- Pi Network has been listed on Onramp Money, adding a major fiat on-ramp for users in over 60 countries

- The project’s long-term strategy is gaining traction, with a new Pi Network ETP launching in Europe

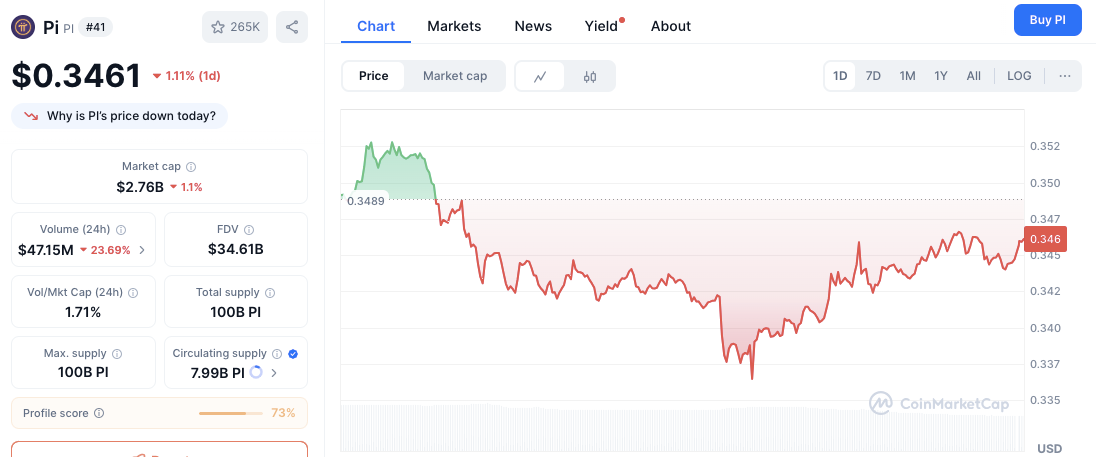

- Despite bullish news, the Pi coin price is down 4% and testing critical support at the $0.336 level

Pi Network has secured a major fiat on-ramp with a listing on Onramp Money, massively expanding its global reach to over 60 countries. But while the project’s long-term adoption strategy is gaining institutional traction, the Pi coin itself is struggling, with the price stuck near a critical support level.

The Bull Case: A Focus on Adoption, Not Speculation

The bull case for Pi Network has always been its unique, long-term strategy of prioritizing real-world utility over speculative hype.

What is the new Onramp Money partnership?

The Onramp Money deal opens up a huge number of new payment channels for users to buy Pi with their local currencies, including Alipay, GCash, and Maya. This is a major step in expanding the project’s global footprint.

Besides expanding access, the listing improves liquidity by connecting fiat directly to Pi. It follows Pi Network’s carefully managed adoption strategy, which avoids flooding centralized exchanges with tokens.

Instead, the project distributes coins through KYB-approved partners like Onramp, Banxa, and TransFi. Together, these platforms operate in more than 100 countries and support over 170 payment methods.

Is institutional money taking notice?

Yes. The recent launch of the first Pi Network exchange-traded product (ETP) in Europe highlights a growing confidence in the project’s controlled, compliance-focused rollout.

Related: PI Remains Missing on Coinbase and Binance: An Analyst Explains Why

Dr Altcoin, an analyst, argue that Pi Network is prioritizing long-term ecosystem growth instead of short-term price gains. The decision to supply tokens only through approved partners reflects a model built for compliance and utility. Consequently, the network encourages users to engage in peer-to-peer transactions, app-based services, and real-world commerce, rather than speculative trading.

The Bear Case: Pi’s Chart Flashes Warning Signs

The big question for traders is whether any of this fundamental news matters for the price chart, which currently looks weak.

What are the key price levels to watch?

Despite the listing milestone, Pi’s market performance remains weak. The token trades near $0.345, down over 4% on the day. Volume has also decreased, suggesting reduced investor activity. Technically, the coin faces strong resistance around $0.350, with deeper resistance near $0.355.

Related: Pi Price Jumps 10%: A Bigger Rally Next?

On the downside, $0.336 has emerged as critical support. A breakdown below this level could accelerate losses toward $0.330.

Indicators such as the MACD remain bearish, though momentum appears to be softening. The RSI at 43 suggests neutral-to-bearish sentiment, leaving room for either consolidation or reversal.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.