and Bitcoin’s direction. A weak broader crypto environment could keep Pi capped under $0.38, making a $0.32 retest more likely than a breakout.

Conclusion

The Pi coin price prediction for September 2025 reflects a market at crossroads. With resistance stacked at $0.38–$0.40 and strong support at $0.32, the month’s outcome will depend on which side of this range breaks first. A close above $0.38 opens bullish continuation, while a slip under $0.32 risks new lows. Traders should watch the $0.34–$0.38 pivot zone closely for clues on Pi’s next direction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.