- Pump.fun faces resistance at $0.00745 despite buyback offsetting 7.9% of supply.

- On-chain data shows $3.27M in outflows, signaling profit-taking near short-term highs.

- Key support rests at $0.00628–$0.00585, with upside targets at $0.0078–$0.0081.

Pump.fun price today trades at $0.00676, slipping nearly 2% as buyers struggle to extend the recovery above key Fibonacci and EMA resistance zones. The recent $54 million buyback has reignited community confidence, but persistent outflows suggest short-term hesitation among traders.

Pump.fun Price Tests Mid-Fibonacci Resistance

PUMP Price Dynamics (Source: TradingView)

Pump.fun remains locked between the 0.5 ($0.00695) and 0.618 ($0.00745) Fibonacci retracement levels, showing clear resistance after last week’s rebound. The 20-day EMA at $0.00677 continues to cap upside momentum, while the 50-day EMA at $0.00648 acts as immediate dynamic support.

The 200-day EMA sits lower at $0.00585, forming a solid base for any deeper correction. RSI readings hover near 51.4, showing neutral momentum after cooling from near-overbought levels earlier in the week. If buyers fail to reclaim the $0.00745 zone, the risk of another retest toward $0.0060 grows, where the 50 EMA and the 0.382 retracement converge.

$54 Million Buyback Supports Fundamental Confidence

Pump.fun’s official update on October 4 revealed a $54,273,082 buyback in PUMP tokens between September 4 and October 2 — representing 99.65% of total platform revenue during that period. The purchases offset roughly 7.9% of the circulating supply, highlighting one of the most aggressive token repurchase programs among DeFi-linked assets.

This strategy reinforces investor confidence by reducing supply pressure, but its timing amid declining on-chain inflows raises questions about the sustainability of the current rally. While buybacks provide structural support, PUMP’s broader market stability will depend on consistent ecosystem activity and continued revenue growth.

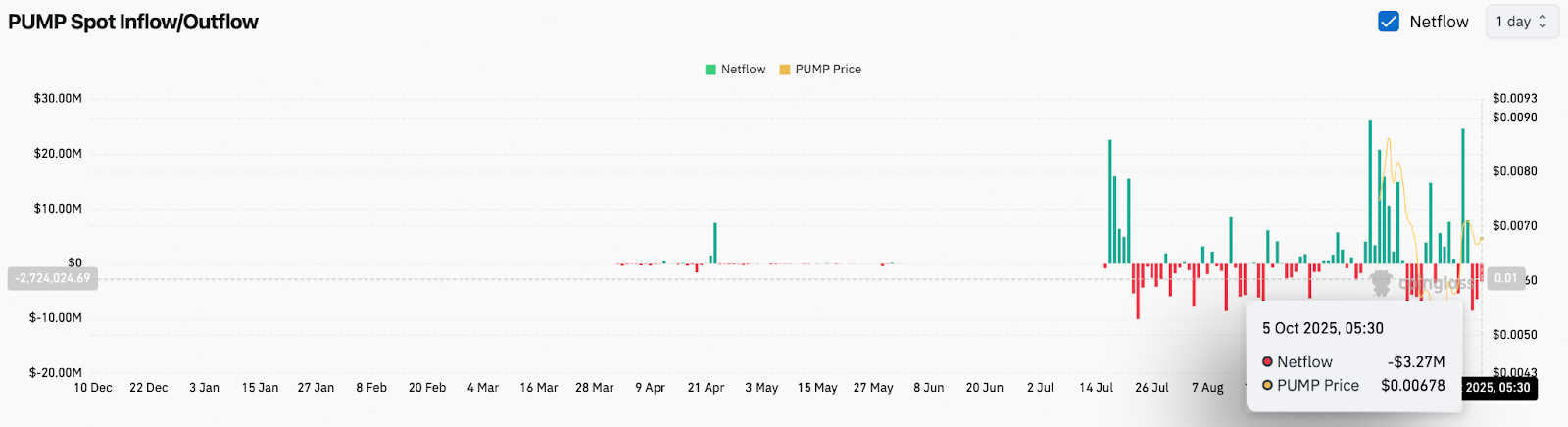

On-Chain Data Shows Renewed Outflows

PUMP Netflows (Source: Coinglass)

Data from Coinglass indicates a $3.27 million net outflow on October 5, marking a notable shift from the inflow streak seen earlier this month. Despite the bullish buyback headline, short-term traders appear to be taking profits near the $0.007–$0.0074 range.

The persistence of red netflow bars through late September into October suggests that some speculative capital is rotating out after PUMP’s earlier spike. Sustained outflows above $2 million per day could limit further price expansion, especially if buyback activity slows in the near term.

Technical Outlook For Pump.fun Price

Pump.fun price prediction for the near term identifies crucial support and resistance levels to watch.

- Upside targets: $0.00745 (Fib 0.618) and $0.00810 (Fib 0.786) remain key hurdles before a potential retest of $0.0089 highs.

- Downside supports: $0.00628 and $0.00585 form the immediate demand zones.

The EMA alignment shows near-term consolidation, with bulls needing a close above $0.00745 to reassert dominance. Losing $0.00648 could expose the token to further weakness toward $0.0058.

Outlook: Will Pump.fun Go Up?

Pump.fun’s short-term outlook hinges on whether its aggressive buyback program can outweigh the pressure from ongoing outflows. The fundamentals remain strong — with nearly $126 million in cumulative purchases since inception — but technicals show consolidation after a sharp rebound.

If PUMP holds above $0.0065 and inflows resume, the path toward $0.0078–$0.0081 remains open. Failure to maintain that floor could shift sentiment back toward a neutral-to-bearish tone, with traders eyeing $0.0058 as the next key defense line.

For now, PUMP remains a range-bound asset balancing between strong tokenomics and fading short-term liquidity.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.