- 86.2% of Binance users have voted to list Pi Network (PI) on the exchange.

- PI price shot up 20% in the past day and the token trades at $1.87 at press time.

- Pi debuted the Open Network last week providing external connectivity.

Pi Network (PI) launched its Open Network a few days back, hitting a new milestone and keeping investor interest high with impressive price jumps.

Just yesterday, the altcoin jumped 20% and is currently trading at $1.87, CoinMarketCap data affirms.

Open Network Expansion and Binance Listing Potential

The Open Network adds external connectivity, allowing Pi users (called Pioneers) to connect with other compatible blockchain networks, increasing its real-world uses, according to their blog post. What’s interesting is a listing on major crypto exchange Binance could give a huge user base access to the PI coin.

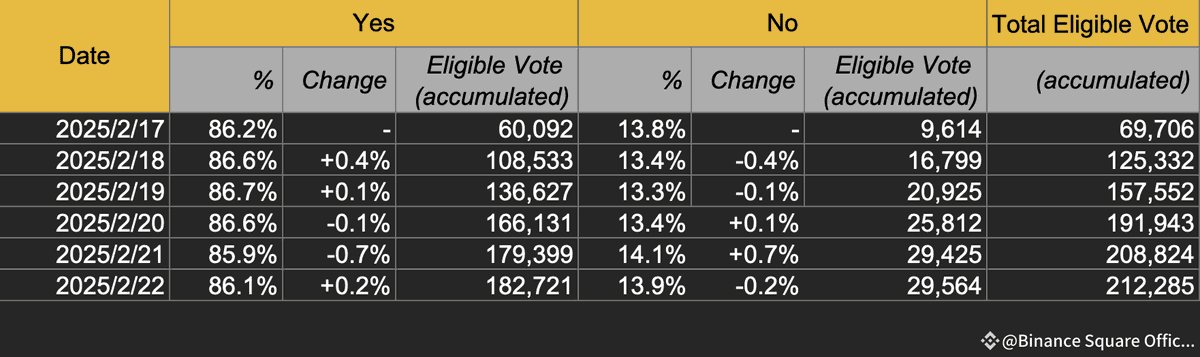

As pointed out in a post on X (formerly Twitter) by “MOON JEFF,” community voting for a Binance listing of PI wraps up in two days.

Right now, 86.2% of eligible users voted yes to listing PI on the exchange. If a listing happens, it could really help PI’s liquidity, draw in more investors, and maybe push the price to new highs.

Pi Price Analysis: Symmetrical Triangle Breakout

If you look at PI’s 15-minute chart, a symmetrical triangle has appeared. This pattern, which shows up after a big price wave, signals a time of stabilization before a major price move. The breakout already took place, lifting PI 22.95% higher from the triangle’s resistance.

If this positive momentum keeps going, PI could aim for $2.00-$2.20 soon. However, if sellers step in, the asset might test the $1.59 support level again before another possible breakout.

RSI Indicates Overbought Conditions

Looking at the hourly chart, the Relative Strength Index (RSI) for PI shot above 85, meaning PI is currently overbought. This suggests while the uptrend is strong, a short-term price dip is possible.

Related: Pi Coin’s 169% Breakout: Analyst Targets $3.78 – Find Out How

Also, PI’s price is testing the upper Bollinger Band, further showing the overbought situation. If it breaks above resistance at $1.90, it could start another move up. On the flip side, the closest support levels are at $1.67 and $1.44.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.