- Sonic Labs is entering a “fundamentals-first” growth phase under CEO Mitchell Demeter.

- The S token is being redesigned to include deflationary mechanics and better holder rewards.

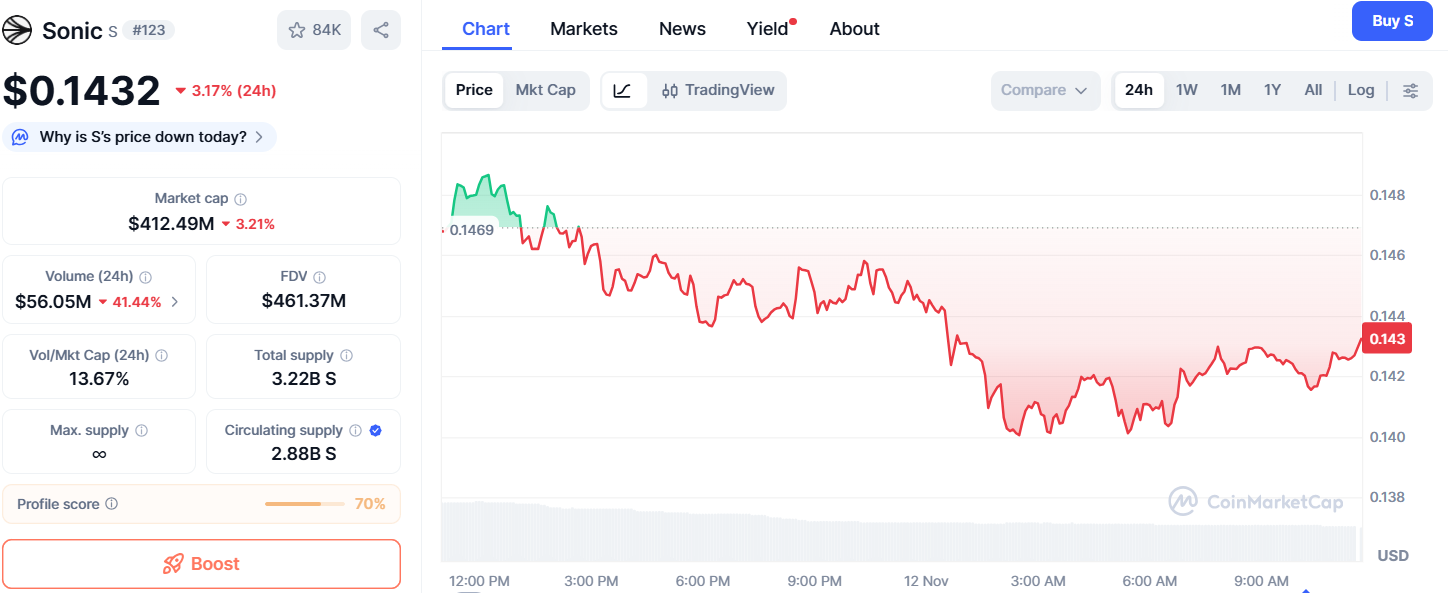

- Price outlook: breaking the $0.22 resistance could send S token toward $0.30, but failure may lead to $0.11.

Sonic Labs CEO Mitchell Demeter says the company is entering a new stage focused on real growth and long-term value instead of hype. After spending six weeks learning about the company’s structure and goals, Demeter said Sonic is now ready to move forward with a “fundamentals-first” plan.

The company wants to strengthen its network, expand its user base, and build tools that last. Sonic also plans to make changes to how its S token works — adding features that could make it deflationary and more rewarding for users who hold or build on it.

Even though the S token has dropped about 3% this week, trading around $0.14, Demeter said Sonic’s finances are stable and the company’s treasury is in good shape.

What’s Changing

Here are some of the updates Sonic Labs is rolling out:

- Updated Fees System: Sonic will update its FeeM model, giving clear rewards to builders and validators while using token burns to reduce supply.

- US Expansion: Sonic is opening a New York office to grow its presence in the U.S. and work more closely with regulators.

- Ecosystem Growth: The GMSonic project will become a global hub for education and community updates.

- Tech Upgrades: Sonic plans to adopt new Ethereum-inspired improvements (EIPs) and Sonic Improvement Proposals (SIPs) to make its network faster and more useful for businesses.

Why Price Still Matters

Demeter also said that price matters because it shows confidence in the project. “Price reflects confidence,” he said. “But price alone isn’t the goal. It’s the outcome of consistent vision, solid fundamentals, and credible execution which builds a foundation for long term growth.”

He added that a healthy token price helps attract more developers and investors.

Sonic Price Analysis

Sonic’s next move largely depends on Bitcoin’s direction and overall market sentiment. A strong Bitcoin bounce could help Sonic retest higher levels, but if the crypto market weakens, the token risks slipping to new lows.

Sonic remains in a long-term downtrend since early 2025, repeatedly failing to break resistance levels. The next major test lies between $0.21 and $0.22, a zone that has rejected the token multiple times.

If Sonic can break above this range, it could rally toward $0.27 to $0.30, an 80–90% potential upside. However, failure to break out may trigger another correction toward $0.11.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.