- Senate draft bill praised for the strongest crypto developer protections to date.

- Proposal clarifies DAO governance, staking, airdrops, and token protections.

- Draft sets dual oversight with the SEC for securities and the CFTC for commodities.

The Senate Banking Committee’s latest market structure discussion draft has received positive initial reactions from cryptocurrency industry leaders. The 182-page “Responsible Financial Innovation Act of 2025” text, released Friday afternoon, contains what experts describe as the most comprehensive developer protection language seen in federal legislation to date.

Amanda Tuminelli, executive director and CLO at DeFi Education Fund, praised the draft’s developer protections and called them the best language observed in any previous legislative proposal. Legal expert Gabriel Shapiro highlighted the bill’s improved approach to decentralized governance systems. He also noted that the legislation addresses previous concerns about governance tokens potentially creating securities law complications.

Legislative Framework Addresses Key Industry Concerns

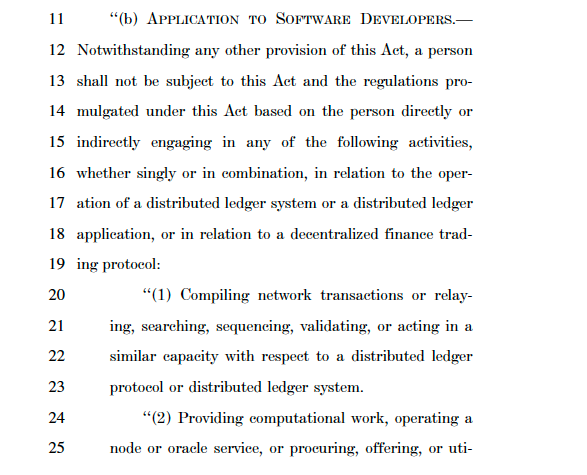

Shapiro specifically commended the draft’s handling of decentralized autonomous organizations. This includes blockchain-based governance tokens (BORGs). The legislation limits “disqualifying financial rights” carve-outs to actual securities rather than applying broader restrictions to payment and utility tokens.

The bill creates clarity around decentralized governance, staking mechanisms, airdrops, tokenization processes, and self-custody protections. Additional provisions include safeguards for existing non-fraudulent tokens against future SEC enforcement actions and exemptions for decentralized physical infrastructure networks and DeFi protocols.

Colin McLaren emphasized the importance of Democratic support for the legislation, arguing that Senate Democrats should prioritize innovation over regulatory constraints. McLaren referenced the potential for building “the next great American startup” rather than enriching legal professionals through prolonged regulatory uncertainty.

The Draft Establishes A Dual Regulatory Structure

The draft establishes a dual regulatory structure dividing oversight responsibilities between the Securities and Exchange Commission and the Commodity Futures Trading Commission. This framework aims to resolve jurisdictional ambiguity that has affected digital asset regulation by creating clear boundaries based on asset classification and functional characteristics.

Under the proposed structure, the CFTC would take primary authority over digital commodities – tokens intrinsically linked to blockchain systems that derive value from blockchain functionality. The SEC would retain oversight of securities and maintain authority over investment contracts involving digital commodities during primary market transactions.

The next step involves the Banking Committee introducing a formal bill and conducting markup proceedings, potentially by the month’s end. Timeline progression depends on the Democratic response and willingness to negotiate on divisive provisions within the draft legislation.

Related: SEC and CFTC Issue Vague Crypto Statement, But Lawyers Say Nothing Has Changed

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.