- Simplified crypto rules align with securities law, supporting clarity and fostering innovation.

- Decentralization metrics in token regulation create vagueness, risking legal inconsistency.

- FIT21 revisions can enhance enforcement by removing decentralization as a defining criterion.

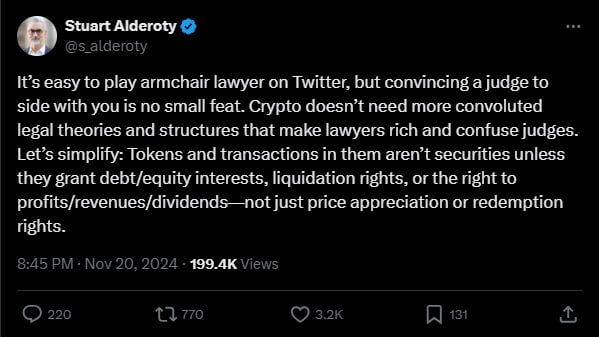

Crypto tokens classified as securities have been a hot-button issue within the digital asset space. Instead, Stuart Alderoty, Chief Legal Officer at Ripple, advocates for a simplified approach to crypto regulation. He asserts that only tokens with equity or profit rights should be classified as securities. This approach can, he says, reduce legal ambiguity.

Alderoty believes this targeted approach would better align with established securities law and offer clarity for all parties involved.

These cases occur when tokens embody financial rights like equity, debt interests, or entitlements to profits or liquidation proceeds. Simplifying these criteria reduces legal ambiguity and supports innovation without unnecessary legal entanglements.

Reassessing Decentralization as a Defining Metric

Further noted by MetaLawMan, crypto regulation often suffers from an over-reliance on subjective metrics like decentralization. Using decentralization to determine a token’s legal status introduces vagueness into a framework that should be predictable.

This, in turn, creates uncertainty and allows lawyers to capitalize on unclear rules, leaving judges and regulators to grapple with unnecessary complexity. As a result, developers and investors face risks due to inconsistent legal interpretations. Simplifying these definitions would reduce litigation costs, foster trust, and encourage the responsible use of blockchain technology.

Alignment with Established Securities Law

U.S. securities law, refined over a century, offers clear precedents for determining what constitutes a security. Tokens granting rights to dividends, revenue shares, or liquidation proceeds are similar to traditional securities and should be regulated accordingly.

However, tokens that only offer price appreciation or redemption rights lack these critical characteristics. Therefore, applying established principles ensures regulatory decisions are consistent with historical practices, providing a solid foundation for both new and experienced market participants.

Proposed Legislative Adjustments

The current draft of the Financial Innovation and Technology for the 21st Century Act (FIT21) relies on decentralization metrics to classify tokens. However, this approach should be revised to reflect a more practical and consistent framework.

Additionally, removing decentralization as a defining criterion ensures that regulations are clearer and easier to enforce. Consequently, this adjustment would reduce unnecessary legal disputes, allowing stakeholders to focus on meaningful innovation rather than compliance uncertainties.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.