- The SEC could miss the deadline to appeal against Ripple.

- Crypto community members debate over the correct deadline for the SEC’s appeal.

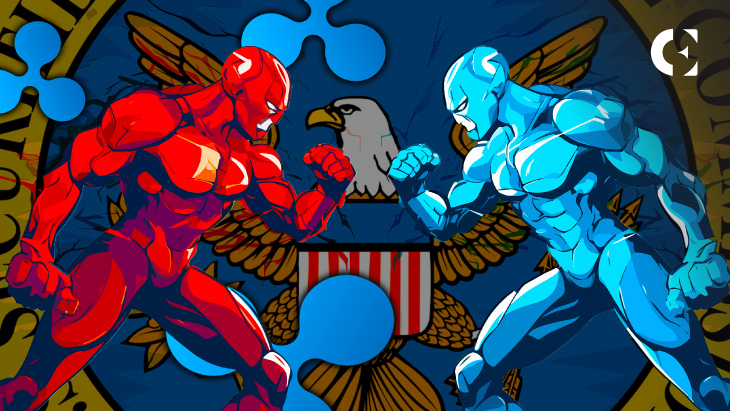

- XRP surges as the appeal deadline nears expiry

The deadline for a potential SEC appeal in the Ripple case is fast approaching, sparking discussion about the implications if the commission misses it. An X post by a well-known commentator predicts the SEC will file an appeal today, October 17.

The commentator believes this would surprise many in the crypto community, who don’t expect the agency to appeal. He says the SEC is aiming for October 17 as the deadline, while many in the crypto community believe the Form C deadline was October 16.

In the meantime, Crypto lawyer Jeremy Hogan agrees that the SEC’s timeframe for filing Form C has nearly expired, supporting the October 16 deadline. Hogan shared a screenshot of the Civil Appeal Pre-Argument Statement, which requires appellants to file Form C within 14 days of filing the notice of appeal.

Potential Implications for XRP

As of writing, the SEC has not yet filed Form C, leaving crypto users to speculate about the impact on XRP. Many believe that if the SEC doesn’t appeal, it would be positive for XRP, supporting Ripple’s view that the original judgment was a victory.

Read also: XRP Tests Critical Resistance, Can it Break Out and Rally?

XRP jumped 3.85% in the early hours today, climbing from $0.5456 to $0.5662 within a few hours. This pushed XRP above the crucial resistance level at $0.5551, signaling a potential further upward movement.

If the SEC misses the appeal deadline, any later filing could be dismissed, ending the legal battle between Ripple and the SEC. Many believe this litigation has hindered XRP’s growth and mainstream adoption.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.