- Ash Crypto says markets may dump early in October to shake out weak bulls.

- Then between October 15-20, a “massive pump” could carry BTC to $150K–$180K and ETH to $8K–$12K.

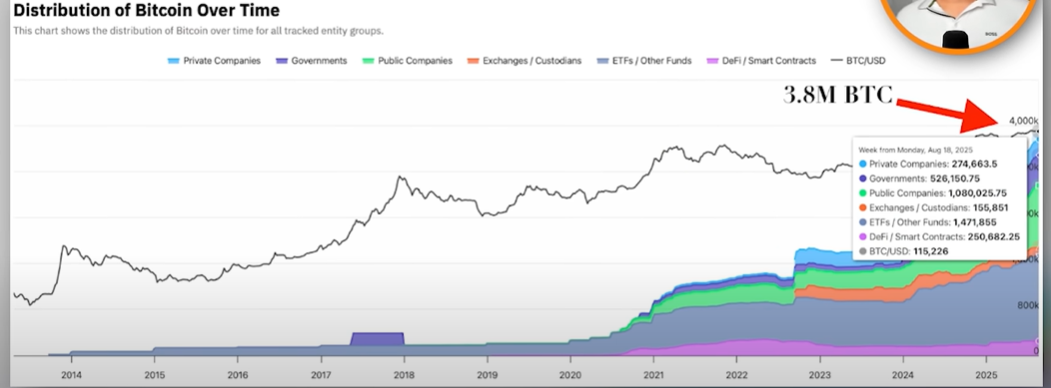

- Institutions already hold over 3.8M BTC, building the foundation for a Q4 breakout.

Bitcoin has tagged downside targets earlier this week, prompting traders to ask whether bulls can defend current levels and close the week in green. Altcoins, however, continue to show weakness, with several large-cap assets trading in a fragile zone. On the traditional front, gold remains in a strong uptrend.

The Total3 chart, which measures the market cap of all cryptocurrencies excluding Bitcoin and Ethereum, continues to struggle. The chart has not yet shown higher highs or higher lows — a signal required for altcoin recovery.

Analysts Expect a “PUMPtober” Comeback

Crypto analyst Ash Crypto said the current market pullback is designed to liquidate overleveraged positions before the next upward move. He expects Bitcoin and altcoins to recover between October 15 and 20, leading to what he calls a “massive pump” into month-end.

“They want you to believe that PUMPtober is canceled. When fear peaks, the market will bounce and a parabolic Q4 rally will start,” he said.

That reversal, he believes, will set off a parabolic run in Q4, with BTC pushing toward $150K to $180K and ETH racing past $8,000 to $12,000. He also predicted that altcoins could see 10x to 50x gains once the true altseason begins.

The Four-Year vs. Extended Cycle Debate

Analyst Lark Davis addressed the ongoing debate about whether Bitcoin still follows its historical four-year cycle or has transitioned into an extended one. Bitcoin took 524 days to top after the 2016 halving and 548 days after the 2020 halving. Based on this pattern, Bitcoin should theoretically top around October 2025 — roughly 536 days after the 2024 halving.

“If Bitcoin continues making new all-time highs after this week, it strengthens the case for an extended cycle,” he said. The analyst added that if major new highs occur in February or March 2026, it would confirm that the traditional four-year cycle is no longer valid.

Institutional vs. Retail Dynamics

Data shows a sharp contrast between institutional and retail activity. Institutions currently hold about 3.8 million BTC, up from 1.3 million at the 2021 peak and just 387,000 in 2017. Wallets holding over 100 BTC have also climbed steadily since late 2024, even as Bitcoin trades above $120,000.

Retail activity tells a different story. Addresses holding small amounts of BTC have declined since early 2024, indicating that small investors are not participating in the rally. “Retail isn’t buying this cycle,” Davis said.

The analyst expects gradual price increases into 2026, followed by a synchronized market correction across risk assets.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.