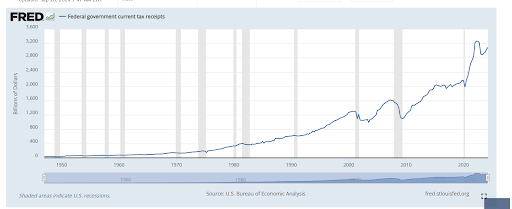

- U.S. federal interest payments surpassed $1 trillion annually in 2024, highlighting rising debt and fiscal sustainability concerns.

- Steady growth in U.S. interest payments since the 1980s has accelerated dramatically since 2020 due to rising rates and pandemic borrowing.

- Higher interest costs strain the federal budget, potentially limiting spending on infrastructure, healthcare, and education.

Ripple CTO David Schwartz, also known as JoelKatz, shared data showing record-high U.S. federal interest payments, which have now surpassed $1 trillion annually.

This surge reflects a significant change in the U.S. economy, driven by higher interest rates and increased national debt. This trend is raising concerns about fiscal sustainability and future federal spending.

Decades of Growth in Interest Payments

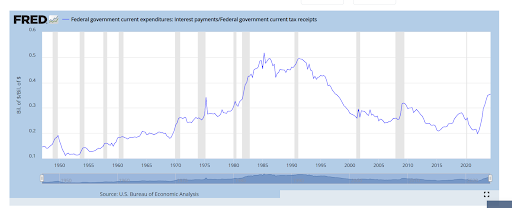

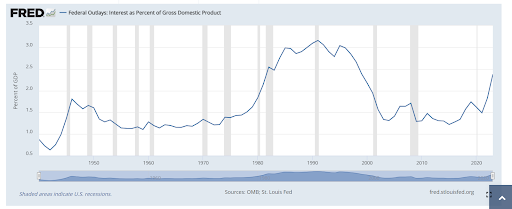

The cost of federal interest payments has grown steadily since the early 1980s, reflecting the increase in national debt. Measures to reduce inflation in the 1980s and 1990s also contributed to higher interest payments.

However, the growth rate was relatively stable until recent years, with manageable levels during recessions. During these periods, net interest payments often declined or stabilized before rising again.

Economic Policies and Rising Rates Drive Recent Surge

Since 2020, the federal government’s response to economic challenges has increased debt levels. Efforts to combat the effects of the COVID-19 pandemic included stimulus packages, which required significant borrowing. Consequently, interest payments surged as borrowing costs escalated alongside rising interest rates. The data suggests that without interventions, the upward trajectory may continue as economic pressures remain high.

Moreover, this surge reflects changes in monetary policy and higher bond yields, resulting in increased borrowing costs. This has put pressure on the federal budget, with interest payments consuming a larger portion of tax revenue.

Read also: Federal Funds Rate Set to Jump, Will Crypto Market Survive the Aftermath

Fiscal Implications of Rising Debt Servicing Costs

The increasing interest burden has notable implications for U.S. fiscal policy. Rising interest payments could limit the government’s ability to fund other priorities, including infrastructure, healthcare, and education. Besides, managing this debt may require more borrowing, potentially creating a debt cycle.

Additionally, with interest rates expected to remain high, policymakers face challenges in balancing the budget. Higher interest costs could lead to discussions about taxation, spending adjustments, or debt restructuring.

Historical Context and Future Outlook

Historically, federal interest payments have surged during periods of economic strain, such as in the 1980s and the 2008 financial crisis. The current spike, however, is unprecedented, surpassing past peaks. Besides inflation and rate control measures, today’s context involves the lingering effects of pandemic-related expenditures. Consequently, the situation appears more complex, as managing debt levels becomes a priority to avoid further economic strain.

As U.S. interest payments continue to grow, questions remain about future fiscal strategies. Will higher payments crowd out essential spending, or will adjustments in monetary policy ease the burden? These concerns highlight the urgency of finding sustainable solutions to manage federal debt amidst rising interest costs and evolving economic conditions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.