- Ripple leaders are discussing adding native staking and DeFi capabilities to the XRP Ledger.

- CTO David Schwartz proposed a “two-layer” consensus to separate governance from compute.

- The move follows the launch of the Canary XRP ETF, signaling a pivot to institutional DeFi.

The XRP Ledger (XRPL), which began as a settlement network in 2012 is now heading for a major change in utility, as Ripple CTO David Schwartz and RippleX Head of Engineering J. Ayo Akinyele open the door to native DeFi capabilities and even the possibility of staking.

The move follows the launch of the first XRP spot ETF by Canary. Schwartz said that the blockchain world has changed since XRPL’s debut and developers now need to reconsider long-held assumptions about governance, incentives, and how value should flow across the network.

Related: XRP Price Prediction: XRP Price Sits at a Critical Turning Point as Downtrend Holds

Why Ripple Is Considering Native Staking Now

Historically, XRP has served as a fast, efficient bridge asset and liquidity instrument. It powered payments, enabled settlement of tokenized assets, and facilitated real-time movement of value across global markets. But the arrival of institutional-grade products like tokenized Treasuries, money market funds, and ETFs has flipped the table completely.

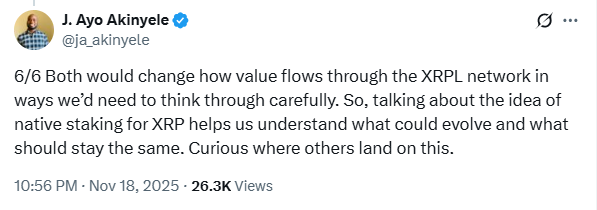

Schwartz and Akinyele both note that XRP is being used in DeFi environments through external protocols such as Flare, Axelar, MoreMarkets, and Doppler. Akinyele questioned if soon XRPL will support native staking.

While staking is typically used to align economic incentives between validators and token holders, XRPL operates differently. Transaction fees are burned. Validators have equal influence regardless of token ownership. Any introduction of staking would therefore represent a major shift.

The ‘Two-Layer’ Solution: Splitting Governance from Compute

To address challenges, Schwartz brought two early conceptual frameworks. The first is a two-layer consensus design that keeps XRPL’s existing trust-based model intact while introducing an incentivized layer for performance-heavy tasks.

Under this model, the outer layer would continue to oversee governance, amendments, fee structures, and validator policy. It would preserve XRPL’s current stability and institutional reliability. The inner layer, however, would be responsible for advancing ledger transitions more frequently and efficiently.

It is important to note that a staking-based selection mechanism could determine which validators take part in this inner layer. This split would allow XRPL to maintain its strengths, speed, security, minimal cost, and encourage more validator diversity.

Vet, a crypto enthusiast, asked whether such a structure truly offloads the computational demands of new features. Schwartz responded that the inner layer could handle compute-heavy processes while the outer layer supervises.

Related: XRP Down 11% as Many ETFs Prepare for Launch Week Between Nov 18-25

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.