- A SOL whale has unstaked 1,366,028 SOL worth around $198 million.

- The whale sent tokens to FalconX which deposited 440,202 SOL to Binance and Coinbase.

- SOL’s transfer volume has crashed from $1.99 billion in November 2024 to just $14.57 million now.

Solana (SOL) has been slipping, seeing a big drop in price and activity. Over the last month, SOL is down almost 40%, and the price is now around $140.54. That’s a steep drop from its 2024 high of $264.

While the price crash was part of a bigger market downturn, investors are wondering if SOL can bounce back.

Whale Activity Sparks Sell-Off Fears

Blockchain analysis platform Lookonchain reported that a whale unfroze 1,366,028 SOL (worth about $198 million) and sent it to FalconX.

Then, FalconX sent 440,202 SOL ($62.6 million) to exchanges, Binance and Coinbase. This looks like a possible sell-off, adding to negative feelings in the market.

Transfer Volume Plummets, Confidence Wanes

Another big worry is the huge drop in Solana’s total transfer volume. Analyst Ali Martinez notes SOL’s transfer volume has plunged from $1.99 billion in November 2024 to just $14.57 million by February 23. This massive drop in activity shows less investor confidence and weaker network use.

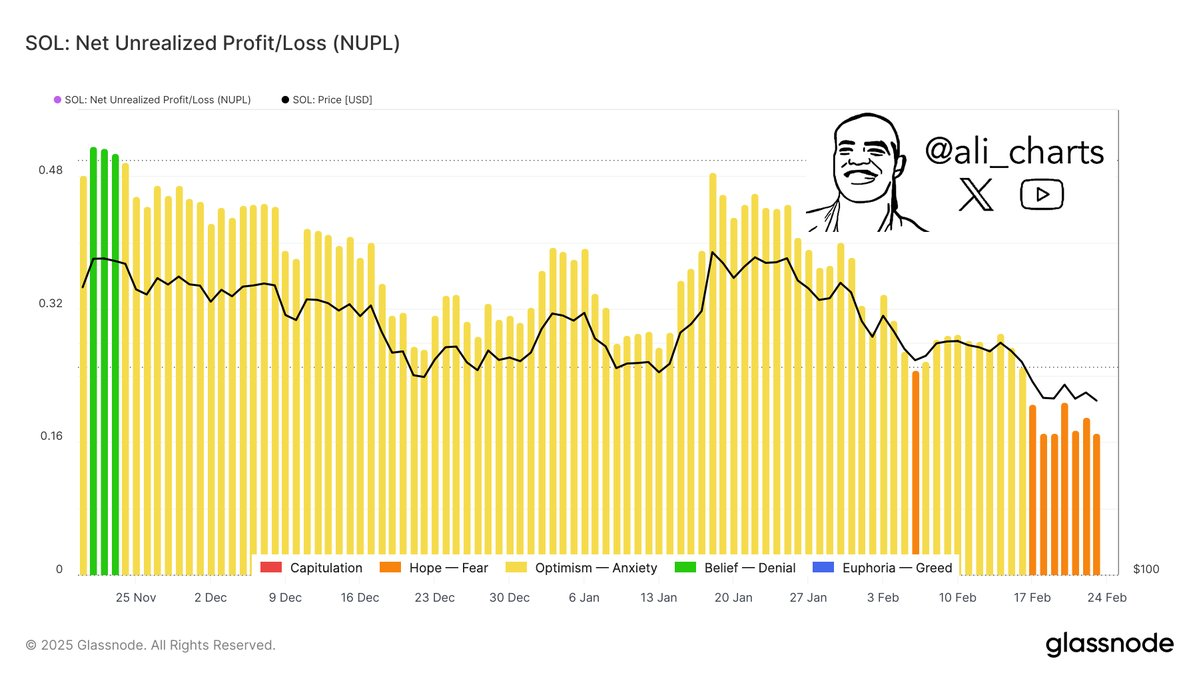

In another X (formerly Twitter) post, Martinez also noted that “SOL investors appear to be in a state of fear,” reinforcing the current bearish sentiment surrounding the asset.

Related: Solana Whales Bet on Price Drop: Put Options Spike Before Token Unlock

SOL Price Analysis: Key Levels to Watch

The 20-day Exponential Moving Average (EMA) for SOL is at $175.78, way above the current price. This difference shows strong downward momentum.

SOL needs to get back above this level for any real recovery. The daily chart from TradingView also confirms SOL’s bearish state.

RSI Signals Oversold, But Rebound Uncertain

The Relative Strength Index (RSI) is currently 26.07, as seen in the chart. This means SOL is oversold. Usually, an RSI below 30 suggests an asset is very undervalued and might see a short-term rise. However, the strong downtrend could limit any recovery.

Related: Crypto Market Plunges to “Extreme Fear” – Time to Buy?

Further, SOL is trading near the lower Bollinger Band at $140.32. This indicates SOL is experiencing high volatility and is testing a key support zone at $140. If this level breaks, the price could fall further.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.