- Shiba Inu price today trades near $0.00001005, rebounding from demand zone support as buyers defend the floor.

- EMA resistance cluster between $0.00001068 and $0.00001257 continues to reject every breakout attempt.

- A breakout above the 20-day EMA confirms momentum shift, while failure risks a return to $0.00000980 support.

Shiba Inu price today trades near $0.00001005, stabilizing after a rebound from last week’s low. Buyers stepped in at the lower demand zone and forced an intraday recovery back above the short term trend channel. But the broader structure remains controlled by sellers as SHIB trades below a long running descending trendline that has rejected every breakout attempt since August.

Sellers Still Control The Higher Timeframe Structure

The daily chart shows SHIB locked underneath a descending trendline stretching from the early year highs. Each rally attempt has been capped at that trendline and rejected back into the range.

Major moving averages reinforce the ceiling:

- 20 day EMA: $0.00001068

- 50 day EMA: $0.00001146

- 100 day EMA: $0.00001200

- 200 day EMA: $0.00001257

All four EMAs are stacked above current price. Until Shiba Inu closes above at least the 20 day EMA, the structure stays corrective. The Supertrend indicator also remains red, signaling that sellers still have directional control.

This cluster of EMAs acts as a thick resistance zone. Every bounce into this region has been met with selling, sending SHIB back toward lower liquidity levels.

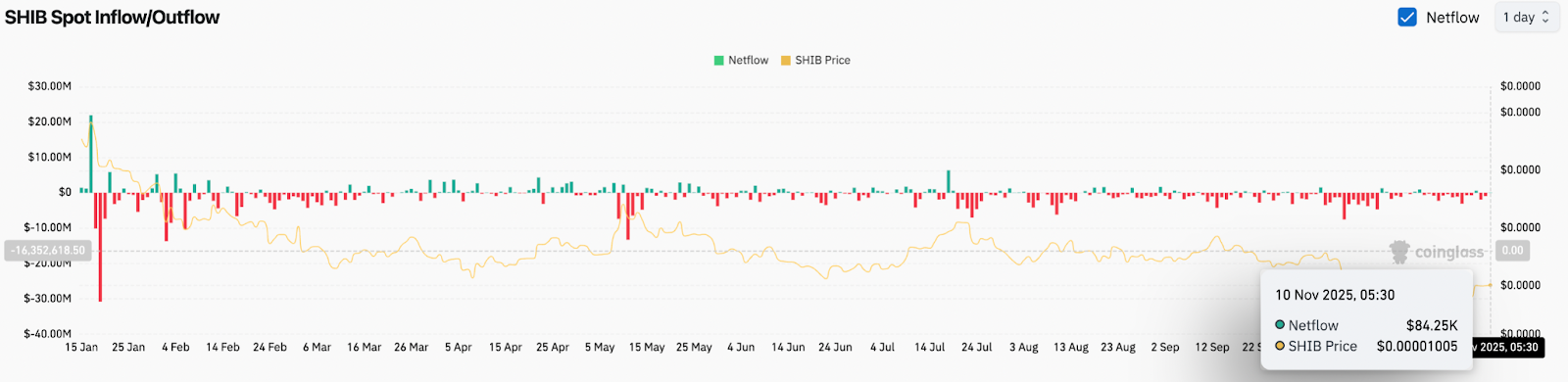

Spot Flows Show Stabilization As Buyers Defend The Floor

Netflow data shows SHIB recorded a small $84.25K inflow today. While modest, it marks a shift after several sessions of consistent outflows. Positive netflow suggests some accumulation interest returning, especially near key support levels.

The inflow aligns with price holding above $0.00000980, a zone where buyers have stepped in multiple times during the past month. As long as SHIB stays above that region, the downside remains limited.

However, flows are not yet strong enough to support a breakout. For a sustained rally, SHIB would need rising inflows and increased volume as price pushes toward the EMA cluster.

Intraday Momentum Turns Higher But Not Confirmed Yet

On the 30 minute chart, SHIB broke out of a short term descending channel and reclaimed the VWAP line, an early sign of buyers regaining momentum. The move shows that short term traders are actively defending dips rather than allowing continuation lower.

- RSI sits near 52, slightly above neutral.

- Price holds above short term support at the mid channel zone.

- First intraday resistance stands near $0.00001020.

The structure shows early strength, but buyers need a follow through push to confirm trend change.

A clean break above $0.00001020 flips intraday momentum in favor of bulls.

Outlook. Will Shiba Inu Go Up?

Shiba Inu is showing signs of stabilization, but a full reversal has not been confirmed. The trendline and EMA cluster overhead remain the key barriers.

- Bullish case: If SHIB closes above $0.00001068 (20 day EMA) and then pushes into $0.00001146 to $0.00001200, momentum shifts bullish. Breaking above the 200 day EMA at $0.00001257 confirms trend reversal and opens a path toward $0.00001400.

- Bearish case: Failure to break EMAs sends price back to $0.00000980, with deeper downside toward $0.00000900 if selling returns.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.