- Raydium (RAY) drops 22.9% as Pump.fun plans its own AMM liquidity pool.

- Pump.fun’s internal liquidity pool could disrupt Raydium’s role in meme token liquidity.

- Raydium faces continued bearish momentum, with key indicators showing downward pressure.

Raydium Protocol’s token (RAY) has taken a hit, dropping 22.9% and currently trading at $3.30, according to Coingecko data. This significant drop comes as reports surface suggesting that Pump.fun is developing its own Automated Market Maker (AMM), potentially cutting out Raydium as the third-party liquidity provider for its platform.

As Pump.fun gears up to launch its testnet AMM liquidity pool, the market is reacting strongly to the growing possibility of a shift in how liquidity is handled across the network.

Pump.fun’s AMM: Aiming to Boost Meme Token Liquidity

Pump.fun’s plan to create its own AMM is all about improving the liquidity experience for meme tokens, which currently rely on Raydium for third-party liquidity.

The new in-house liquidity pool will make the move smoother for these tokens, making it easier for meme coins to transition away from Raydium’s platform.

If Pump.fun pulls this off, this development could make the system run more efficiently, allow Pump.fun to grab a larger chunk of transaction fees, and maybe even introduce a reward system for token holders.

Related: Pump.fun Eyes Own AMM, Thwarts Bybit Hacker’s Laundering Attempt

Raydium Faces Market Headwinds

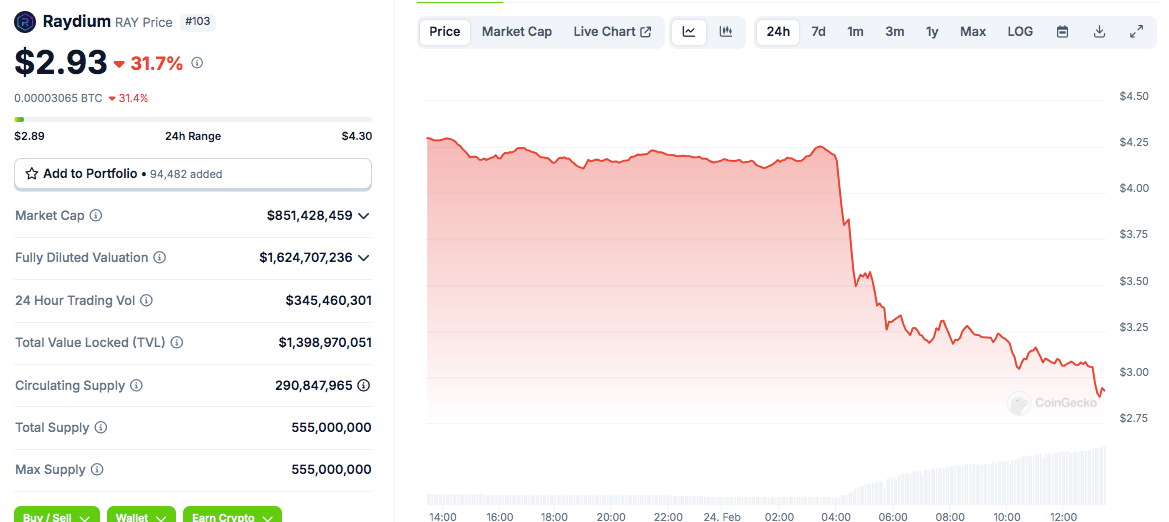

As these events unfold, Raydium has run into a price drop. As of writing, RAY had fallen by 31.7%, trading at $2.93—within a range of $2.89 to $4.30. Even with this downturn, Raydium still has a presence in the market, with a market cap of $851.4 million and a fully diluted valuation of around $1.62 billion.

Raydium’s current market trends show some instability. The total value locked (TVL) in the platform is roughly $1.4 billion, while the circulating supply is at 290.85 million RAY tokens out of a total supply of 555 million.

Bearish Technical Signals Point to Further Price Weakness

Adding to the negative vibe, technical indicators suggest that the bearish trend for Raydium could continue.

The MACD is currently showing a negative value of -0.1411, with the MACD line positioned below the signal line. This suggests ongoing selling pressure.

Related: Raydium (RAY) Price Prediction 2025-2030: Will RAY Price Hit $15 Soon?

On the other hand, the RSI is currently sitting at a low 18.99, deeply in oversold territory. Generally, an RSI below 30 can indicate that the asset might be due for a price rebound, but there are no guarantees.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.