- Max Keiser, adviser to El Salvador’s president, criticized the US focus on “crypto” over Bitcoin, stating there is “only one Bitcoin country.”

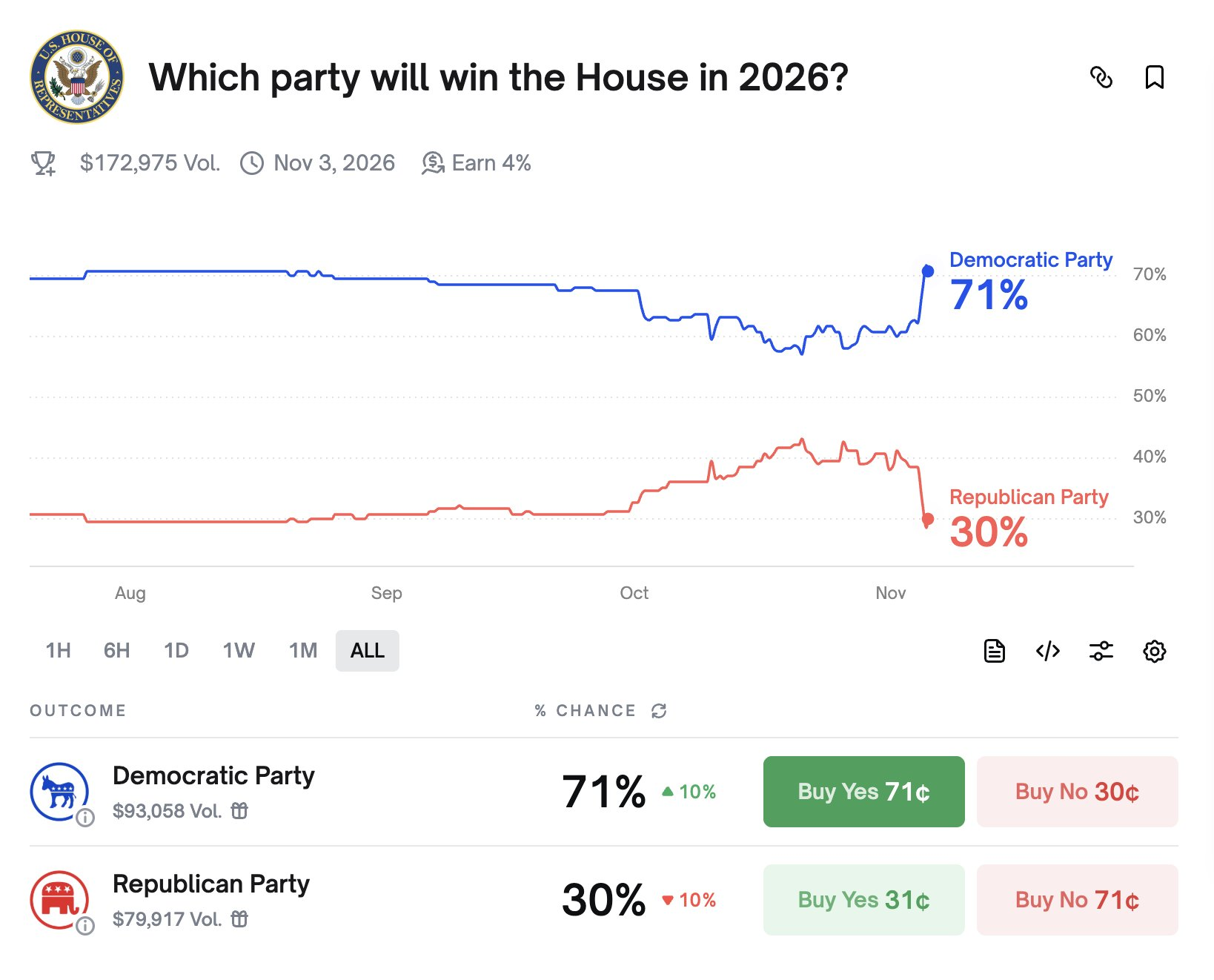

- The comments followed Polymarket data showing Democrats favored to win the House in 2026.

- Trump continues to push for US “crypto superpower” status despite scrutiny over his family’s $800 million in related venture earnings.

Max Keiser, senior adviser to El Salvador’s president Nayib Bukele, took a jab at the US President Donald Trump’s pro-Bitcoin policies, calling out the rise of “shitcoins” and misplaced priorities in the crypto industry.

Keiser wrote that “there is only one Bitcoin country,” pointing to El Salvador’s earlier, cleaner BTC-first strategy, and said U.S. efforts now are what happens “when shitcoiners run the table for too long.” This sets up a clash between a nation-state BTC model and Trump’s campaign-style crypto model.

Bukele’s adviser called President Trump’s Bitcoin purchase through Trump Media a self-serving maneuver and termed it “The Great Bifurcation,” which basically implies that Trump is filling his own pockets in the name of crypto.

Related: Ethics Experts Warn of ‘Legal but Questionable’ Trump Crypto Operations

Keiser Uses Polymarket Odds to Hint at a Coming Policy Swing

Keiser shared a Polymarket screenshot showing Democrats at 71% and Republicans at 30% to win the House in 2026, noting that a Democratic House would likely bring a different tone to crypto enforcement. The image showed Democrats breaking higher in early November while GOP odds dropped sharply, suggesting traders expect Republicans to lose their policy leverage.

By tying this chart to his “only one Bitcoin country” line, Keiser implied that the U.S. crypto stance is fragile and tied to short political cycles, unlike El Salvador’s BTC law, which is already progressing. For traders, the message is that U.S. crypto friendliness can be voted away.

Trump Sells A Bitcoin-And-AI America, Not A CBDC State

Speaking at the America Business Forum in Miami, Trump thanked his administration for driving the force behind America’s new crypto leadership. He claimed to have ended what he called the “war on crypto,” boasting of historic executive orders that had cleared the path for innovation.

Trump positioned the US as both a Bitcoin and AI powerhouse, declaring, “We’re making the United States the Bitcoin superpower, the crypto capital of the world.”

Related: Trump Maintains He Doesn’t Know Binance CZ Despite Granting Him a Pardon

He drew a sharp contrast with the Biden administration’s enforcement-first approach, linking his policies to dollar stability and private-sector participation. Trump said that US dominating crypto was a geopolitical necessity, warning that China and other nations were already closing in.

Policy And Profit Lines Are Blurring Around The Trump Brand

According to a Reuters investigation, the Trumps earned over $800 million from crypto-related ventures in the first half of 2025 alone, with much of the revenue stemming from the sale of World Liberty Financial (WLFI) tokens, a project spearheaded by Eric and Donald Trump Jr.

The family’s global investor roadshow, stretching across Dubai, Europe, and Asia, reportedly attracted foreign capital, including a $100 million token purchase by an Abu Dhabi-based entity linked to a Chinese businessman under investigation for money laundering.

Analysts argue that this intertwining of policy and profit blurs the line between public office and private gain, even as Trump continues to push for the adoption of cryptocurrencies.

Related: China Extends 24% Tariff Suspension For A Year, Crypto Gets A Macro Tailwind

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.