Shiba Inu price today is trading at $0.00001241, holding steady after repeated defenses of the $0.00001230–$0.00001232 support band. The token remains pinned within a descending channel, with overhead resistance capped by clustered EMAs and the upper boundary of the downtrend. The market now faces a critical standoff between technical pressure and expanding cross-chain adoption news.

Shiba Inu Price Holds Support In Descending Channel

On the 4-hour chart, Shiba Inu price continues to trade inside a well-defined descending channel stretching back to mid-July. Support has been repeatedly defended at $0.00001230, where dip buyers have stepped in to stabilize losses. Overhead resistance converges near $0.00001270–$0.00001275, reinforced by the 200-EMA and the channel’s descending trendline.

Related: Ethereum (ETH) Price Prediction: Foundation Sale Sparks Market Debate

Momentum indicators are leaning neutral. The RSI currently sits at 53, reflecting balanced sentiment after recovering from late-August lows. Short-term EMAs (20 and 50) remain tangled near price, showing compression that often precedes a breakout. A clean move above $0.00001270 would likely flip momentum bullish, while a failure to hold $0.00001230 risks reopening a decline toward $0.00001180 and potentially $0.00001120.

Chainlink Partnership Expands SHIB’s Cross-Chain Reach

Beyond technical patterns, fundamentals have strengthened after Shiba Inu announced a major integration with Chainlink’s Cross-Chain Interoperability Protocol (CCIP). SHIB is now the first meme token listed on Folks Finance, enabling cross-chain lending and borrowing functionality.

This listing allows SHIB holders to use their tokens as collateral, borrow against them, or earn yield across multiple blockchains. Folks Finance emphasized SHIB’s unique position as the “first memecoin with cross-chain lending markets,” highlighting the community’s growing push into decentralized finance.

Chainlink’s CCIP integration is not new to the ecosystem. Last year, SHIB, alongside tokens like BONE and LEASH, adopted CCIP to expand availability across a dozen blockchains. The new lending utility reinforces SHIB’s status as one of the few meme coins progressing beyond speculative use into functional DeFi adoption.

Related: Cardano (ADA) Price Prediction: Analysts Predict $0.92 Breakout

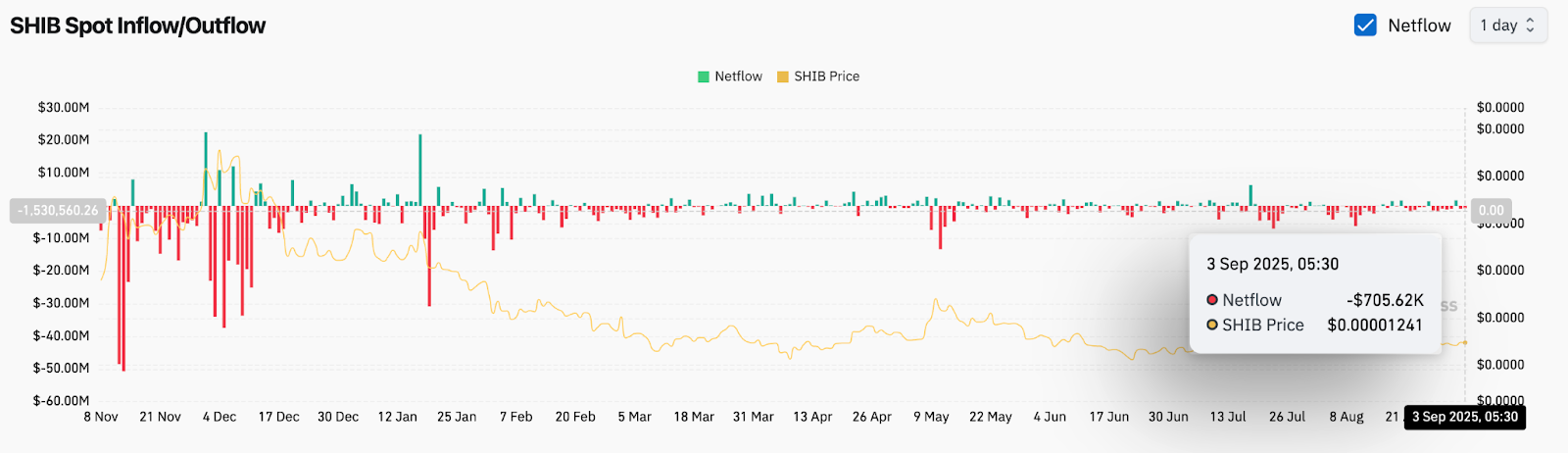

Net Outflows Point To Investor Caution

On-chain data shows that while the news has bolstered sentiment, investor flows remain cautious. According to Coinglass, Shiba Inu recorded $705,000 in net outflows on September 3, reflecting profit-taking and reduced exchange demand despite the upgrade announcement.

This trend fits with the broader pattern of subdued activity since July, where consistent outflows have capped price rallies. The lack of sustained inflows underscores that many traders remain defensive, waiting for stronger catalysts before committing fresh capital. Analysts suggest that for SHIB to break above $0.00001300 with conviction, inflows would need to shift decisively positive, ideally above the $10–$20 million daily range seen during prior rallies.

Technical Outlook For Shiba Inu Price

Technically, SHIB remains locked between well-defined levels. On the upside, clearing $0.00001270–$0.00001275 opens the path toward $0.00001350 and potentially $0.00001420, where a heavier supply zone awaits. The upper channel boundary and EMA resistance must be cleared to confirm this bullish leg.

On the downside, a breakdown below $0.00001230 would confirm renewed selling pressure. That could drag SHIB toward $0.00001180, with a deeper decline risking $0.00001120, the next critical support cluster inside the channel.

Bollinger Band tightening suggests volatility expansion is imminent. Combined with neutral RSI positioning, the next breakout move could come within days, depending on whether on-chain flows and DeFi headlines sustain buying interest.

Related: Solana (SOL) Price Prediction: Can Bulls Push Through $220?

Outlook: Will Shiba Inu Go Up?

The near-term direction for Shiba Inu price hinges on whether bullish catalysts like Chainlink-driven cross-chain adoption outweigh cautious investor flows. As long as SHIB holds the $0.00001230 floor, the setup favors an attempted retest of $0.00001350. A decisive inflow shift would strengthen the case for a breakout toward $0.00001420.

However, without increased exchange participation, the odds continue to favor further consolidation. Traders are currently observing the $0.00001230 support and $0.00001270 resistance as the pivotal points that will shape SHIB’s future trajectory.

Forecast Table: Shiba Inu Price Levels

| Level | Key Zone | Implication |

| $0.00001420 | Major resistance | Breakout target if bullish momentum builds |

| $0.00001350 | First upside target | Resistance before higher expansion |

| $0.00001270 | Short-term resistance | EMA cluster, breakout trigger |

| $0.00001230 | Critical support | Must hold to avoid breakdown |

| $0.00001180 | Secondary support | Next downside level if $0.00001230 fails |

| $0.00001120 | Deeper support | Bearish continuation risk |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.