- Polkadot’s breakout signals a potential rally, targeting $8.80–$9.00 upside.

- ORDI’s breakout suggests a strong upward trend, aiming for $100.00 target price.

- Continued momentum for DOT and ORDI relies on maintaining key support levels.

Polkadot (DOT) and ORDI show impressive bullish potential, according to technical analysis by Captain Faibik. Both assets broke out from descending channels, signaling possible trend reversals. These breakouts, confirmed by strong bullish momentum, suggest both tokens could rally significantly.

Polkadot (DOT) Breakout Analysis

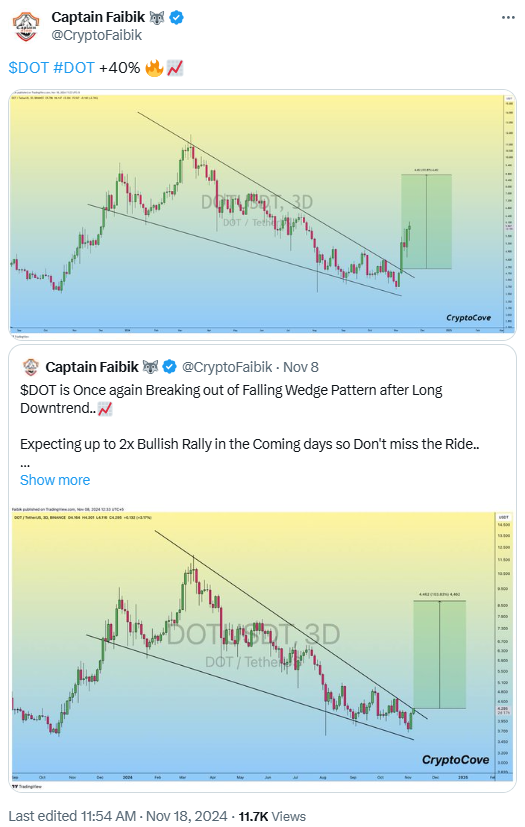

Polkadot has seen a positive shift after breaking out from a descending channel on its 3-day timeframe. Previously, the price was moving within a bearish channel, characterized by two parallel downward sloping lines. The breakout occurred when the price closed above the upper boundary of the channel.

After the breakout, consecutive bullish candles confirmed the strong buying momentum. This trend pushed DOT to key support and resistance levels, with the breakout zone around $4.15 to $4.50 now acting as crucial support. This area could be a foundation for further upward movement if retested. The lower boundary of the channel, near $3.00, remains critical long-term support.

On the resistance side, DOT is testing the $6.10 resistance level. A break above this could trigger a rally. Projections indicate a potential target of $8.80 to $9.00, with a possible upside of 103.83%.

Continued bullish momentum will depend on maintaining support around $5.50–$6.00 and avoiding a breakdown below the breakout zone. With a live price of $5.76, Polkadot is up 2.30% in the last 24 hours, indicating growing market interest.

ORDI Shows Similar Bullish Signals

ORDI is following a similar trend to Polkadot, having broken out from a descending channel on the 3-day timeframe. The breakout from this channel marked a shift from a bearish to a potentially bullish trend. The breakout was confirmed with a strong bullish candle, showing solid buying interest and suggesting a sustained upward movement if the breakout level holds as support.

Read also: Crypto Market Bloodbath: What’s Next for SOL, NOT, STRK, ORDI, and GALA?

The key support zone for ORDI is around $37.00 to $38.50. A successful retest of this area would solidify the breakout and reinforce a bullish outlook. If this support holds, ORDI could continue its ascent towards its immediate resistance near $41.50 to $44.00. A decisive break above this zone could lead to a target of $100.00, offering a 165.18% potential upside.

As at press time, ORDI is priced at $38.99, with a slight 0.13% drop in the past 24 hours. However, the overall trend remains bullish, and a break above resistance levels would trigger substantial price movement.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.