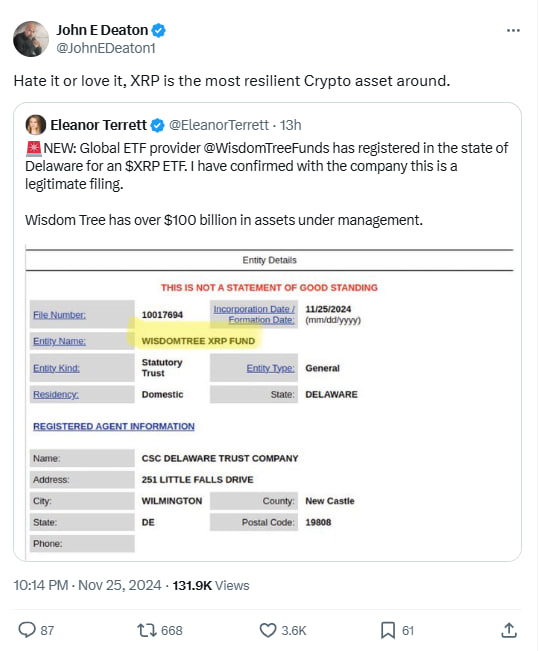

- WisdomTree Funds filed for an XRP ETF in the state of Delaware on November 25.

- Attorney John Deaton addresses the XRP token as the most resilient asset.

- Bitwise was the first to apply for the XRP ETF, followed by Canary Capital and 21Shares.

Pro-XRP attorney John Deaton termed Ripple’s XRP the most resilient digital asset as WisdomTree Funds, a leading New York-based asset manager, filed for an XRP exchange-traded fund (ETF) in Delaware on November 25, 2024.

WisdomTree’s application is just the start toward launching an XRP ETF, with further steps, including an S-1 filing with the SEC, still pending. Fox Business journalist Eleanor Terrett confirmed the filing after reaching out to the asset manager.

With this filing, WisdomTree became the fourth firm to apply for an XRP ETF, following Bitwise, Canary Capital, and 21Shares. This reflects growing institutional interest in Ripple’s XRP. Ripple CEO Brad Garlinghouse labeled the demand for XRP ETFs as “inevitable.”

Bitwise led the ETF race with its initial application, while Grayscale launched an XRP Trust with plans to convert it into an ETF.

Optimism Rises Despite Regulatory Challenges

Although the SEC’s decision on XRP ETFs remains uncertain, recent developments, including SEC Chair Gary Gensler’s upcoming resignation in January 2025 and President-elect Donald Trump’s crypto-friendly policies, have sparked hope. With Bitcoin and Ethereum ETFs already approved, XRP’s ETF approval seems increasingly likely.

XRP has been staying green over the past few days despite fluctuations. WisdomeTree Fund’s ETF application has since boosted XRP’s upward trajectory with a 3.68% surge in 24 hours. The token has seen more significant upticks over the last week and month- 29% and 182%, respectively.

‘Hate it or love it,’ Deaton remarked, stressing XRP’s resilience despite polarizing opinions. While advocates praise its utility, critics dismiss it as a ‘centralized pump and dump,’ claiming its primary purpose is to benefit Ripple CEO Brad Garlinghouse.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.