- Pi Network struggles to break $1.20 resistance despite a bullish price trend.

- Falling trading volume raises concerns about PI’s short-term market momentum.

- Exchange resistance and KYC deadline add uncertainty to PI’s price outlook.

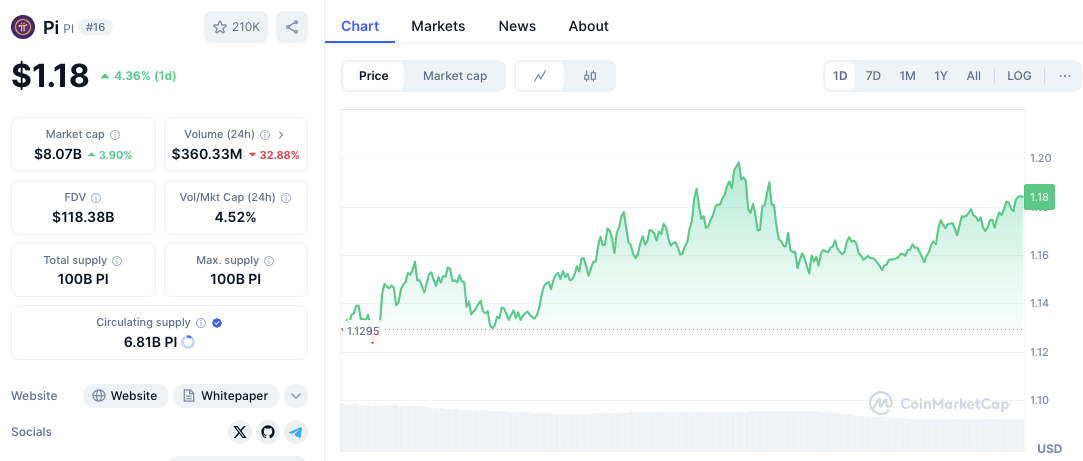

Pi Network (PI) has shown some fight in its recent price action, but it’s heading into a critical resistance level around March 21st. Right now, the token sits at $1.18, which is a 4.79% jump over the last 24 hours.

Even with this price bump, the amount of PI traded in the last 24 hours has dropped by a significant 32.90% to $361.2 million. This dip in trading activity might mean that market players are being a bit cautious.

On the other hand, the total value of all PI out there (market cap) has risen by 4.34% to $8.06 billion, suggesting that overall investor confidence is still holding up.

Key Levels for PI Traders to Watch

For traders keeping an eye on PI, there are some important price levels to note. The strongest area of support seems to be around $1.12, which was the lowest point recently. There’s also another support zone between $1.14 and $1.15, where the price has often consolidated before making upward moves.

According to CoinMarketCap, the big challenge right now is the $1.20 resistance level. If the price can break above this with strong trading activity, then the next target could be the $1.22 to $1.25 range.

Related: Pi Network (PI) Price Crash: Token Unlock and Binance Uncertainty Weigh Heavy

Market Sentiment and Potential Price Movement

Pi coin’s price is making higher highs and higher lows, which usually points to an uptrend. However, the fact that trading volume has dropped off sharply could mean that the upward momentum might be losing steam. If buyers step in strongly and push the price above $1.20, we could see a further rally past $1.25.

On the flip side, if PI can’t keep up the upward push, it might fall back down towards the $1.12 – $1.14 support area. Right now, market sentiment seems split, with some traders betting on a surge while others are predicting a potential drop towards the $1.00 mark.

Why Are External Factors Important for PI’s Price

Several things happening outside of just trading could impact where PI’s price goes in the next few days.

The deadline for completing the KYC (Know Your Customer) verification process was on March 14th, and this might have created some uncertainty in the market. Users who didn’t get verified risk losing their mined PI tokens, which could lead to some selling pressure.

Related: Pi Network Price Plunge: What’s With the Pi Coin’s Wild Price Swings?

Also, the fact that major cryptocurrency exchanges haven’t listed PI is weighing on sentiment. Even though the community on Binance voted overwhelmingly (86%) in favor of listing it, they haven’t done so yet.

Similar big exchanges like Coinbase, Kraken, and Bybit have also stayed away from the token. This lack of major exchange listings could limit how easily people can buy and sell PI, which in turn could cap its potential price growth.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.