- Global crypto market value reached $4 trillion in Q3 2025, up 16%.

- Ethereum and BNB led the rally with gains above 50%.

- DeFi and stablecoin activity surged amid higher liquidity

The cryptocurrency market made a strong recovery in Q3 2025, growing by 16.4% to hit a market cap of $4 trillion, according to CoinGecko’s Q3 report. Notably, the quarter added about $563.6 billion, the strongest three-month advance since late 2021.

Gains aligned with rallies in Ethereum and BNB, firmer risk appetite, and growth in decentralized finance (DeFi) and stablecoins.

Related: Q3 2025 Crypto Recap: Bitcoin ETFs, U.S. Laws, and Stablecoins Surge

Moreover, the report highlighted improved liquidity and rising institutional investments as major factors behind the market’s rebound. Average daily trading volume increased by 43.8%, reaching about $155 billion.

Ethereum and BNB Lead Quarterly Gains

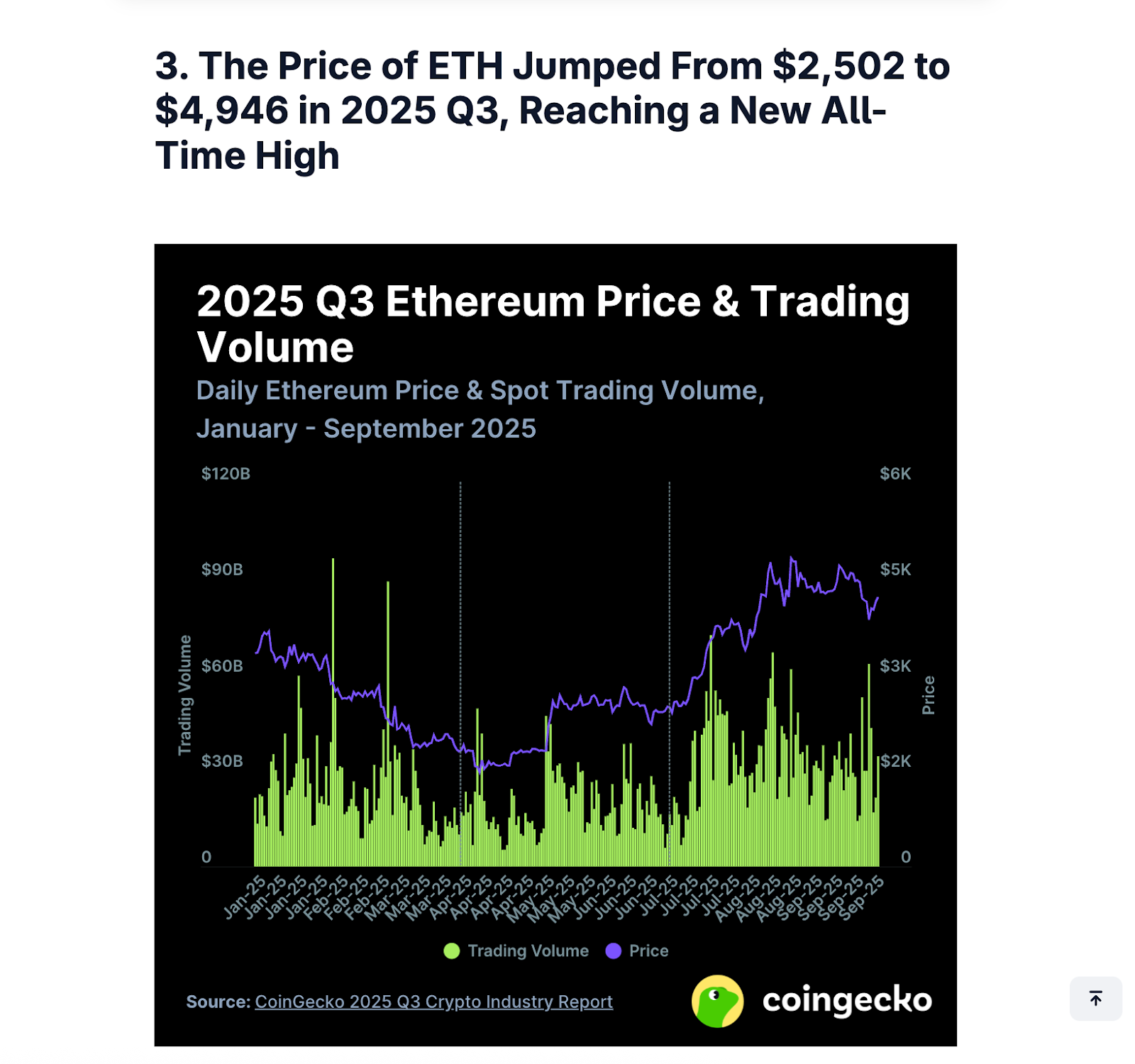

Ethereum saw one of its best quarters in years, climbing 68.5% to end September near $4,215 after briefly touching $4,946. The report attributed Ethereum’s performance to higher institutional participation and the growing appeal of Ethereum-based exchange-traded funds (ETFs).

BNB also experienced growth, advancing 57.3% to reach a record high of roughly $1,048. CoinGecko cited increased usage across Binance’s ecosystem and stronger decentralized exchange (DEX) volumes as key drivers of BNB’s performance. Notably, the surge spilled to the last quarter as BNB reached a new all-time high above $1360.

DeFi and Stablecoins Regain Momentum

DeFi posted a major comeback in Q3. Total value locked (TVL) across DeFi protocols rose 40.2%, climbing from about $115 billion to $161 billion. New token launches, higher on-chain activity, and a surge in trading on perpetual DEXs fueled the recovery.

Perpetual decentralized exchange volumes reached an all-time high of $1.8 trillion. Established platforms like Hyperliquid maintained dominance while newer entrants such as Aster and Lighter gained market share through incentive programs.

Stablecoins also expanded rapidly. Their collective market capitalization grew 18.3% to $287.6 billion. Ethena’s USDe saw the highest percentage growth at 177.8%, while Tether (USDT) added $17 billion in value but experienced a slight decline in market share.

Centralized Exchanges See Trading Revival

Centralized exchanges (CEXs) also recorded significant growth in Q3. Spot trading volume on top exchanges rose 31.6% quarter-over-quarter to reach $5.1 trillion.

Binance retained its position as the industry leader, while Bybit saw a notable increase in activity. Coinbase, however, dropped to the tenth spot globally by trading volume.

This rise in trading activity reflects broader market recovery, supported by renewed investor participation and more favorable macroeconomic conditions.

Related: DeFi Tops Crypto Sectors With 44.6% YTD Gains as RWAs and Stablecoins Follow Close

CoinGecko’s report suggested that the market’s momentum could continue if liquidity remains strong and institutional demand stays high. However, market corrections could challenge the sustainability of these gains.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.