- PUMP breaks key Fibonacci resistance, confirming a bullish shift after compression.

- Price holds above rising EMAs, yet overextension hints at near-term consolidation risk.

- Derivatives and spot flows stay cautious, suggesting limited leverage behind the breakout.

Pump.fun (PUMP) entered January’s final week showing renewed bullish intent after weeks of muted trading activity. On the 4-hour chart, PUMP/USDT broke above several technical barriers, signaling a potential shift in short-term momentum. This move followed a prolonged period of compression, where volatility faded and speculative interest cooled.

Consequently, the recent price expansion stands out, not only for its strength but also for its timing. Market participants now assess whether this breakout can extend or if near-term exhaustion emerges.

Bullish Structure Emerges on the 4H Chart

PUMP advanced decisively above the 0.786 Fibonacci retracement near $0.00285, confirming a bullish structural change. Price then pushed higher, setting a fresh local high close to $0.00317. Significantly, the chart now shows a sequence of higher lows formed between the 0.382 and 0.5 Fibonacci levels. This pattern reflects improving buyer control.

Additionally, the 20, 50, and 100-period exponential moving averages align bullishly below price. This setup typically supports trend continuation. However, price trades well above these averages, suggesting short-term overextension. Hence, traders may watch for consolidation rather than immediate follow-through.

The $0.00317 to $0.00320 zone marks the first major resistance area. This level aligns with the prior swing high and the Fibonacci 1.0 extension. A clean break above this range could open a path toward the psychological $0.00330 level. Moreover, sustained momentum would likely require renewed volume expansion.

On the downside, former resistance between $0.00285 and $0.00290 now acts as first support. A deeper pullback could test the $0.00262 to $0.00268 region, where multiple EMAs converge.

Consequently, this zone holds importance for trend stability. A breakdown below $0.00242 would weaken bullish structure, while losses below $0.00220 would invalidate it.

Derivatives and Spot Flows Signal Caution

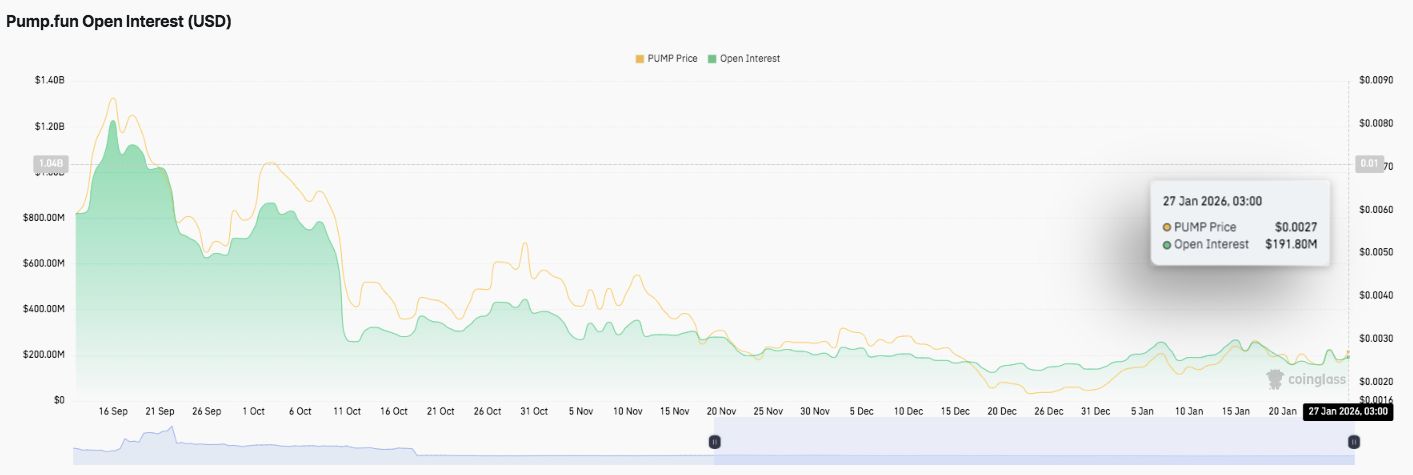

Despite the technical breakout, derivatives data reflects restraint. Open interest peaked above $1.2 billion in September before entering a steady decline. By late November, it fell below $300 million. Although early January brought a modest rebound, open interest now sits near $192 million. This level suggests limited leverage participation.

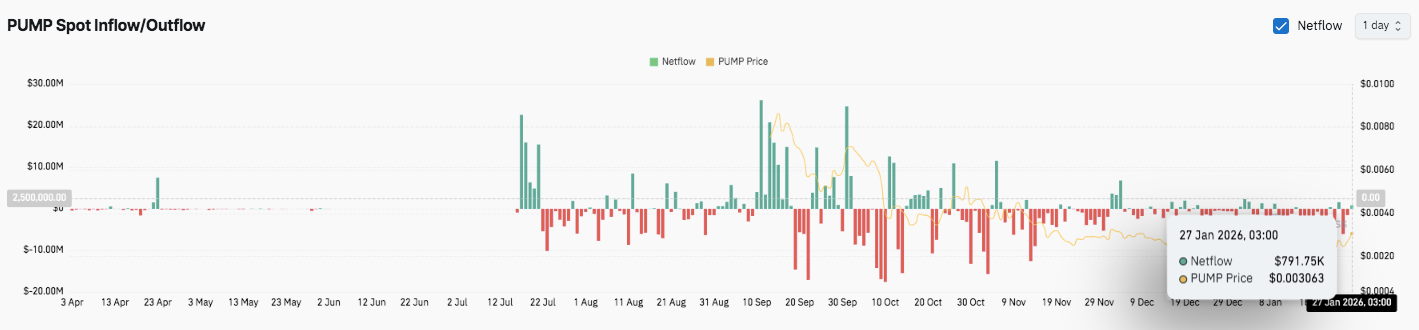

Besides derivatives, spot flows provide additional context. PUMP experienced persistent net outflows from August through November, pointing to distribution. Recently, outflows eased and netflows flattened. The latest data shows a modest $792,000 inflow. However, accumulation remains cautious.

Technical Outlook for Pump.fun (PUMP)

Pump.fun (PUMP) enters the January 28 session with a clearer technical structure after reclaiming major Fibonacci levels on the 4H chart. Price recently pushed above the 0.786 retracement near $0.00285, confirming a short-term bullish breakout. Higher lows from the $0.00242–$0.00268 range reinforce trend continuation, although near-term momentum shows mild overextension.

- Upside levels: Immediate resistance stands at $0.00317–$0.00320, marking the recent local high and Fib 1.0 extension. A sustained breakout above this zone could open upside continuation toward the $0.00330 psychological level.

- Downside levels: First support sits at $0.00285–$0.00290, which now acts as reclaimed structure support. Below that, the $0.00262–$0.00245 zone remains critical, aligning with the EMA cluster and prior consolidation. A deeper pullback toward $0.00220–$0.00225 would invalidate the current bullish structure.

- Resistance ceiling: The $0.00320 area represents the key level bulls must flip to sustain upside momentum. Rejection here may trigger a healthy retracement before trend continuation.

The broader technical picture shows PUMP transitioning from consolidation into expansion. However, derivatives data reflects caution, with open interest near $192 million, signaling limited leverage participation. Spot flows recently turned modestly positive, suggesting selling exhaustion rather than aggressive accumulation.

Will Pump.fun go up?

The short-term PUMP price outlook depends on whether buyers can defend $0.00285 during pullbacks. Holding this level keeps the bullish bias intact toward $0.00320 and $0.00330.

Failure to maintain support risks a return to the $0.00262–$0.00245 demand zone. For now, PUMP trades in a pivotal range, where technical confirmation and follow-through flows will define the next directional move.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.