- Santiment’s new index shows Bitcoin and Ethereum whales selling at the same time as retail, so forced selling is not finished.

- Ethereum stays below $3,300 and under the 50-week SMA, keeping the door open to another leg lower before recovery.

- XRP still looks like the cleaner rebound play, but traders want a flush to $1.90 before chasing a move back to the $3 area.

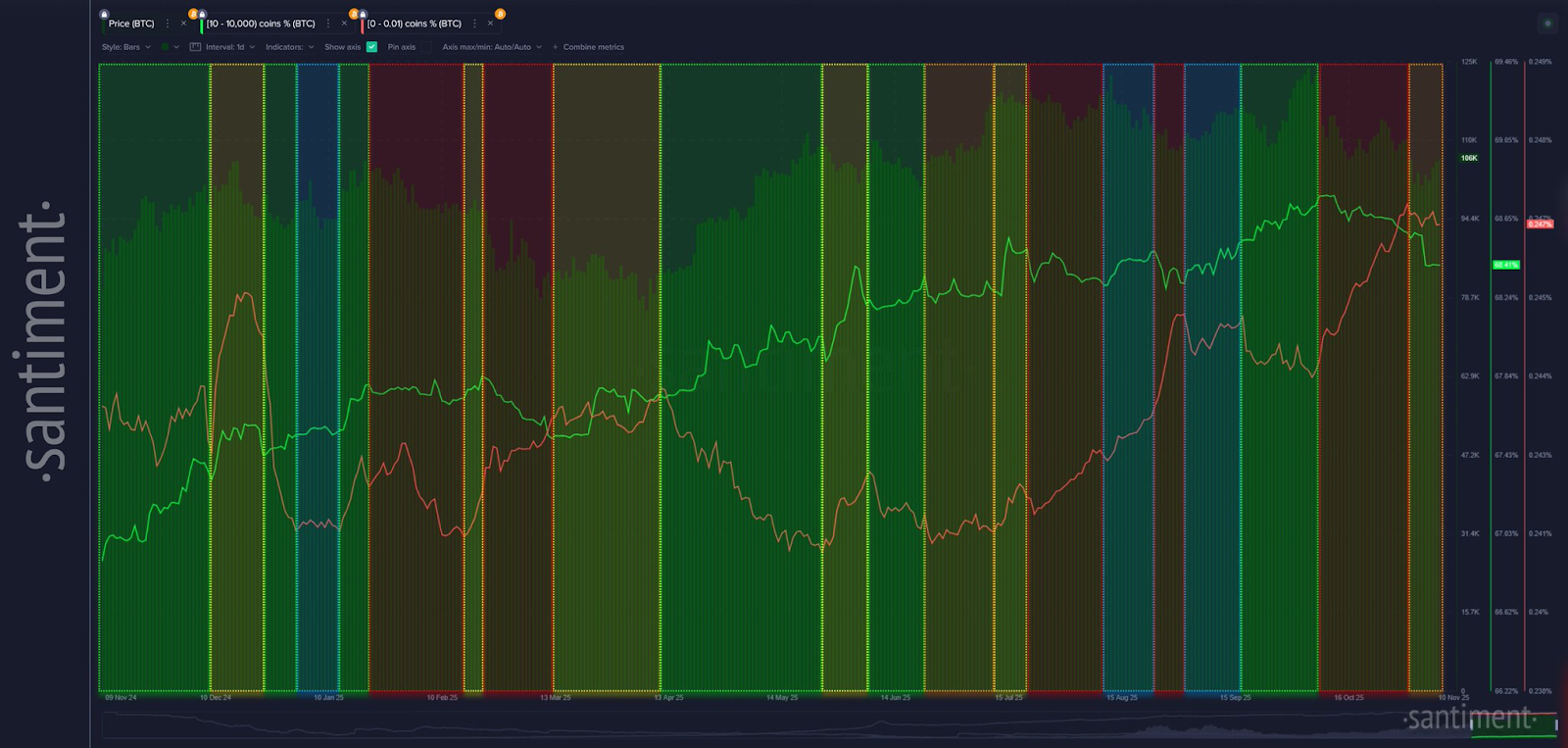

The latest Santiment dashboard shows something traders don’t like to see at the end of a selloff: Bitcoin wallets holding 10 BTC to 10,000 BTC are reducing exposure at the same time as small holders, which means capitulation pressure is still active, not finished.

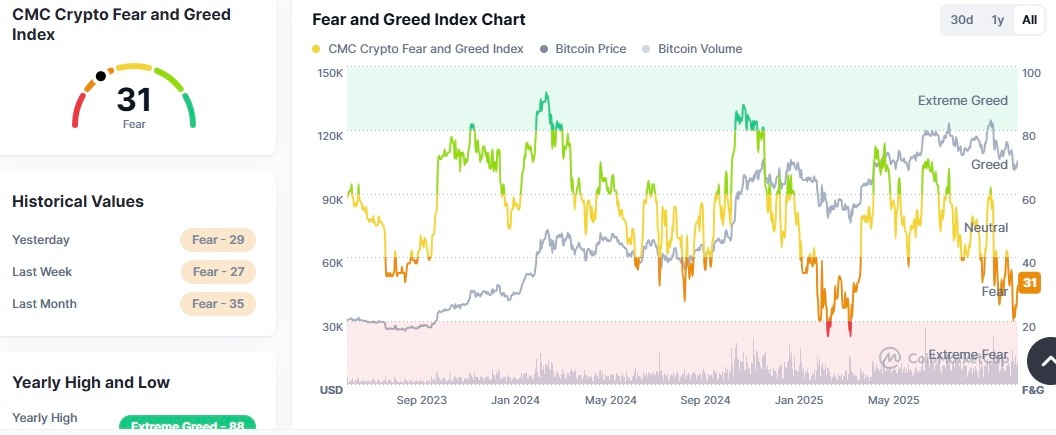

The fear and market weakness observed in Bitcoin (BTC) has trickled down into the wider altcoin market, with the exception of privacy-centric altcoins.

Retail addresses have been offloading since the October 11 crypto crash and larger wallets have now joined them, creating a single-direction flow that usually delays a full rebound. This keeps the broader altcoin market tied to Bitcoin’s tone until bigger buyers return.

Ethereum Price Stays Soft Below Key Weekly Levels

Ethereum has not followed the small relief pops elsewhere. Price slipped below the 50-week simple moving average, which tells you spot demand is still thin compared with 2024 and early 2025.

In the 1-hour timeframe, the ETH/USD pair has been forming a potential double top, coupled with bearish divergence of the Relative Strength Index (RSI). The ETH/USD pair also dropped below its recent rising logarithmic trend, signaling more pain ahead.

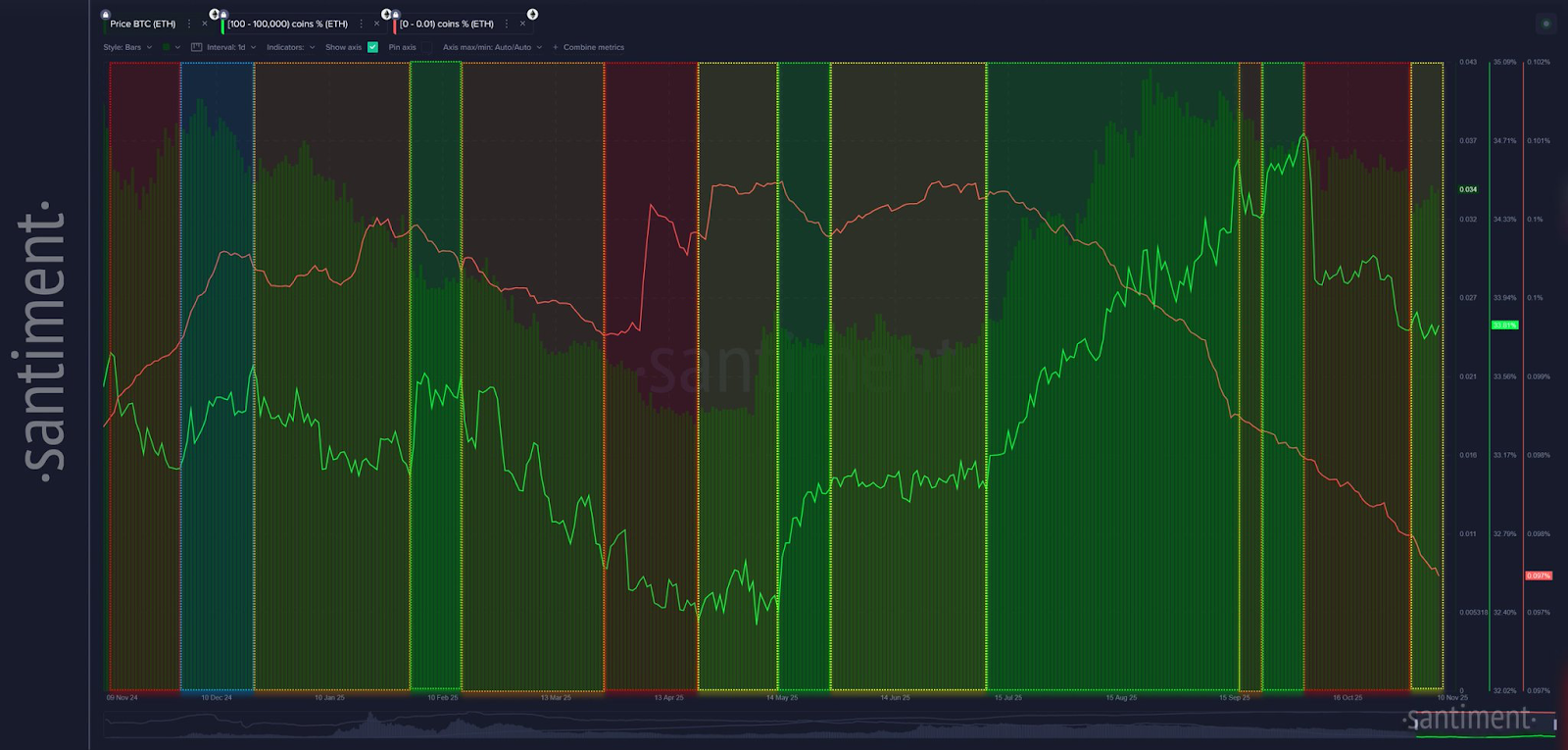

Santiment Data Confirms ETH Whales And Small Holders Are Still Reducing

Santiment’s new index for Ethereum shows the same two-sided reduction: wallets with 100 ETH to 100,000 ETH have been sending coins back to exchanges, and the smallest wallets below 0.01 ETH have been cutting exposure since July 2025.

When both lines slope down together, history says the market needs more time to reset before a durable bottom forms. That pushes the “perfect” accumulation window for ETH and high-beta alts further out.

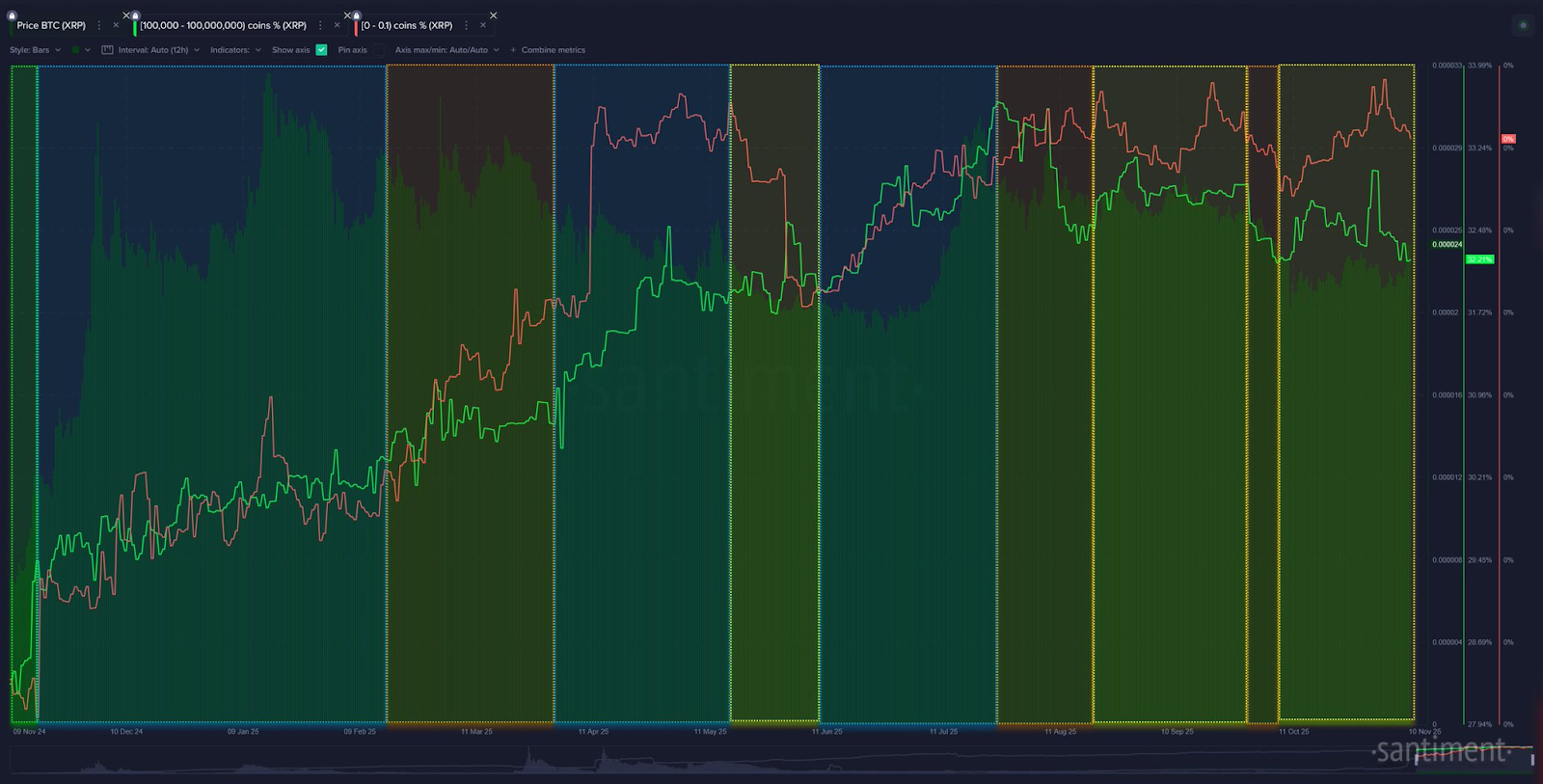

XRP Still Looks Like The First To Rebound, But Needs The $1.90 Flush

XRP is the outlier in this setup. Santiment shows the earlier aggressive XRP accumulation has slowed and both whales and retail trimmed this week, which is why XRP slid into a midterm correction.

Analysts tracking the XRP range still want to see a price of $1.90 again, because that level has been the most reliable launch point in this cycle. A clean retest there, combined with the expected spot XRP ETF listings once Washington reopens and the Fed turns the liquidity taps back on, is the setup traders are waiting for.

Related: Analyst Says XRP Could “Melt Faces” in 4–6 Weeks, “Mark My Words”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.