- RedotPay raised $107 million in Series B funding, taking its total 2025 capital raised to $194 million.

- The company reports over 6 million users in more than 100 countries with $10 billion annualized payment volume.

- Payment activity nearly tripled in 2025, driven by more than 3 million new users joining the platform.

RedotPay’s latest funding round shows a shift in how investors view crypto. Rather than focusing on trading or speculation, capital is increasingly flowing toward companies using blockchain to solve real payment problems.

The Hong Kong–based fintech company recently raised $107 million in Series B funding, bringing its total capital raised in 2025 to $194 million, according to company disclosures. The round was led by Goodwater Capital, with participation from Pantera Capital, Blockchain Capital, Circle Ventures, and existing backers.

Related: Crypto Miners Face Jail Time as Tajikistan Fights Winter Blackouts

What Do the Numbers Reveal About RedotPay’s Growth?

RedotPay reported more than 6 million registered users across over 100 countries as of November 2025. The company said annualized payment volume has surpassed $10 billion, while revenue has reached more than $150 million on an annualized basis.

Payment activity nearly tripled year over year, driven in part by more than 3 million new users added in 2025. The figures suggest stablecoin-based payment services are gaining traction beyond crypto-native users, especially in regions where traditional banking is costly or unreliable.

What Comes Next for the Company?

RedotPay is building financial services powered by stablecoins that help users move money quickly and across borders. The platform is designed to work for both crypto users and people new to digital assets.

Its services include:

- A payment card that allows users to spend stablecoins and other digital assets worldwide

- Stablecoin-based payout services that enable faster and more secure international transfers

- Tools that connect traditional currencies with digital assets, allowing users to hold, exchange, and use stablecoins through multi-currency accounts and peer-to-peer options

Crypto Venture Funding Continues to Grow in 2025

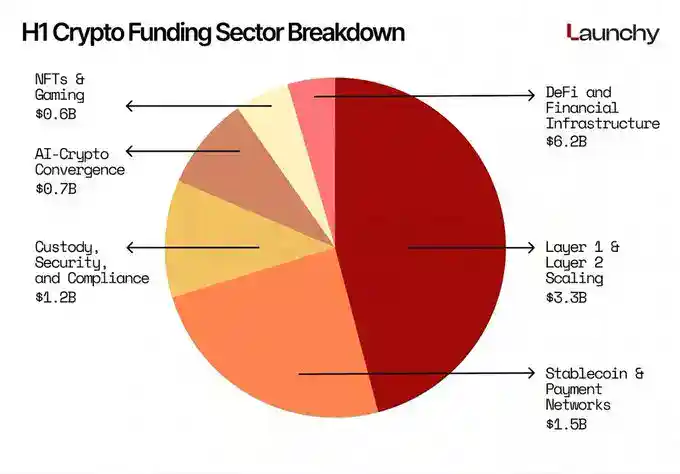

Funding for crypto and blockchain companies has been rising over time. In the first half of 2025, crypto companies raised more than $16 billion in venture funding. During the second quarter alone, global investors put about $2 billion into crypto and blockchain startups across 378 deals.

By the first quarter of 2025, companies had already raised $4.8 billion, which is close to 60% of the total raised in all of 2024.

Related: Solana Is The Most Watched Blockchain in 2025, Withstands Record-Breaking 6 Tbps DDoS Attack

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.