- Pi Network consolidates after 78% rally as traders eye $0.262 key support zone

- Upcoming 121.5M token unlock may test Pi’s bullish momentum and price stability

- Automated KYC expansion boosts Pi Network growth ahead of crucial breakout phase

The Pi Network (PI/USDT) has drawn attention with its recent sharp rally, followed by an early-stage pullback. After rising from $0.167 to $0.297 within two days, the token has now cooled near $0.265. The move represents a strong bullish reversal on the 4-hour chart, but smaller candlesticks and longer wicks indicate that investors may be taking profits after the rapid surge.

Bullish Momentum Faces Temporary Pause

Pi’s latest chart pattern suggests a brief consolidation before another potential upside move. The $0.262 level, aligned with the 0.236 Fibonacci retracement, currently acts as short-term support.

If the token holds above this level, momentum could remain positive toward $0.271 and $0.297. However, a break below $0.262 may send the price toward the next Fibonacci zones at $0.232 and $0.216.

The exponential moving averages (EMA 20/50/100/200) at $0.239, $0.225, $0.223, and $0.240 confirm that the price remains above all key averages. This setup reflects early signs of a mid-term uptrend. Besides, the SuperTrend indicator, which turned bullish near $0.215, recently displayed a short-term “SELL” alert at $0.271, hinting at temporary resistance before the next move.

Upcoming Token Unlock Could Influence Price Action

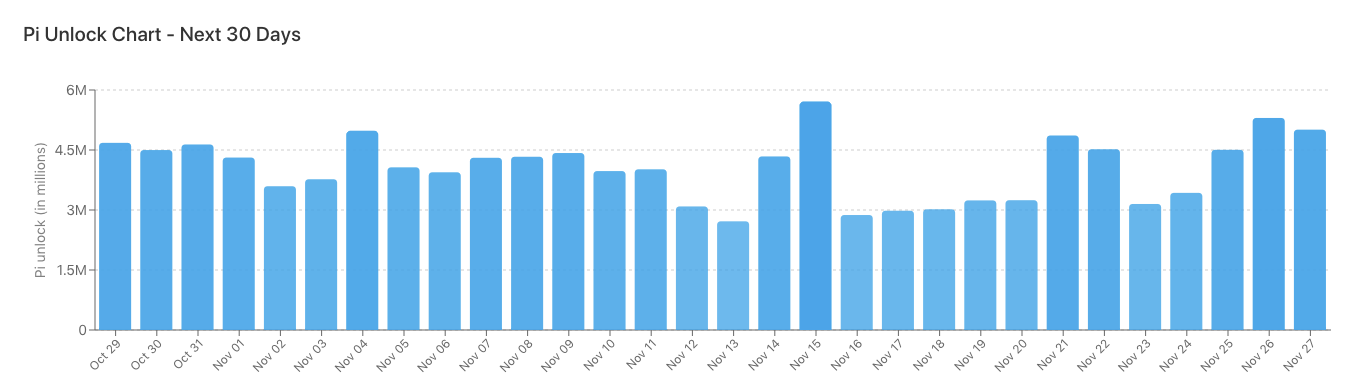

In the coming weeks, Pi Network is expected to unlock about 121.5 million tokens roughly 2.39% of its locked supply. According to Piscan data, the project still holds around 5.07 billion Pi in locked circulation, valued at nearly $1.35 billion. Consequently, the largest daily unlock, scheduled for November 15, could release over 5.7 million Pi worth more than $1.5 million.

New Automated KYC Process Targets Broader Network Growth

Meanwhile, Pi Network continues its effort to enhance user verification through a new automated KYC system. The update follows the October rollout that verified over 3.36 million Pioneers using artificial intelligence to review Tentative KYC cases. The upgraded process aims to clear an additional 3 million accounts, improving network integrity and accelerating Mainnet migration.

Technical Outlook for Pi Network (PI/USDT)

Key levels remain clearly defined as Pi Network enters a consolidation phase following a sharp rally.

- Upside levels: $0.271, $0.297, and $0.310 serve as immediate resistance zones. A breakout above $0.297 could open the path toward $0.330 and $0.350, reinforcing bullish continuation.

- Downside levels: $0.262 (0.236 Fib) acts as short-term support, followed by $0.232 (0.382 Fib) and $0.216 (0.618 Fib) as deeper correction zones. The $0.216 level also aligns with the prior accumulation base, making it crucial for maintaining the broader uptrend.

- Resistance ceiling: The $0.297–$0.310 region remains the key threshold for confirming medium-term bullish strength. A sustained close above this range would likely attract renewed buying pressure.

The technical structure suggests Pi is consolidating after a near 78% rally, forming a potential continuation pattern. Short-bodied candles and long upper wicks reflect brief profit-taking, but momentum indicators continue to favor bulls. The 4-hour EMAs remain positively aligned, confirming that Pi holds a healthy trend bias above $0.240.

Will Pi Extend Its Breakout?

Pi Network’s price action hinges on whether buyers can defend the $0.262–$0.232 support cluster through the ongoing token unlock phase. Holding these zones could trigger a retest of $0.297 and $0.310, potentially establishing a higher low for sustained gains.

Conversely, failure to maintain $0.262 support may invite further retracement toward $0.216 before another accumulation round begins. With major KYC progress and new supply releases approaching, volatility is expected to rise. For now, Pi remains in a pivotal range where market conviction and volume flows will dictate the next breakout direction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.