- SEC delays decisions on multiple altcoin ETFs, including those for Solana, XRP, and Dogecoin

- Despite the delays, analysts remain optimistic about eventual approval of altcoin ETFs

- Delays reflect SEC caution towards non-Bitcoin crypto assets, despite broader acceptance

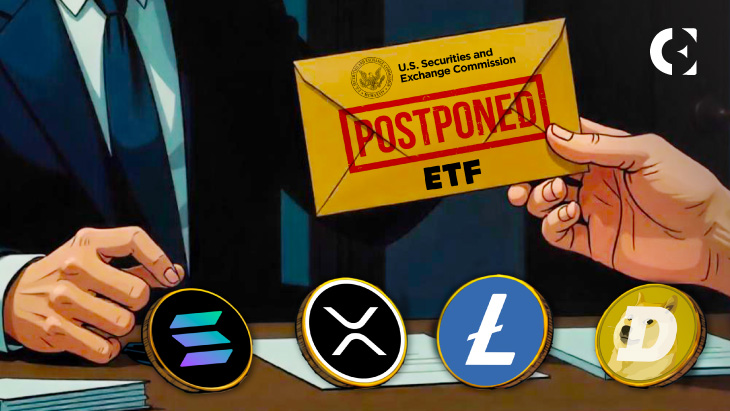

The U.S. Securities and Exchange Commission (SEC) has again postponed decisions on several cryptocurrency spot exchange-traded funds (ETFs), prolonging the wait for investors eager to see more altcoin’ backed ETFs enter the market. This delay affects ETFs tied to Solana, XRP, Litecoin, and Dogecoin, among others.

The SEC stated that additional time is needed to evaluate the proposed ETFs and their potential impact on the market. While this move may seem like a setback, analysts remain optimistic that these products will eventually receive regulatory approval.

Multiple Altcoin ETF Applications Delayed

In its latest round of postponements, the SEC extended the review process for multiple altcoin spot ETFs, including those filed by VanEck, Canary Capital, Grayscale, Bitwise, and 21Shares.

The decision affects several key applications, such as VanEck’s Spot Solana ETF, Canary’s Spot Litecoin and XRP ETFs, and Grayscale’s Spot Dogecoin and XRP ETFs. The regulator also delayed decisions on ETFs that feature staking options for Ethereum and in-kind creation and redemption mechanisms for Bitcoin and Ethereum ETFs.

The SEC has specifically pushed back decisions on Grayscale’s Spot XRP ETF and Cboe BZX’s Spot Solana ETF until May. Additionally, the deadline for the Canary Spot ADA ETF has been moved to May 29. The agency cited the need for a longer review period to thoroughly examine the proposed rule changes and any issues raised by these filings.

Related: A Potential Tidal Wave for the Altcoin Market: Solana ETFs

Analysts Still Expect Eventual Approval

Despite the postponements, industry experts remain optimistic about the eventual approval of these ETFs. Bloomberg ETF analyst James Seyffart reassured investors that this is part of the SEC’s standard process.

He pointed out that the delay does not indicate a lower chance of approval. According to Seyffart, the final deadlines for these ETFs extend until October, giving the agency ample time for further evaluation.

Similarly, analyst Eric Balchunas highlighted that delays were anticipated across the board, including for Ethereum ETFs featuring staking capabilities. He noted that while regulatory scrutiny remains high, the likelihood of approval remains high.

Regulatory and Political Context

The delay comes amid shifting regulatory attitudes towards digital assets in the U.S. The recent executive order signed by President Donald Trump, which established a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, indicates a growing institutional acceptance of cryptocurrency.

Related: SEC Cracks Down on Solana ETFs: What It Means for Crypto’s Future

However, the SEC’s reluctance to greenlight altcoin ETF approvals suggests a more cautious stance when dealing with non-Bitcoin assets.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.