- Pi holds key Fibonacci levels as price coils within tightening consolidation range.

- Upcoming token unlocks raise short-term volatility risks as supply expands steadily.

- App Studio upgrades enhance developer flexibility and fuel continued ecosystem growth.

Pi Network is attempting to stabilize after a strong surge earlier in the month, with price action now caught in a narrow range that traders are watching closely. The asset pulled back from the recent peak and now moves near the mid-range around $0.227. The broader market remains uncertain, yet Pi continues to defend important Fibonacci levels from the last rally.

Price Holds Crucial Fibonacci Range

Pi trades between two clear boundaries, creating a tightening consolidation structure. The $0.216 support, which aligns with the 0.618 Fibonacci level, remains the strongest floor. Buyers returned to this zone several times and protected it with consistency.

However, the $0.237 resistance level, which matches the 0.382 Fibonacci marker, limits upward movement. The broader chart reflects reduced volatility because the Bollinger Bands continue to contract.

Additionally, the price reclaimed the nine-day EMA and the Bollinger mid-band. This signals early strength, although a breakout remains undecided. A move above $0.237 could attract momentum toward the $0.26 area. The broader target remains the $0.297 swing high, which set the tone for the last rally. Conversely, losing $0.216 may create pressure toward $0.20.

Supply Unlocks Shape Short-Term Outlook

The network’s distribution cycle adds another dimension to the analysis. Over 5.03 billion Pi tokens remain locked, valued at about $1.14 billion.

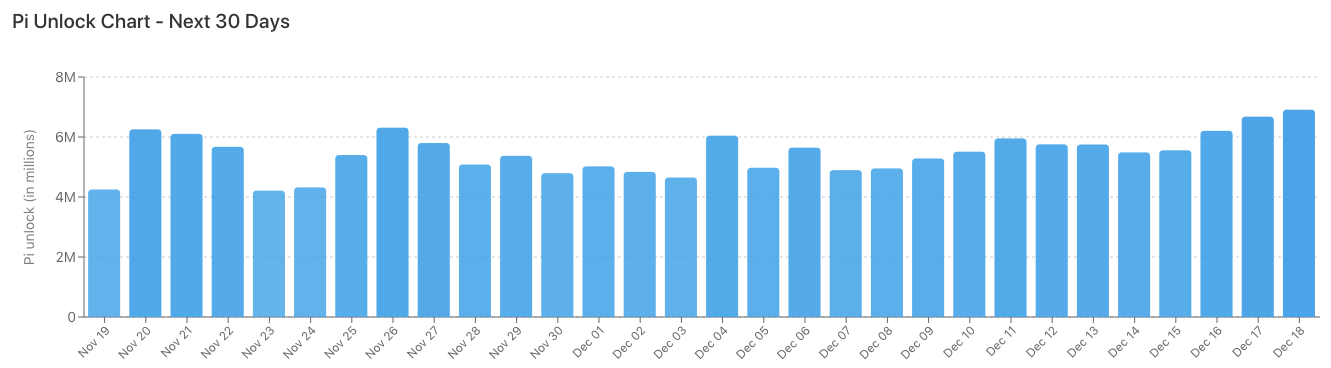

Moreover, the network expects about 163.65 million Pi to unlock in the next 30 days. This equals roughly 3.25 percent of the locked supply. Daily unlocks may average 5.45 million Pi, worth about $1.24 million.

Consequently, the largest scheduled release lands on December 18, when over 6.9 million Pi will become available. These unlock patterns shape short-term sentiment because supply expansion often influences intraday volatility.

App Studio Upgrade Supports Future Development

Pi Network also rolled out upgrades to Pi App Studio. The platform now allows creators to download existing app code and upload revised versions.

Hence, creators gain more flexibility, while developers can build advanced prototypes without friction. The changes also include improved project management, new sorting tools, and a broader app creation limit of up to 100 projects.

Related: Starknet Price Prediction: STRK Holds Breakout Zone As Buyers React To $3M Spot Inflows

Moreover, these updates strengthen Pi’s ecosystem by encouraging faster experimentation. The platform continues to pursue features that make development more intuitive, which may support long-term adoption as activity grows.

Technical Outlook for Pi (PI) Price

Key levels remain clear heading into the next trading phase, with Pi holding a tight consolidation zone.

Upside levels sit at $0.237, $0.266, and $0.297, forming the immediate hurdles for any short-term breakout attempt. A move above these zones could extend toward the $0.26–$0.27 cluster, where prior rejection points remain active.

Downside levels include the $0.216 support at the 0.618 Fibonacci zone, followed by $0.195 and the structural low at $0.167. The $0.237 region, which aligns with the first major retracement barrier, acts as the resistance ceiling Pi must flip to establish medium-term bullish momentum.

The technical picture suggests Pi is compressing between the $0.216 and $0.237 boundaries, forming a narrowing equilibrium. A decisive breakout above the upper band may trigger volatility expansion, especially if volume strengthens. Conversely, a breakdown below $0.216 risks shifting control to sellers and exposing deeper supports around $0.20 and $0.195.

Outlook: Will Pi Move Higher?

Pi’s near-term direction depends on whether buyers can protect $0.216, which has repeatedly acted as the anchor of the current structure. Holding this floor increases the probability of a retest of the $0.237–$0.266 cluster, where a breakout could reclaim bullish momentum and open the path toward the $0.297 swing high.

However, losing $0.216 may erode market confidence and expose Pi to the lower retracement zones. For now, Pi remains in a pivotal zone where compression, historical behavior, and incoming unlock cycles all point toward heightened volatility ahead. The next leg depends on conviction flows and a confirmed break of either boundary.

Related: Internet Computer Price Prediction: ICP Holds $5 Support as Futures Leverage Surges

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.