- Pi Network trades near $0.26, pressured by descending channel and weak sentiment.

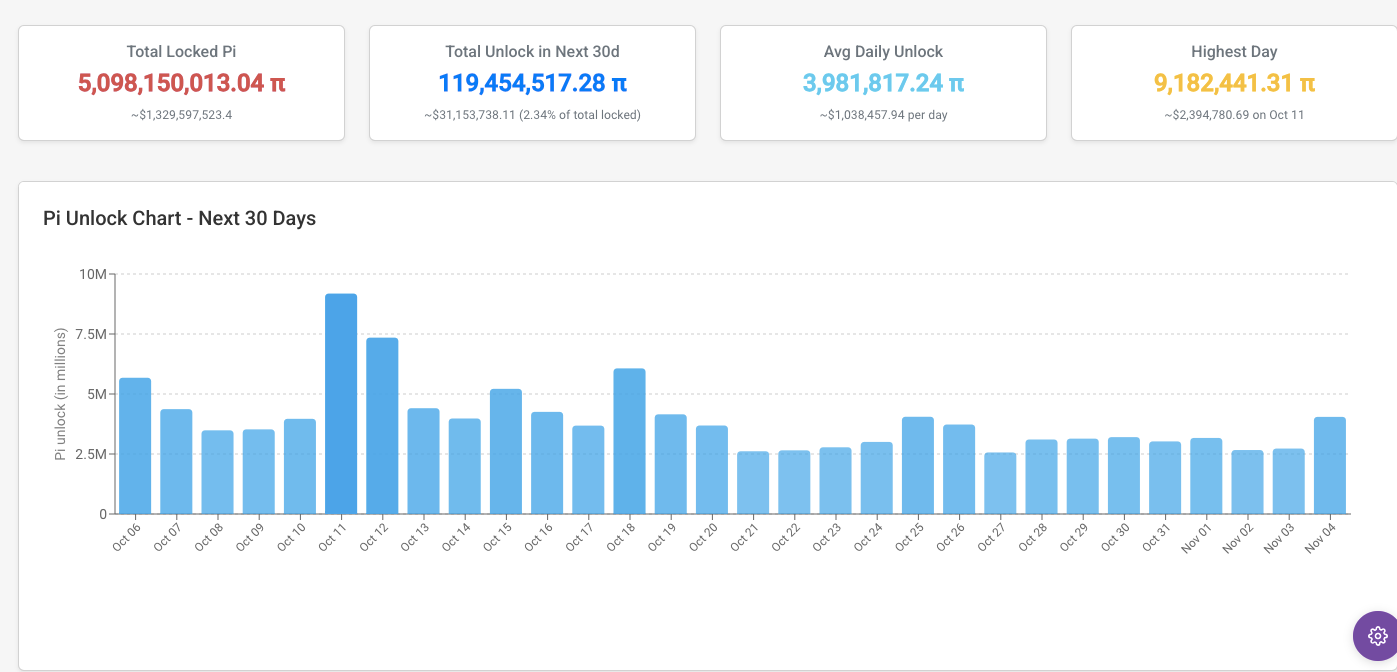

- Oversupply risk rises as 119.4M PI unlocks this month, pressuring short-term price.

- RSI near 30 signals oversold, but rebounds struggle without strong buying volume.

Pi Network (PI) continued its downward trajectory today, extending its recent losing streak amid renewed supply pressure and weak market sentiment. The token traded at $0.2605 after shedding 0.11% in the past 24 hours, while its seven-day decline stood at 2.08%.

With a circulating supply of 8.2 billion PI, Pi Network’s market capitalization now hovers around $2.14 billion. Despite steady trading volume at $22.5 million, the broader structure still points to sustained bearish pressure.

Price Structure and Key Levels

Pi Network’s chart continues to show a well-defined descending channel that has persisted since April. The token has repeatedly tested both the upper and lower boundaries of this channel, suggesting strong resistance against any bullish breakout. The current trading zone near $0.26 remains close to the lower band, where buyers previously attempted to defend losses.

Immediate support lies near $0.185, marking the base of the channel and the lowest Fibonacci retracement level. A breakdown below this threshold could open the way toward new multi-month lows.

Related: Litecoin Price Prediction: Bulls Hold Ground Above $118 Despite ETF Delay

On the upside, the first recovery target sits around $0.30, aligning with the channel’s midline. A move beyond that resistance could trigger a short-term rebound toward $0.535 and potentially $0.93, corresponding to the 0.236 and 0.5 Fibonacci levels respectively.

Momentum and Market Reaction

Technical momentum indicators also underline weakness. The Relative Strength Index (RSI) currently sits around 30, signaling that the token is oversold.

Historically, this zone often precedes brief relief rallies, however, such rebounds have struggled to hold without fresh demand catalysts. For sustained recovery, Pi must reclaim the upper boundary of the descending channel with strong volume confirmation.

Moreover, the recent reopening of PI withdrawals on OKX sparked unexpected pressure. Within 24 hours, over 15.7 million PI tokens were withdrawn, yet prices failed to recover. This pattern suggests traders are repositioning for potential short-term declines rather than accumulation.

Unlock Schedule and Oversupply Risk

In the next 30 days, approximately 119.4 million PI tokens, worth over $31 million, will unlock according to PiScan data. The daily unlock average stands near 3.98 million PI, with the largest event of 9.18 million PI expected on October 11.

Related: Shiba Inu (SHIB) Price Prediction: Analysts Track Breakout From Key Triangle

Technical Outlook for Pi Network (PI) Price

Key levels remain clearly defined heading into October.

- Upside levels: $0.30 (mid-channel resistance), $0.535 (0.236 Fib), and $0.93 (0.5 Fib). A confirmed breakout above $0.30 could accelerate momentum toward $0.535.

- Downside levels: $0.22 minor support, $0.185 (channel base and 0% Fib), followed by $0.165 if selling deepens. The zone near $0.185 remains critical to prevent a structural breakdown.

- Resistance ceiling: The upper boundary of the descending channel near $0.35 acts as the major level to reclaim for a medium-term bullish shift.

- Technical picture: PI continues to trend within a descending channel since April, reflecting sustained selling pressure and weak buyer participation. The RSI near 30 highlights oversold conditions, but recovery attempts have repeatedly stalled below $0.30.

Will Pi Network Rebound in October?

The October outlook hinges on whether buyers can defend the $0.185–$0.22 range amid heavy token unlocks. Market data shows roughly 119.4 million PI tokens are set to enter circulation this month, posing short-term supply pressure.

Related: BNB Price Prediction: BNB Holds $1,200, Eyes $1,300 Breakout

If the price holds above $0.22 and breaks $0.30 with solid volume, a relief rally toward $0.535 could emerge. However, failure to maintain support at $0.185 may expose PI to deeper losses and new cycle lows.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.