- SHIB’s 200-EMA golden cross on the daily timeframe could trigger an uptrend in the long term.

- The token lacked liquidity due to the stagnancy in the OBV.

- Traders are not excited about its short-term prospects.

IntoTheBlock data revealed that Shiba Inu’s (SHIB) 90.16% decline from its All-Time High (ATH) has left 81% of its holders in a loss. This situation explains how the token has been unable to catch up with other cryptocurrencies during short-term rallies.

According to the crypto market insight platform, this performance has left SHIB’s correlation with Bitcoin (BTC) at 0.86. Although this correlation could be considered near perfect, it suggests that the meme has not followed BTC’s movement 100% in recent times.

However, SHIB’s inability to offer gains to its long-term holders might not be connected to submerged interest and a lack of liquidity alone.

SHIB’s bearish nature continues to linger

Instead, the emergence of Pepecoin (PEPE) has also played a part. Despite the drop in the token value, the broader crypto community still seemed to have their eyes on it.

This was because LunarCrush showed that its social engagement increased significantly over the last week. For the unfamiliar, when social engagement spikes, it means that search and discussion around an asset have increased. But how soon will SHIB exit this underwhelming performance?

Based on the daily chart above, SHIB has been unable to hold on to notable resistance. As of 19 April, the 0.00001549 psychological resistance fell sharply. And subsequent attempts have also ended futile.

In addition, the 20-day Exponential Moving Average (EMA) crossed the 50-day EMA (orange). The state of these indicators suggests that sellers are in control. Therefore, it could be difficult for SHIB to recover in the short term.

However, there was an upward crossover or golden cross of the 200-day EMA (purple) above the 20 and 50 EMAs on 9 March. A situation like this indicates that SHIB could establish a new uptrend in the mid to long term.

Meanwhile, the On-Balance-Volume (OBV) which measures buying and selling pressure has mostly stayed flatlined. At press time, the OBV showed that the intent of market players have swayed from buying and selling the token.

Shorts’ time to reign in the market

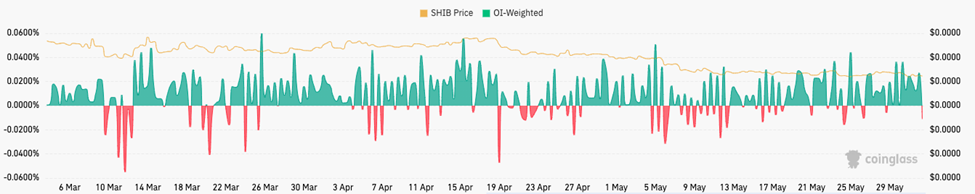

In terms of funding rate, Coinglass revealed that SHIB had gone negative. This means that traders holding short positions were willing to pay the funding fees of long position holders to keep their futures contracts open.

On the flip side, when the funding rate is positive, it implies bullishness with traders’ position. Hence, long-positioned traders would be willing to pay shorts.

In the long run, SHIB has the tendency to revive considering how it’s one of the top tokens held by whales. However, short-term expectations might continue languishing in the bearish area.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.