- Shiba Inu loses triangle support while sellers defend the descending trendline and EMAs flip into resistance.

- Exchange outflows exceed $3.06M, signaling distribution as liquidity returns to exchanges.

- Breakdown exposes $0.0000080 liquidity zone, with deeper downside toward $0.0000072 if support fails.

Shiba Inu price today trades near $0.00000905, slipping below its multi-week consolidation range as sellers reject price at the descending trendline. The breakdown places short term pressure on buyers and exposes the $0.0000080 liquidity shelf as the next major downside target.

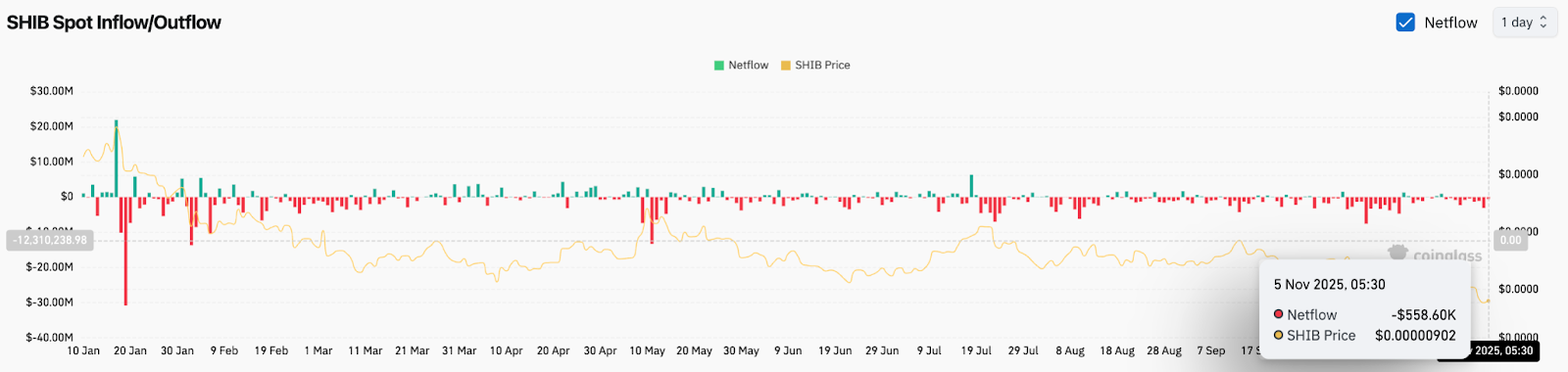

Spot Outflows Rise As Buyers Step Aside

Coinglass data shows $3.06 million in outflows yesterday, followed by another $558,600 outflow today, signaling active distribution. The streak of red netflow bars throughout October and November reflects holders moving tokens onto exchanges rather than withdrawing to cold storage.

When flows remain negative for consecutive sessions, liquidity leaves the ecosystem and price typically continues trending lower. In SHIB’s case, the selling pressure aligns directly with the technical breakdown. There is no evidence of spot accumulation yet. Buyers are not stepping in to defend the falling structure.

EMAs Flip Into Resistance As Breakdown Confirms Trend Strength

Shiba Inu lost the triangle support that had held for nearly two weeks. The rejection occurred exactly at the descending trendline drawn from the August high, confirming that the broader downtrend remains intact.

Price now sits below all major moving averages:

- 20 day EMA: $0.00001062

- 50 day EMA: $0.00001163

- 100 day EMA: $0.00001252

- 200 day EMA: $0.00001271

All EMAs are stacked downward and positioned above price, forming a ceiling. Every attempt to reclaim the 20 day EMA has been met with immediate selling, showing that buyers lack strength even for relief rallies.

The Supertrend indicator remains firmly red. Until SHIB closes above the Supertrend band, the trend cannot be considered neutral, let alone bullish.

Key Support Levels Are Now In Focus

SHIB’s current price action places immediate importance on the $0.0000088 to $0.0000080 zone, a level that last acted as a demand pocket in July. Losing this region opens a clear air pocket toward June’s swing low.

Below $0.0000080, the next visible liquidity area does not appear until $0.0000072.

This creates a simple downside sequence:

- Below $0.0000090, bears remain in control

- Losing $0.0000080 confirms a deeper correction

- Next major magnet becomes $0.0000072

Short Term Chart Shows Attempts To Stabilize

Smaller timeframes show buyers trying to slow the decline. On the 30 minute chart, SHIB regained the VWAP band after a brief oversold flush. RSI recovered above 50, showing intraday stabilization after the breakdown.

But the rebound lacks confirmation until price can close above $0.00000930, the intraday supply zone aligned with session VWAP. Until then, every uptick is a reactive bounce inside a larger downtrend.

Outlook. Will Shiba Inu Go Up?

The next move depends on how price reacts at the $0.0000088 to $0.0000080 support zone.

- Bullish case: SHIB rebounds from $0.0000088 and closes above $0.00001062 with volume. This clears the first resistance layer and allows a move toward the upper trendline at $0.00001200.

- Bearish case: A daily close below $0.0000080 exposes $0.0000072 and confirms continuation of the broader downtrend.

If price reclaims $0.00001062 and breaks above the Supertrend, momentum shifts. Losing $0.0000080 turns the move into a full correction toward $0.0000072.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.