- Gold set a fresh record as Bitcoin eased near $105K in mixed risk flows

- Ricardo Salinas projected a $1.516M BTC as capital rotation narrative builds

- BTC to gold ratio watched for a reclaim after a key trendline breakdown

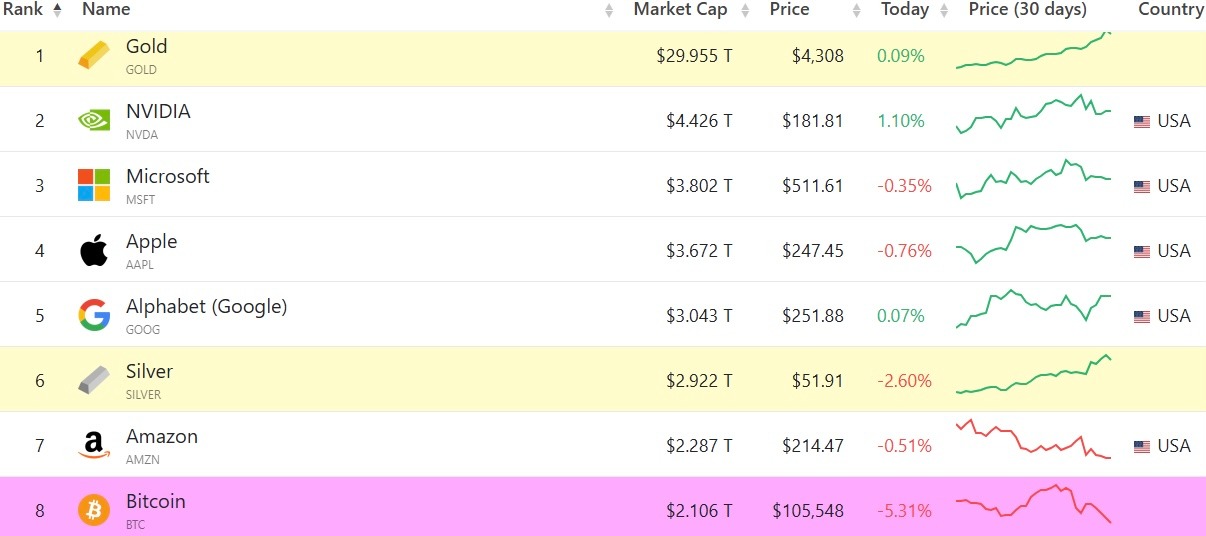

Mexican billionaire Ricardo Salinas Pliego bets Bitcoin (BTC) must rally 14 times, or to $1.516 million, just to match gold’s new $30 trillion market cap. The bold Ricardo Salinas Bitcoin $1.5M bet lands as BTC price today trades near $105,522, sliding 5% in the last 24 hours.

This contrasts sharply with gold (XAU), which just hit a new all-time high of $4,380. The 14x gap highlights the long-term bet on capital rotation, even as short-term charts favor the metal.

Why the $1.5M Bitcoin Bet Matters Today

Salinas Pliego, who reportedly holds 70% of his investment portfolio in Bitcoin exposure, frames the $1.516 million target as the minimum price BTC needs to achieve parity with gold. His calculation stems from gold recently securing its $30 trillion market capitalization.

The billionaire’s forecast anticipates this 14x move happening over the next 12 months, with BTC outperforming in subsequent bull markets. This long-term thesis, however, faces a stark short-term reality.

Related: BTC, XRP, BNB, ADA Post Double-Digit Weekly Losses as “Risk-Off” Deepens

Price Analysis: BTC vs. Gold (BTC/XAU)

While Salinas bets on Bitcoin, latest market action favors the metal. Gold (XAU) gained roughly 64% year-to-date, hitting a new all-time high near $4,380 on October 17 before settling at $4,310.

Bitcoin moved in the opposite direction. BTC price dropped over 5% in the same 24-hour period, briefly touching a range low of $103,598 before finding support near $105,522. The dip pushed Bitcoin’s market cap down to $2.1 trillion, still ahead of major equities like Meta Platforms and Saudi Aramco.

Levels and Structure

Technical analysis of the BTC/XAU pair suggests the path to $1.5 million faces immediate hurdles. The pair, which charts Bitcoin’s value against gold, recently broke below a critical rising logarithmic support trendline that held since January 2024.

This breakdown follows a triple rejection at the 36.16 resistance level, which aligns with the pair’s 2021 all-time high. The chart structure now shows a potential head and shoulders (H&S) top, a classic bearish reversal pattern.

Momentum

Momentum indicators support the short-term bearish case for Bitcoin against gold. The daily Relative Strength Index (RSI) shows a clear bearish divergence, signaling that the previous uptrend was weakening before the support line broke. For the 12-month bullish scenario from Salinas to play out, the BTC/XAU pair must first reverse this breakdown and reclaim its multi-year logarithmic support.

What Changes the Path Next

The primary driver for the long-term $1.5 million target relies on accelerating capital rotation from gold to Bitcoin. Long-term investors and sovereign entities increasing their BTC allocations are key to this thesis.

This trend includes the United States government, which now holds approximately 198,000 BTC in its strategic reserve, valued at over $20.8 billion. The government has previously adopted Bitcoin as a store of value and a hedge against inflation and national debt.

Related: Bitcoin’s Q4 Setup: $100K First, $88K Risk, $125K Breakout Clears Records

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.