Pump.fun (PUMP) price today is trading at $0.00421, consolidating after hitting the top of its ascending channel. The token has risen sharply from late August lows, supported by rising creator adoption and fresh capital inflows. However, resistance around $0.00435–$0.00440 is proving difficult to break as indicators flash near-term caution.

PUMP Price Climbs Inside Ascending Channel

The 4-hour chart shows PUMP holding firmly inside an upward channel since late August, with higher lows and consistent closes above the 20-EMA. The token is now testing the upper bound of the channel at $0.00435.

Support sits near $0.00382, where the 20-EMA aligns with the lower channel line. A breakdown here could open downside risk toward $0.00355 and the 50-EMA. On the upside, a successful close above $0.00440 would validate continuation toward $0.00460, the next supply zone.

Related: Cardano Price Prediction: $0.92 Breakout In Play As Hoskinson Cleared Of Allegations

RSI at 69 is close to overbought territory, suggesting bulls may struggle to maintain momentum without fresh catalysts. MACD remains constructive, but narrowing histogram bars signal potential slowing momentum.

Creator Earnings Spark Fundamental Optimism

Pump.fun’s growth story received another boost after its official feed revealed $2.5 million in creator fee claims within 24 hours. More than 4,400 creators participated, a figure that dwarfs typical single-day payouts from streaming rivals like Twitch and Kick.

This wave of earnings underscores the platform’s unique value proposition, strengthening the bullish narrative around PUMP. Analysts argue that creator-driven tokenomics are attracting sticky users, which could translate into sustained adoption and price resilience.

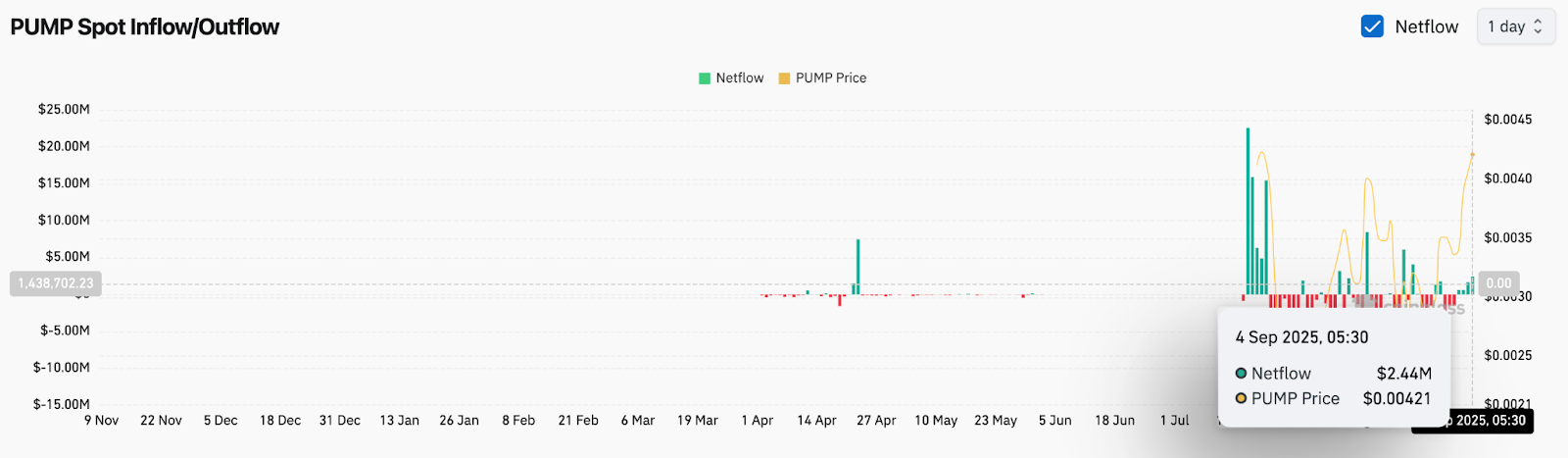

On-Chain Flows Show Renewed Accumulation

Exchange data confirms the bullish undertone. Net inflows hit $2.44 million on September 4, marking one of the largest positive flow days in recent months. The return of spot demand suggests that traders are positioning ahead of potential platform growth headlines.

Related: XRP Price Prediction: Analysts Track $3 Breakout As Cycle Patterns Reemerge

Still, flows remain inconsistent compared to earlier spikes in April, highlighting that conviction is building but not yet widespread. Sustained inflows above $5 million would likely be needed to trigger a breakout beyond $0.00460.

Supertrend And Parabolic SAR Remain Bullish

Technical overlays reinforce the constructive bias. The Supertrend indicator flipped green at $0.00361 and continues to trail spot price. Parabolic SAR dots are firmly below candles, signaling that the uptrend is intact.

That said, the confluence of resistance at $0.00435 and overbought RSI means traders must watch for exhaustion. Failure to clear this barrier may invite short-term profit taking back toward $0.00390–$0.00382.

Related: World Liberty Financial (WLFI) Price Prediction 2025–2030

Outlook: Will PUMP Go Up?

Pump.fun’s near-term outlook hinges on whether fresh creator adoption and positive inflows can sustain momentum through key resistance. A breakout above $0.00440 would likely extend gains toward $0.00460 and possibly $0.00480.

If selling pressure prevails, downside levels to watch are $0.00382 and $0.00355, with deeper risks toward $0.00340 if inflows stall.

Analysts remain cautiously optimistic as long as PUMP holds above $0.00382, with platform growth offering a fundamental tailwind. Traders, however, should watch for a potential cooling phase before the next leg higher.

Forecast Pump.fun Price Table

| Indicator / Level | Bullish Scenario | Bearish Scenario |

| Key Support Levels | $0.00382, $0.00355 | $0.00340 |

| Resistance Levels | $0.00440, $0.00460 | – |

| RSI (4H) | Near 69, overbought risk | Reversal below 55 |

| Net Flows | +$2.44M inflow | Decline toward neutral/negative |

| Trend Indicators | Supertrend & SAR bullish | Flip bearish below $0.00361 |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.