- Research indicates that the SOL market has been rising over the last day.

- Constant bidding from SOL buyers pushes the cost up by more than 6 %.

- As bullish momentum wanes, reversal signals become increasingly likely.

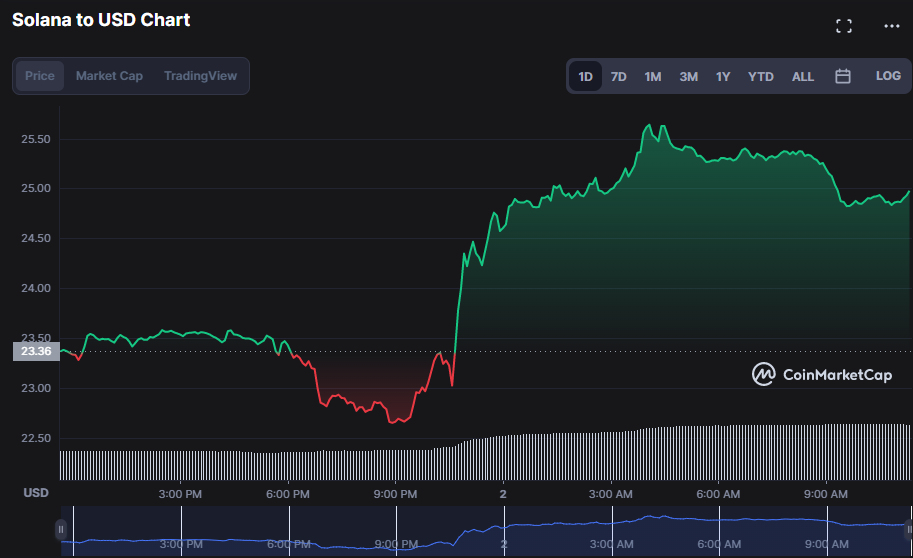

Despite encountering resistance at $25.68, Solana (SOL) bulls ultimately succeeded in their attempts to invalidate bear control over the last day. Until now, the SOL market had shown a positive trend that had sent the price up 6.93% to $24.96.

The bullish persistence paid off as the market cap increased by 6.92% to $9,284,622,068, and the 24-hour trading volume increased by 94.99% to $1,140,544,538. The increased trading volume over the last 24 hours for Solana (SOL) indicates that investors are becoming more confident about future success.

On the SOL 3-hour price chart, the Keltner Channel bands are rising north, with the top bar at $25.64 and the lower band at $22.96 confirming the market’s optimistic mood. This movement implies that the price of SOL may rise soon since it shows that demand for SOL is more significant than supply, which drives up the price.

The growing MACD, with a value of 0.12, confirms SOL’s positive mood as it advances from the negative region and over its signal line. The MACD histogram moves positively, rising above the 0-level to indicate more significant bullish momentum.

The stochastic RSI supports SOL’s optimistic sentiment by rising over the overbought threshold of 70, suggesting that SOL is in an uptrend and hence anticipated to grow in price further. However, with a reading of 93.13 and sliding below its signal line, the uptrend looks slowing. This level suggests that, although SOL is in an uptrend, it is toward the conclusion of the advance, and investors should consider taking gains and re-entering when there is a better entry opportunity.

The Aroon up reading of 78.57% and the Aroon down reading of 57.14%, both pointing south on the SOL price chart, reflect that the bullish momentum is fading. This move reveals that SOL may be transitioning from an uptrend to a downtrend because the Aroon up reading of 78.57% is decreasing, indicating that the uptrend momentum is losing strength. On the other side, the Aroon down reading of 57.14% is rising, indicating that the negative rate is strengthening and SOL may be entering a bearish phase.

The Chaikin Money Flow (CMF) reading of -0.13 validates this perspective, indicating that money is moving out of the market, increasing selling pressure and a negative mood. Furthermore, with a reading of 1.01, the Bull Bear Power (BBP) is heading south, indicating that a bearish reversal is impending.

Bulls must maintain pushing prices above the present resistance level in SOL if the steady advance continues.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.