- Ripple’s CLO clarifies Terra ruling has no impact on XRP’s security status.

- Alderoty said, “the [Terra] Judge has to accept everything that the SEC alleges as true (for now).”

- Terra judge misread reasoning behind Ripple judge’s decision on secondary market sale.

In the wake of the recent ruling in the Terra case, Stuart Alderoty, the Chief Legal Officer (CLO) at Ripple, has come forward to clarify that the decision has no bearing on the status of XRP as a security.

Alderoty emphasized that despite the differing outcome in the Terra case as opposed to that of XRP, it does not alter the conclusion reached in the Ripple case, where it was ruled that XRP token is not a security. He underlined that the Ripple case benefited from a comprehensive factual record developed over two years, while the Terra case is still in its early stages.

The Terra case is just starting, and the Judge has to accept everything that the SEC alleges as true (for now). Our [Ripple’s] ruling came after a full factual record was presented to the court.

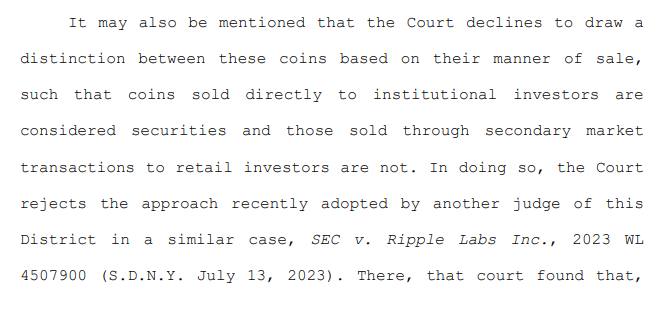

Furthermore, Alderoty pointed out that the Terra judge appeared to have misread the reasoning behind the Ripple judge’s decision. He highlighted a particular oversight regarding the distinction between institutional and public sales of digital assets that “secondary market traders can’t ‘invest money’ in anyone or anything if they don’t know who they are buying from.”

The ruling in the Terra case, which allowed the Securities and Exchange Commission (SEC) to proceed with its case against Terraform Labs and its founder Do Kwon, has created confusion in the crypto industry regarding regulatory clarity.

In the Ripple case, Judge Torres ruled that XRP token is considered a security when sold directly to institutional investors, but not when traded on exchanges by the general public. However, in the Terra ruling, Judge Rakoff rejected this approach and did not differentiate between coins sold to institutional investors and those traded on secondary markets.

The SEC’s claims lies in the alleged misrepresentations made by Terraform Labs and Kwon. They purportedly enticed investors, both institutional and retail, to purchase and hold their products using false and materially misleading statements.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.