- PUMP surges after Binance.US listing, expanding access to U.S. investors rapidly.

- Double rounded bottom hints at bullish reversal, key support sits near $0.00530.

- Aggressive buybacks reduce supply, boosting scarcity and potential price momentum.

PUMP rallied sharply after securing multiple exchange listings, including Binance.US, which opened trading for the token on September 10 following deposit support a day earlier. The listing gave U.S. investors direct access to PUMP, expanding the token’s reach and driving a surge in adoption and activity.

Chart Patterns Point to Bullish Reversal

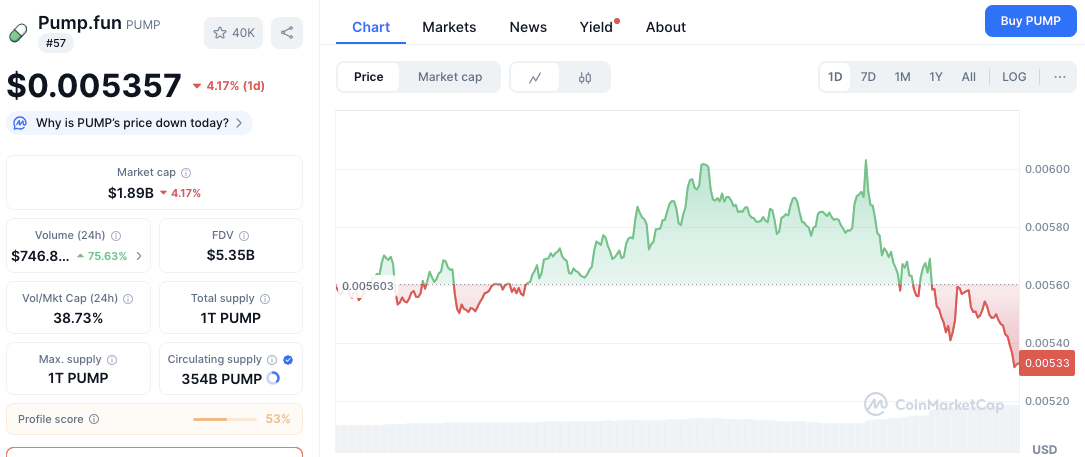

Technical signals showed PUMP completing a double rounded bottom formation that began in mid-August. Traders often view this structure as a bullish reversal indicator, with the price holding key support at $0.00530.

At press time, PUMP traded at $0.005337, just under the recent high of $0.005603. Breaking above the $0.00560 resistance could trigger a stronger uptrend.

Market participation also accelerated. Trading volume reached $738.8 million in 24 hours, up nearly 74% from the previous day. The higher liquidity reflected increased volatility and short-term trading opportunities.

Buybacks Drive Scarcity

Pump.fun’s ongoing buyback strategy added to the bullish case. Over the past day, the platform removed $12.2 million worth of tokens, pushing its total to more than $84 million repurchased since launch two months ago.

By shrinking circulating supply, the buybacks have tightened scarcity, a factor that can amplify price moves when demand rises.

Related: Pump.fun Launches “Glass Full Foundation” to Fund Its Top Memecoins, Sparks Rally

Momentum Indicators Remain Optimistic

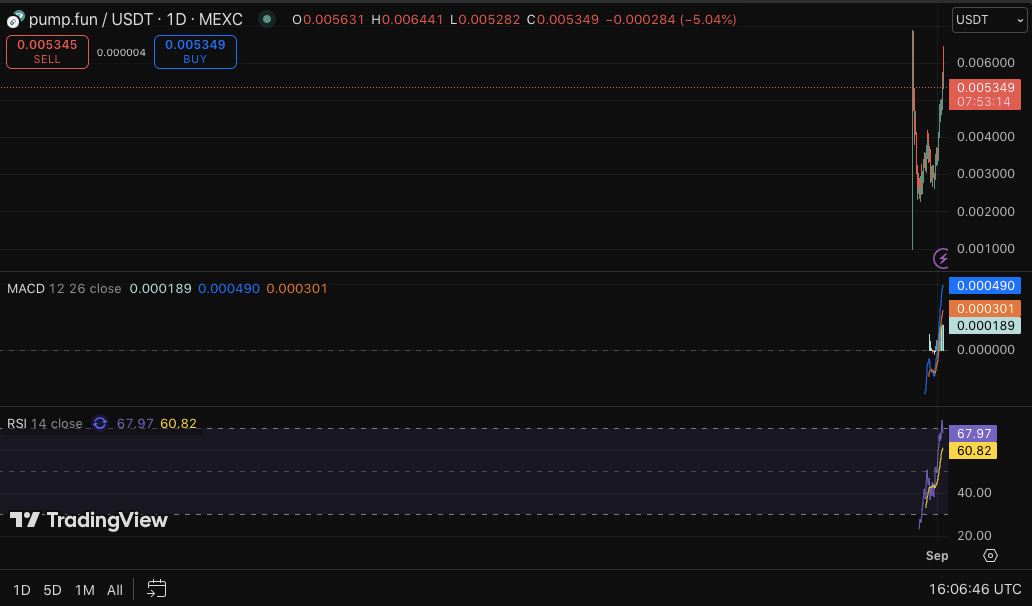

Indicators showed cautious but positive momentum. The MACD printed at 0.000486, above its signal line, suggesting an upward trend. The RSI stood at 67.26, indicating neutral-to-slightly overbought conditions and a potential risk of short-term pullbacks.

Related: Pump.fun Fights Back, Opens Its Books to the Public with New Revenue Tracker

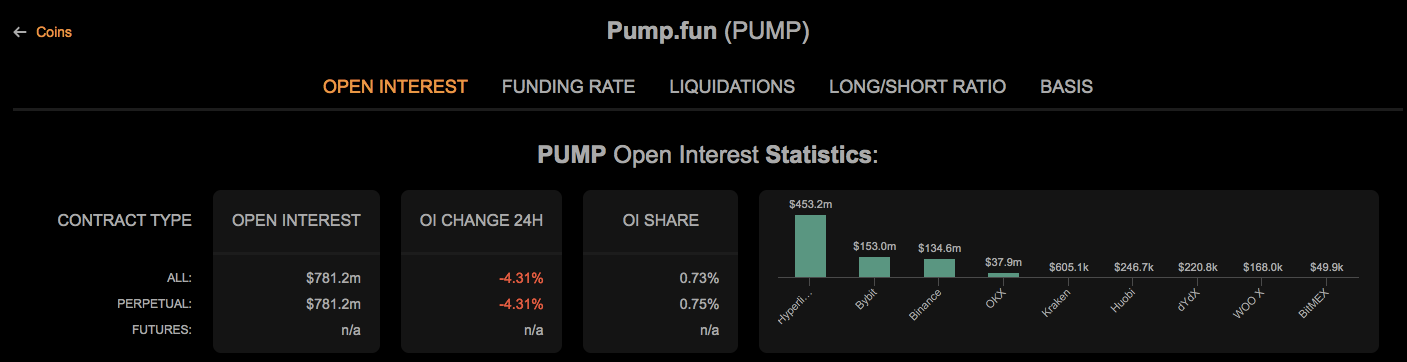

Meanwhile, derivatives data showed Open Interest at $781.2 million, down 4.31% in 24 hours. Huobi held the largest share of contracts, followed by Bybit and Binance, underscoring PUMP’s global trader interest.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.