- Solana faces strong selling pressure as long liquidations hit $83.15 million.

- RSI at 25.14 signals oversold conditions, but no confirmed reversal yet.

- SOL may recover to $211.18 by December 2025, projecting a 49.85% price increase.

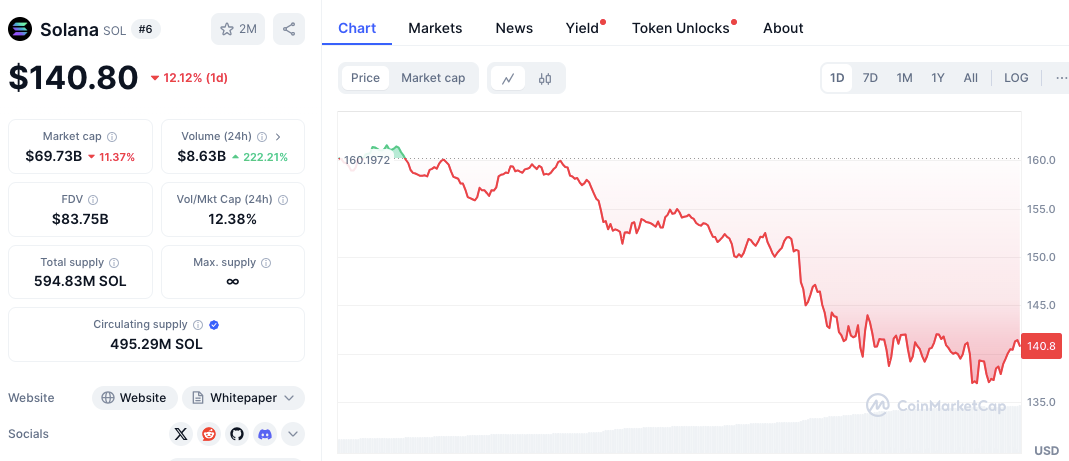

Solana (SOL) has recently seen a sharp decline, falling 11.79% in the past 24 hours to trade at $141.22.

Even with this downturn, its social activity now rivals Ethereum (ETH), showing growing interest in the asset.

$90M+ Solana Liquidations in 24 Hours

Over the same period, Solana saw liquidations of $90.91 million, with $83.15 million coming from long positions. Ethereum, on the other hand, recorded a 24-hour liquidation volume of $192.32 million, with longs contributing $176.60 million.

This data highlights strong long-side liquidations in both assets, pointing to heightened market volatility. Also, Solana’s market capitalization has fallen 11% to $69.94 billion, while its trading volume has surged 225.77% to $8.58 billion, indicating intense selling pressure.

Solana Price Downtrend Intensifies Below $150

Solana’s price started near $159.68 but began a continuous downtrend. The decline became more pronounced when the price fell below $150, a psychological support level.

The lowest point reached in this period was near $135, which now may serve as a potential support level. If the price fails to hold above $135, further declines toward $130 or lower are possible.

$145 Resistance Level in Focus for SOL

Currently, $145 is acting as immediate resistance. This level has been tested multiple times and could limit any short-term recovery. A stronger resistance level lies at $150, and breaking above it would be crucial for a potential rebound.

If Solana manages to regain strength above $145, there is a possibility of testing the $150 mark again. Still, a failure to sustain these levels could lead to more downward pressure.

Bearish Technical Indicators Persist for SOL

The Relative Strength Index (RSI) stands at 25.14, placing SOL deep into the oversold territory. This reading suggests that selling pressure has been excessive, which could lead to a short-term bounce if buyers step in.

However, an RSI below 30 does not always confirm an immediate reversal, and additional bullish signals are required for confirmation.

MACD Confirms Bearish Momentum

The Moving Average Convergence Divergence (MACD) further confirms the bearish outlook. The MACD line is at -3.73, significantly below the signal line at -12.15.

Related: Solana Dip: Binance Buys, But Should You? (Price Analysis)

This shows strong bearish momentum, with the histogram remaining in negative territory. As of now, no signs of a trend reversal have emerged.

Long-Term Outlook: Solana Price Recovery

Despite the current market volatility, Solana’s price is projected to recover over the long term. According to Coincodex price prediction, by December 2025 SOL is expected to trade between $208.62 and $214.04.

Related: Solana Whales Bet on Price Drop: Put Options Spike Before Token Unlock

This would represent a 49.85% increase from today’s price levels, assuming an average price of $211.18. Investors could see potential profits of 51.88% if the prediction comes true.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.