- As gold and silver experienced price swings RWA perps trading volume surpassed $15 billion.

- Traders are using crypto based perpetual swaps to bet on the price of gold and silver.

- Predictions are looming that the tokenized asset market could reach trillions by the end of the decade.

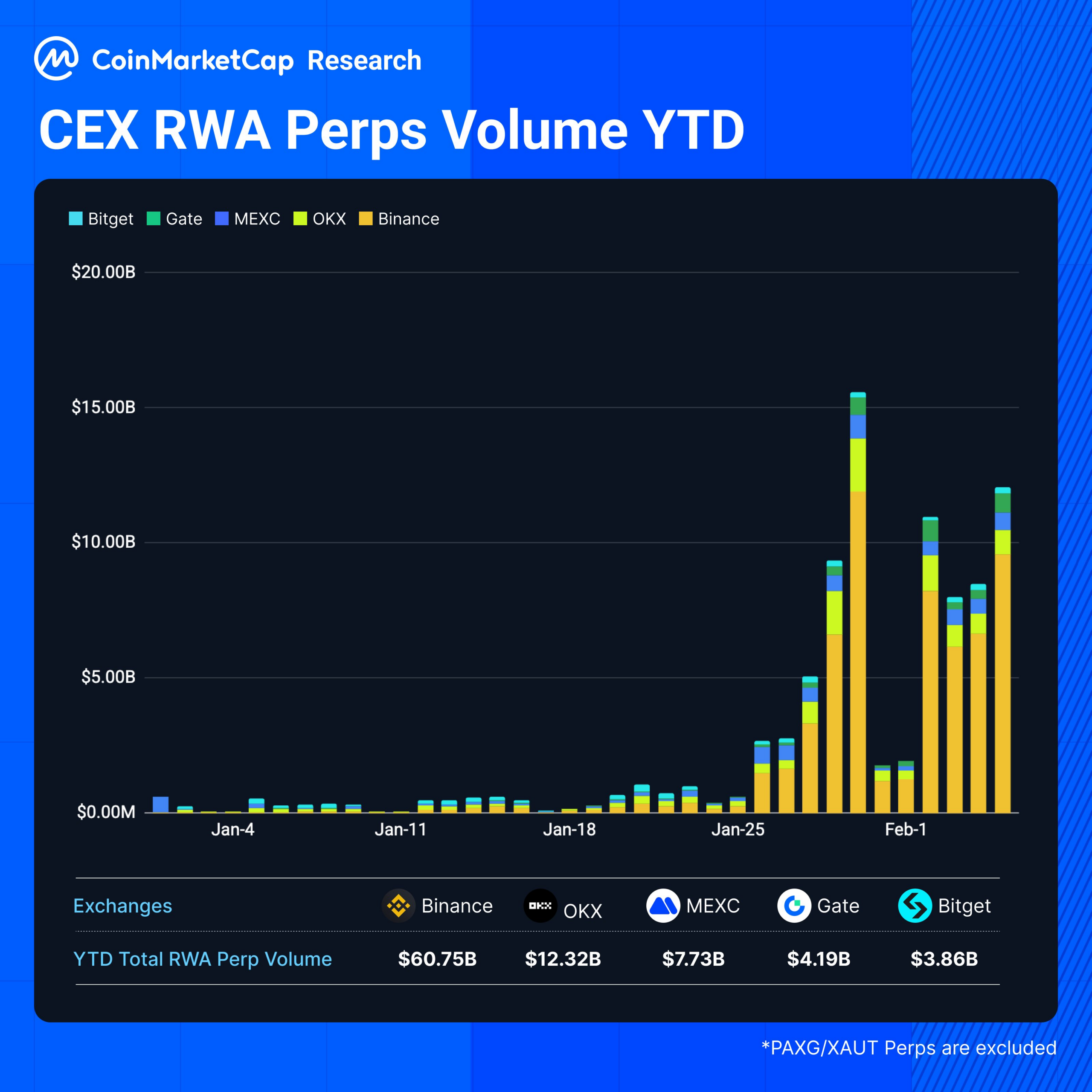

According to a recent X post from CoinMarketCap, projects following the price surge of gold and silver the RWA Perpetuals market is carving a new sector. Over the past two weeks bets on real-world commodities like gold and silver using crypto derivatives has seen a massive growth.

Source: CoinMarketCap

RWA perps trading volume reportedly surpassed $15 billion as gold and silver reached its ATH of $5,500 and $121.64 per ounce, signifying that traders are actively using these markets and not just testing them.

RWA perpetuals are crypto contracts that let users bet on the price of RWAs such as gold or silver, 24/7, with no expiration date. Unlike buying a digital token that represents the actual asset, traders just trade on the price movement, similar to how one would trade a Bitcoin perpetual swap.

On some crypto exchanges, the daily trading of silver perpetual swaps has become nearly as high as on traditional COMEX silver futures. This shows a rather notable mainstream acceptance of blockchain based derivatives for real-world commodities.

Related: Brazil Leads Global RWA Revolution: $100M Milestone Reached in 2026

RWA Expansion With Gold and Silver

Binance has started to let traders speculate with perpetual contracts for gold and silver (XAU, XAG) against USDT on January 5 and January 7, through the regulated entity licensed in the Abu Dhabi Global Market. Currently, it has become the preferred platform for traders to bet on the price movement of gold and silver using perpetual contracts.

Alongside Binance, a few other crypto trading platforms offer similar services. MEXC started offering gold and silver futures with no trading fees, Hyperliquid witnessed a surge in trading activity of gold and silver, and Aster DEX was already listing metal perpetuals as well as it was also running rewards program to encourage users to trade its gold and silver perpetual swaps

On Hyperliquid, the daily trading volume for precious metal perps has topped $1.3 billion, making silver one of the most traded assets after Bitcoin.

Gold and silver prices swung wildly in early 2026 due to global economic factors. Unlike traditional markets that close at night and on weekends, crypto perpetuals let traders bet on or hedge against these price movements around the clock, which appeals to a wide range of market participants.

Estimates reveal that the tokenized asset market could eventually reach the trillions by the end of the decade. In one of its older reports, the global consulting company McKinsey predicted that the total market cap of tokenized assets could hit $2 trillion by the end of 2030.

Related: How is RWA Performing in 2026 and Its Upcoming Outlook?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.