- Stanford Law professors Bankman and Fried will no longer teach from next year.

- SBF’s mother claimed it was part of her retirement plan and had nothing to do with FTX.

- SBF continuously accused Binance CEO of being responsible for FTX’s failure.

The monumental failure of the FTX crypto exchange may have started telling on the families of its founder Sam Bankman-Fried (SBF). According to a university press, Stanford Law professors Joseph Bankman and Barbara Fried, the parents of the former CEO of the bankrupt FTX, would no longer be teaching in the school from next year.

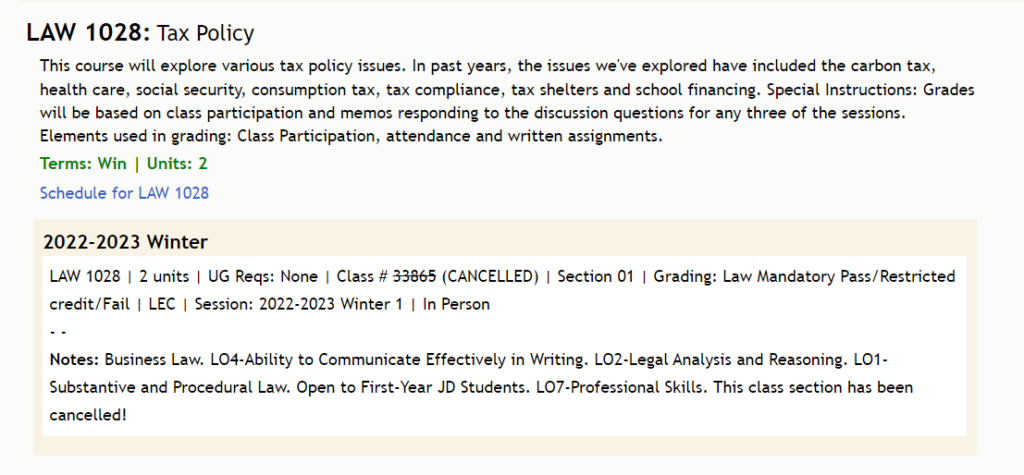

The Stanford Daily reported that SBF’s father, Bankman, dropped his tax policy course initially slated for the winter session when the family faced accusations of purchasing a $16.4 million vacation house with FTX’s money.

Interestingly, SBF’s mother’s name did not appear as an instructor for any course. Although according to the report, professor Fried claimed it was part of her retirement plan and had nothing to do with whatever was happening.

Bankman-Fried found himself in the epicenter of one of the most significant crypto failures after it became clear that FTX did not have the reserve to cover an influx of customer withdrawal requests.

SBF has continuously pointed accusing fingers at the CEO of Binance, Changpeng Zhao, claiming if he had remained silent about FTX’s insolvency, the company would have been more stable.

In response, CEO Zhao labeled Bankman-Fried as one of the greatest fraudsters in history, adding that Bankman-Fried is a master manipulator of the media. Zhao continued:

SBF perpetuated a narrative painting other people and me as the ‘bad guys.’ It was critical in maintaining the fantasy that he was a ‘hero.’

The Binance concluded his argument by saying, “A tweet cannot destroy a healthy business.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.