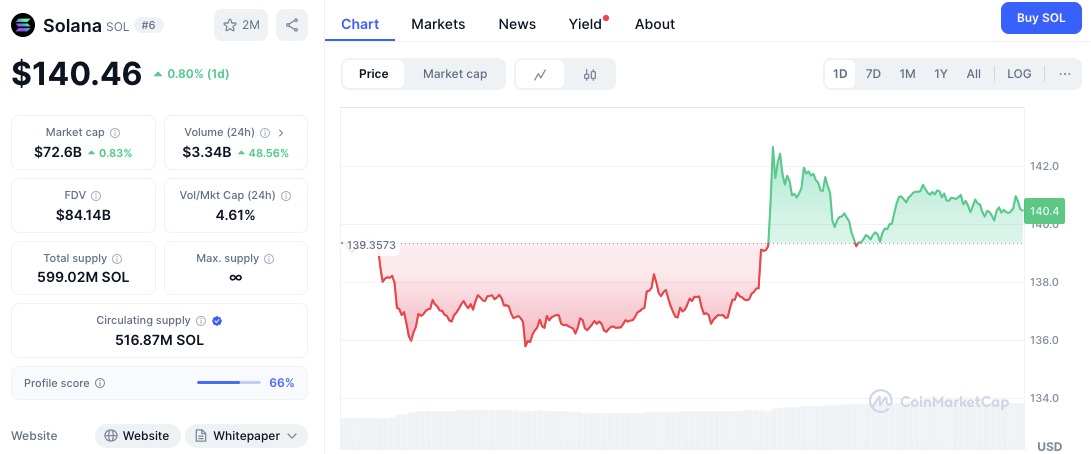

- Solana’s sharp momentum reveals reactive trading, but the long-term trend remains bullish.

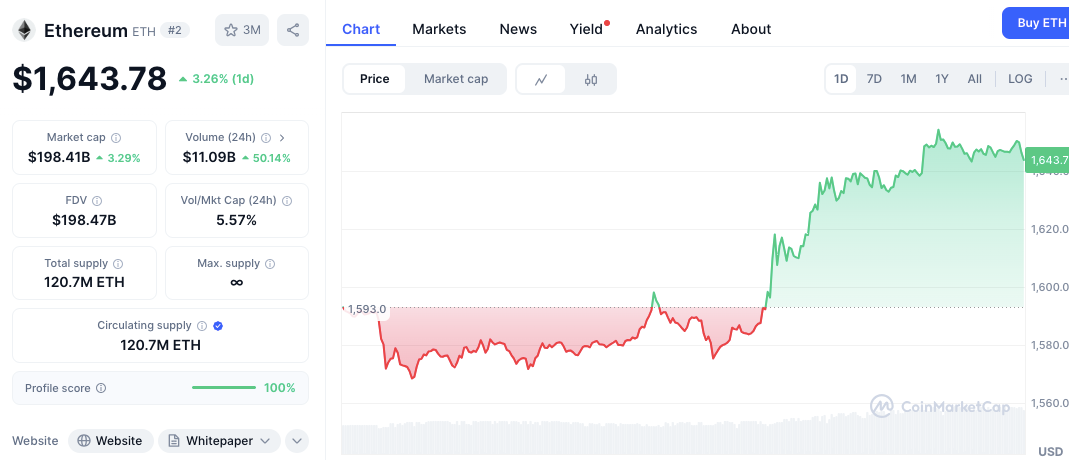

- Ethereum’s steady climb and volume growth show consistent investor confidence.

- Solana faces resistance at $142, while Ethereum aims for a potential $1,675 target.

The Solana-to-Ethereum price ratio (SOL/ETH) touched a surprise all-time high earlier today, briefly showcasing strong Solana momentum versus Ethereum before pulling back sharply.

That initial excitement swiftly faded as the ratio retreated further, reflecting trader hesitation. As per Coingecko data, Solana now trades at 0.08582 ETH, showing a 1.4% decline over the past hour and a 1.9% drop in the last 24 hours. Despite this minor setback, SOL has gained 6.3% over the past week, underscoring its resilience and continued bullish trend since mid-2023.

Ethereum, meanwhile, demonstrated more measured gains, holding key support and reinforcing its market position. While Solana showed flashes of sharp momentum, Ethereum’s behavior reflected long-term investor confidence.

Related: CoinGecko Report Breakdown: Solana’s Rise, Ethereum’s Dip in Q1 DEX Race

Price Action: Solana’s Spikes vs. Ethereum’s Stability

Solana’s price climbed to $140.63, rising 1.20% over 24 hours. After opening near $139.00, it dipped to $135.50 before rebounding.

The rebound wasn’t just technical; it showed traders quickly bought the dip, forming higher lows. A strong breakout occurred near $138.50, pushing prices above $140. After briefly topping $142, the price consolidated between $140 and $141.

Key support remains near $135.50, with $138.00 now acting as a floor. On the upside, $142.00 serves as resistance, while $144.00 stands as the next psychological barrier.

Related: Altcoin Season May Be Near: Key Technical Signal Emerges

Solana’s spike-then-retreat suggests reactive trading volatility, not yet confirming a durable uptrend, per analysts.

Ethereum’s Steady Climb Backed by Volume

Ethereum, priced at $1,650.17, moved more consistently. It opened around $1,591 and briefly dipped to $1,570 before building a base. It later broke out above $1,600 with increasing volume, climbing steadily to peak near $1,653. It now consolidates close to its intraday high, showing strength.

Support lies at $1,570 and $1,600, while resistance is seen between $1,653 and $1,655. The next potential target is $1,675 if momentum continues. Ethereum’s gains were smoother and supported by a 59.55% rise in trading volume, signaling strong buyer conviction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.