- MANA, GRT, and AAVE accumulated significant short positions, potentially setting the stage for further price gains.

- Funding rate data reveals that most traders are betting against these assets.

- Aave increased by 12.5% over the past week, with a 55% growth over 30 days.

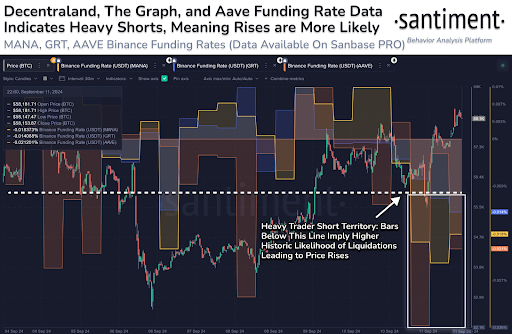

As the recovery rally in the cryptocurrency markets lingers, attention is drawn to Decentraland (MANA), The Graph (GRT), and Aave (AAVE). Data from Santiment shows significant short positions on Binance for these three top 100 assets, potentially setting the stage for price spikes driven by short liquidations.

Funding rate data reveals that the majority of traders are betting against these assets, pushing them into what Santiment identifies as “Heavy Trader Short Territory.”

Why High Short Positions Could Lead to Further Gains

Currently, MANA, GRT, and AAVE are seeing negative funding rates of 0.0184%, 0.0141%, and 0.0212%. Negative funding rates indicate that those holding short positions are paying fees to maintain their stance, suggesting a bearish sentiment.

However, this sets the scene for a possible short squeeze—a scenario where rising prices force short sellers to buy back their positions, further driving prices up.

Historically, when assets accumulate such a large short ratio, any positive price movement can trigger a cascade of buy orders from liquidations, propelling prices upward. This dynamic could lead to significant gains in MANA, GRT, and AAVE if the market recovery continues or experiences sudden upward momentum.

Over the last 24 hours, MANA’s price has risen by 3.3%, trading at $0.2714. The asset also shows a positive trend over the past week. GRT has experienced similar percentage growth in the same timeframe.

On the other hand, AAVE has seen more explosive performance in recent times. Trading at $149.64, AAVE has expanded by a substantial 12.5% over the past week. Zooming out to the 30-day timeframe, AAVE has grown by over 55%, while many other crypto assets, including MANA and GRT, post negative growth.

Essentially, traders betting against the upward trends of these altcoins seem unconvinced about their sustainability. However, historical data suggests their actions could, in fact, be paving the way for further price increases.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.