- Solana gains as trading volume spikes 48% amid rising Fed policy uncertainty.

- Bullish MACD and RSI suggest SOL may extend the rally if resistance at $143 is cleared.

- Political tension over Powell’s position triggers market focus on volatile assets like SOL.

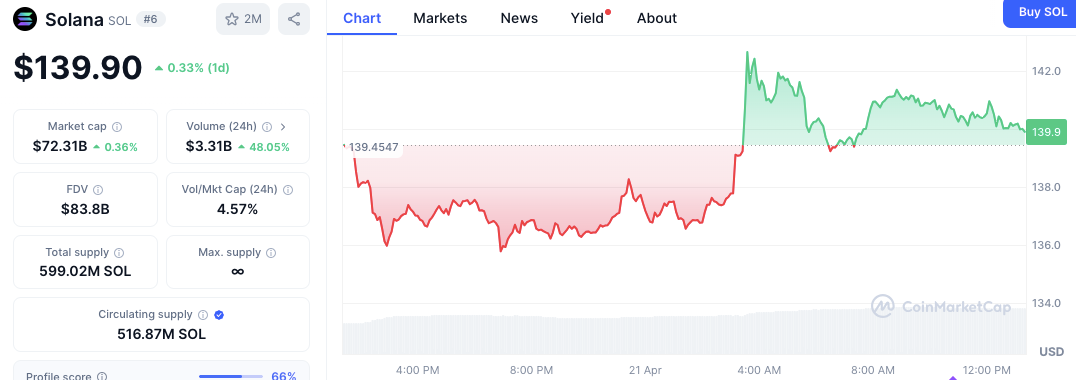

Solana (SOL) posted gains Monday, closing near $139.90 (+0.33% 24h) after a volatile session dipping below $136 then recovering strongly above $142. This price action coincided with high trading activity amid growing uncertainty over US monetary policy.

Market data showed Solana’s trading volume jumping over 48% ($3.31B), while its market cap reached $72.31B (Vol/Cap 4.57%). This points to heightened short-term trader participation, likely fueled by speculation surrounding the Federal Reserve’s leadership.

Related: Powell Speaks, Stocks Sink: Fed Chair Worried About Trump Tariff Fallout

Solana Technical Indicators Turn Bullish

On the technical side, Solana’s momentum has shifted in a favorable direction. The MACD shows a bullish crossover, with the MACD line at 2.87 crossing above the signal line at 2.35. The growing distance between the two lines and rising green histogram bars suggest increasing upward pressure.

Meanwhile, the RSI currently stands at 58.62. While this level is below the overbought mark of 70, it remains above the RSI moving average of 51.16. This position indicates that buyers are gaining control, with room for continued gains.

Fed Chair Powell Faces Rising Political Pressure

Solana’s volatile recovery coincided with rising political friction around Fed Chair Jerome Powell. President Trump notably intensified criticism last week over slow rate cuts potentially hindering economic growth.

In a social media statement, Trump wrote, “Powell’s termination cannot come fast enough!” This comment followed Powell’s remarks linking tariff-driven inflation to potential rate hikes, a view that contradicts the administration’s push for monetary easing.

Related: Did the Fed Just Crush Crypto and Stocks’ Recovery Hopes?

National Economic Council Director Kevin Hassett later confirmed that the White House is studying the possibility of removing Powell from office before the end of his term in May 2026. Powell, first appointed by Trump in 2018 and reappointed by former President Biden in 2022, currently oversees U.S. monetary policy during inflationary risk and economic transition.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.