- SEC Chairman requests whistleblowers’ help to detect, investigate and prosecute violators.

- 10%-30% of the money collected will be awarded to whistleblowers with legit information.

- Empower Oversight blames the former director of SEC for selective enforcement of the law.

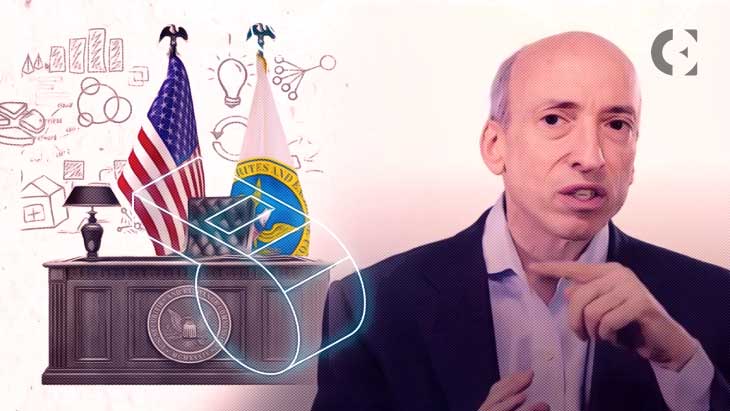

The Chairman of the Securities Exchange Commission (SEC), Gary Gensler, took to Twitter requesting the help of whistle-blowers to detect, investigate and prosecute violators of the SEC’s law. In his Twitter post, Gensler wrote on behalf of the SEC, encouraging the general public to also aid in this regard.

Moreover, as directed by the link on the Twitter post to the article “Office of the Whistleblower”, it is reported that any information provided by a whistleblower to the SEC on violation is a formidable weapon. In addition, the article highlights the importance of early detection of violations and how it could avoid more serious harm to investors.

Additionally, it explains how early detection helps preserve the integrity of the United States capital markets and more swiftly hold accountable those responsible for unlawful conduct.

Interestingly the article states that the commission has been empowered by congress to award those who provide high-quality legitimate information. Furthermore, it states that the information received leads to a commission enforcement action in which over $1,000,000 in sanctions is ordered. The article states that the range for awards is between 10% and 30% of the money collected.

Meanwhile, a popular crypto enthusiast named Kenny Nguyen replied to the Twitter post asking Gensler for his reward for reporting William H. Hinman, the former director of the SEC.

According to whistleblower Empower Oversight, a nonprofit, nonpartisan educational organization, Hinman had allegations of conflicts of interest associated with the SEC’s selective enforcement actions involving cryptocurrencies.

Another user named Eduard Brichuk replied to the tweet and requested Gensler whether he was willing to discuss the Citadel Securities LLC violation or whether this was just gaslighting.

Additionally, Brichuk pointed out that Citadel was a regular violator of REG SHO and the Securities Exchange ACT of 1934; however, they have gone scot-free because of Acceptance, Waiver, & Consent (AWC), which gives them the freedom not to admit it.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.