- Pump.fun trades near $0.00619 after bouncing from $0.00550 support, holding above clustered EMA levels.

- Binance listing sparks liquidity boost and legitimacy, driving fresh speculative inflows.

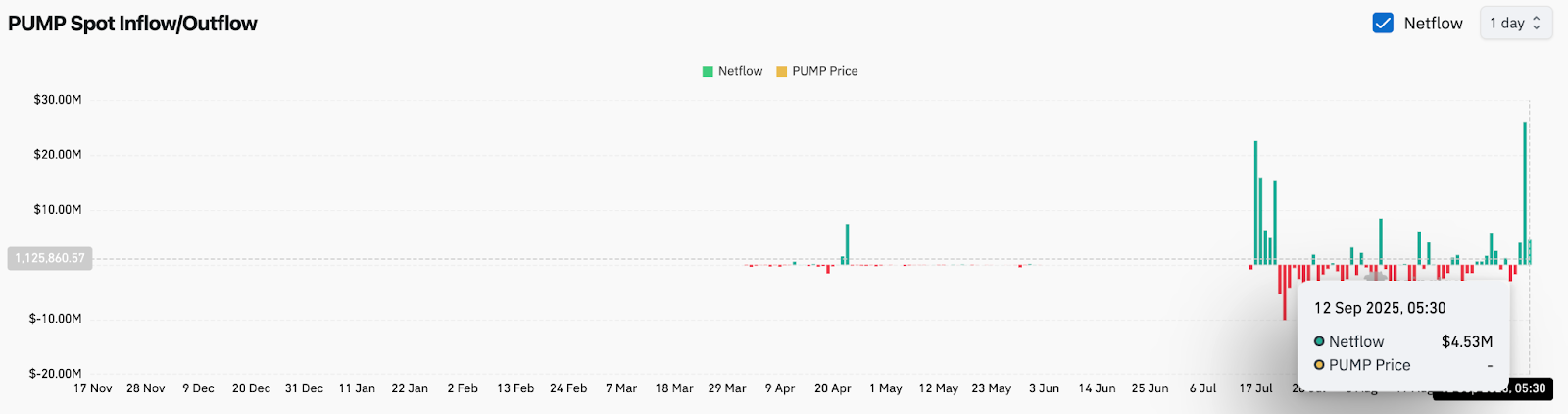

- Net inflows of $4.53M mark strongest demand in months, supporting a bullish case toward $0.007.

Pump.fun (PUMP) price today is trading around $0.00619, holding steady after a sharp bounce from the $0.00550 support zone. The token has been climbing within a defined ascending channel, with traders eyeing $0.007 as the next breakout target. Binance’s announcement of a new listing has added fuel to the bullish momentum, amplifying both technical and flow-driven optimism.

Pump.fun Price Builds Support Above EMAs

The 4-hour chart highlights PUMP’s strong uptrend, trading consistently above the 20-, 50-, and 100-period EMAs. The cluster of moving averages between $0.00445 and $0.00554 now serves as firm support, with price consolidating just beneath the mid-channel zone.

Realted: XRP (XPR) Price Prediction For September 13

Momentum indicators remain constructive. The Supertrend flipped bullish near $0.00509, reinforcing the upward structure, while repeated rejections above $0.00620 show that sellers are still attempting to cap gains. A breakout above this area could open the path toward $0.00680 and $0.00700, while failure to hold $0.00550 risks breaking the channel structure.

Binance Listing Sparks Market Excitement

Fundamentals turned sharply positive after Binance confirmed the listing of PUMP on September 11 with a seed tag. Trading has already activated deposits and withdrawals, sending the token almost 5% higher within hours of the news.

The listing on the world’s largest exchange significantly improves liquidity and access, giving the meme-focused token broader market exposure. While Binance cautioned investors to conduct research before trading, the very presence of the token on its platform has been viewed as a stamp of legitimacy, encouraging speculative inflows.

On-Chain Flows Signal Renewed Demand

On-chain data supports the bullish tilt. Net spot inflows on September 12 reached $4.53 million, one of the strongest daily figures in recent months. This reversal from weeks of muted or negative flows suggests investors are actively positioning for upside momentum following the Binance announcement.

Related: Ethereum (ETH) Price Prediction For September 13

Sustained inflows of this scale would confirm institutional and retail participation, supporting higher liquidity in both spot and derivatives markets. However, analysts warn that without continuous inflow support, price rallies may face exhaustion at resistance zones.

Technical Outlook For Pump.fun Price

The short-term roadmap for PUMP is clear. Immediate resistance lies near $0.00620–$0.00630, followed by the upper channel target at $0.00680–$0.00700. A decisive break above this threshold could trigger momentum traders to extend positions, potentially driving a test toward $0.00720.

On the downside, the first key support remains at $0.00550, aligning with the 20 EMA. A breakdown below this zone would expose deeper support at $0.00445 and $0.00401, levels that coincide with the 50- and 100-EMAs. Failure to defend these supports would shift momentum bearish, risking a retracement toward $0.00380.

Outlook: Will Pump.fun Go Up?

The bullish case for PUMP rests on two reinforcing drivers: Binance’s listing and strengthening on-chain inflows. Both factors suggest that traders are positioning for further gains, as long as the token maintains its ascending channel structure.

Related: Cardano (ADA) Price Prediction For September 12

Analysts remain cautiously optimistic. If PUMP holds above $0.00550, the probability of an upside breakout remains strong, with $0.00680–$0.00700 as immediate targets. A failure to sustain momentum, however, could see price retest deeper supports before bulls regain control.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.