- Quantum computing is a known long-term risk to Bitcoin, not an imminent threat.

- Only about 10,200 BTC sit in addresses that could be realistically attacked and sold quickly.

- Breaking Bitcoin’s cryptography would require millions of qubits, far beyond current quantum machines.

CoinShares says Bitcoin faces a theoretical quantum risk, not an active one. The issue stems from future quantum computers that could break parts of Bitcoin’s cryptography, not from anything close to current capability.

According to the digital asset management firm, for a system securing over $1 trillion in value, that debate is expected and healthy. Bitcoin’s quantum vulnerability is a known engineering problem with long lead times, not a sudden failure risk.

There is no scenario where Bitcoin breaks overnight due to quantum computing, CoinShares added.

What Quantum Computers Can and Cannot Do

Bitcoin security relies on two tools. First, elliptic curve signatures authorize transactions, and secondly, hash functions protect addresses and mining. Notably, quantum algorithms affect these differently.

CoinShares stated Shor’s algorithm could one day expose private keys if public keys are visible. Grover’s algorithm weakens SHA-256 from 256-bit to 128-bit strength, which still remains computationally impractical to brute force. Quantum systems cannot change Bitcoin’s 21 million supply, bypass proof-of-work, or rewrite the chain.

Mining does not meaningfully change under quantum assumptions. Even if a quantum computer mines faster, difficulty adjustment removes any lasting edge.

How Much Bitcoin Is Actually Exposed

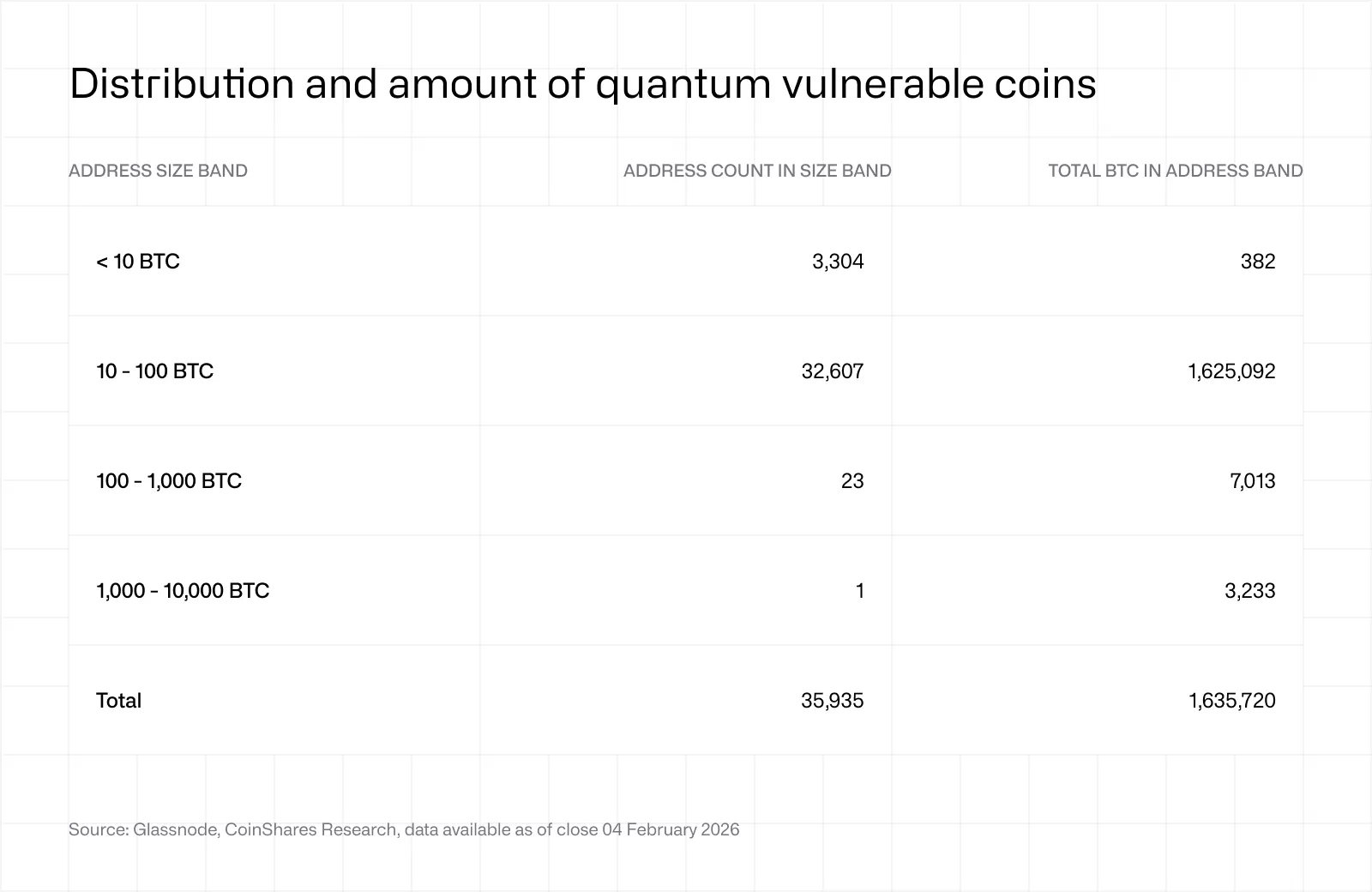

Exposure is limited to legacy Pay-to-Public-Key (P2PK) addresses where public keys are already visible. CoinShares estimates roughly 1.6 to 1.7 million BTC, about 8% of supply, sit in this category.

However, only a very small fraction of that amount could realistically be exploited quickly. CoinShares estimates that around 10,200 BTC sit in UTXOs large enough to be stolen and sold in size without taking decades.

Within this subset, about 382 BTC is spread across 3,304 wallets holding less than 10 BTC each. Another ~7,000 BTC sits in wallets holding 100 to 1,000 BTC, while ~3,230 BTC is held in wallets with 1,000 to 10,000 BTC. Even in a worst-case scenario, CoinShares says activity at this scale would resemble normal large market trades, not a systemic shock.

The remaining 1.62 million BTC are distributed among over 30,000 wallets, each holding roughly 10 to 100 BTC. Even with extreme assumptions, unlocking those coins would take decades.

Modern address types such as P2PKH, P2SH, and most Taproot setups hide public keys until coins are spent. Claims that 20% to 50% of Bitcoin is vulnerable often include address reuse and temporary exposure, which can be fixed with basic wallet behavior and years of warning.

The Technology Gap Is Massive

As of early 2026, the gap between theory and reality is wide. To break Bitcoin keys within a day would require roughly 13 million physical qubits with full fault tolerance. That is about 100,000 times more than today’s largest machines. Breaking keys within an hour would require systems millions of times more powerful.

Google’s Willow quantum computer has 105 qubits. Each additional qubit increases coherence difficulty exponentially. Even optimistic estimates place cryptographically relevant quantum computers in the 2030s or later, with many models pointing to a 10 to 20 year horizon.

Related: Bitcoin Cash 2026 Prediction: May Upgrade Brings Quantum Security & Smart Contracts

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.