- Solana price today consolidates near $199.30, capped by $214–$220 resistance and supported above $187.

- Derivatives open interest hit $9.74B with a 954% spike in options activity, signaling leverage-driven volatility.

- $66M in spot outflows shows profit-taking, though long-term accumulation patterns remain intact above $195.

Solana price today trades near $199.30, slightly lower on the day after a brief attempt to retest the $205 zone. The token continues to oscillate below its descending trendline resistance, with traders watching whether bulls can reclaim control before November’s volatility picks up.

Solana Price Action Tests Key Trendline Resistance

The daily chart shows SOL price consolidating within a descending triangle pattern that has persisted since late September. The structure caps price around $214–$220, while the lower boundary near $173 has repeatedly acted as a strong defense zone.

The 20-day EMA at $202.79 and the 50-day EMA at $197.72 are converging tightly, signaling a compression phase. The 200-day EMA, currently at $187.16, continues to act as a broader trend base. A breakout above $214 could confirm a shift in sentiment, paving the way toward $225, where the Supertrend resistance and prior distribution zone align.

On the other hand, a close below $187 would expose the $173 support, which marks the intersection of the year’s ascending base trendline and a strong historical pivot.

Derivatives Market Data Reveals Renewed Leverage Exposure

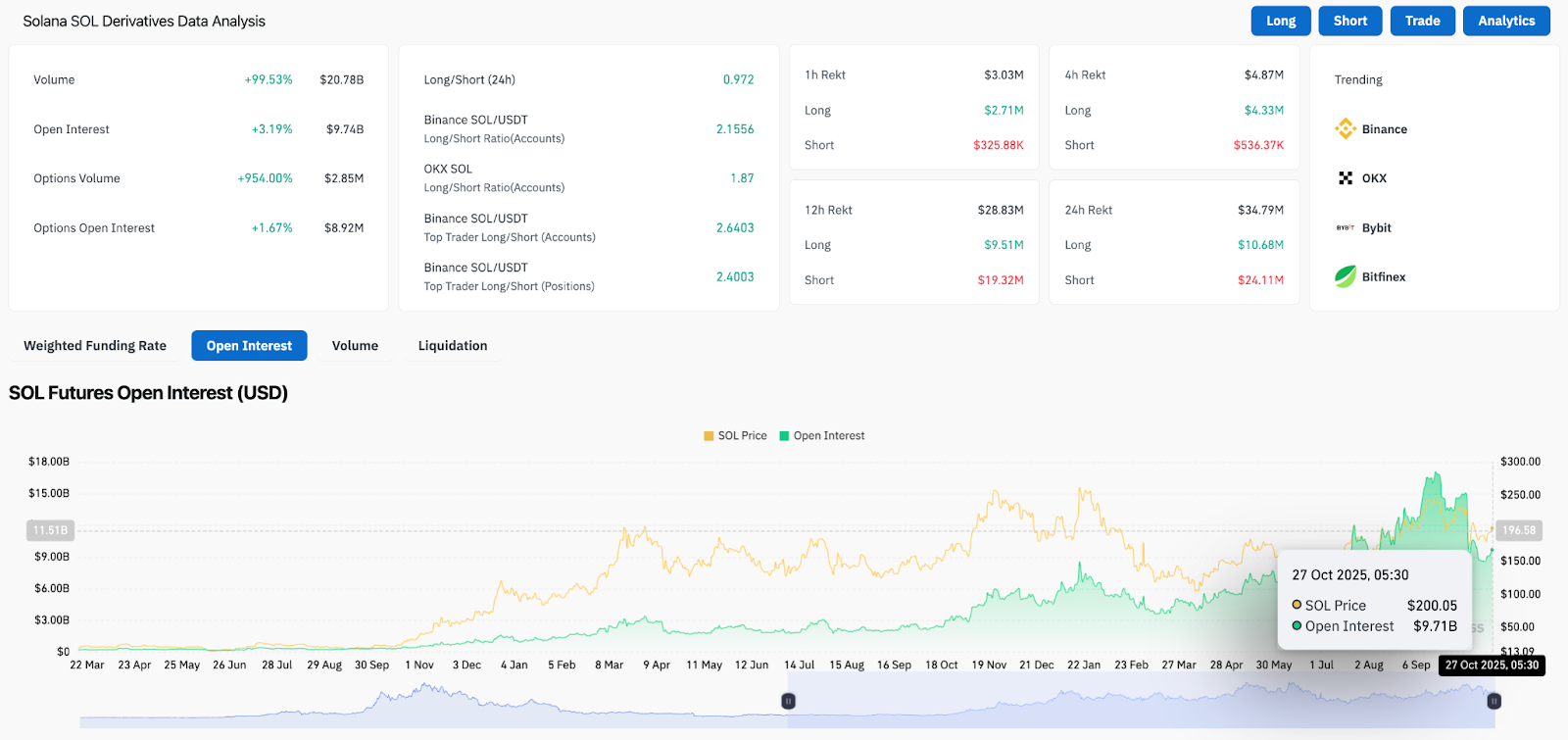

Coinglass data shows SOL futures open interest rising 3.19% in 24 hours to $9.74 billion, accompanied by a near 100% jump in daily trading volume to $20.78 billion. This reflects aggressive positioning among leveraged traders following last week’s rebound from $173.

Related: Cardano Price Prediction: Can 2,100 Validators and $1M Outflows Push ADA Higher?

The Binance long/short ratio stands at 2.15, while top trader positions show a higher bias of 2.40, suggesting optimism among institutional accounts. Meanwhile, options volume spiked 954%, a sharp increase indicating renewed speculative activity around key strike levels near $210 and $230.

Such a jump in derivatives activity often precedes volatility expansions. If long positions continue to dominate without spot inflows confirming the move, short-term shakeouts remain possible before a sustainable breakout forms.

Spot Outflows Show Investors Taking Profits

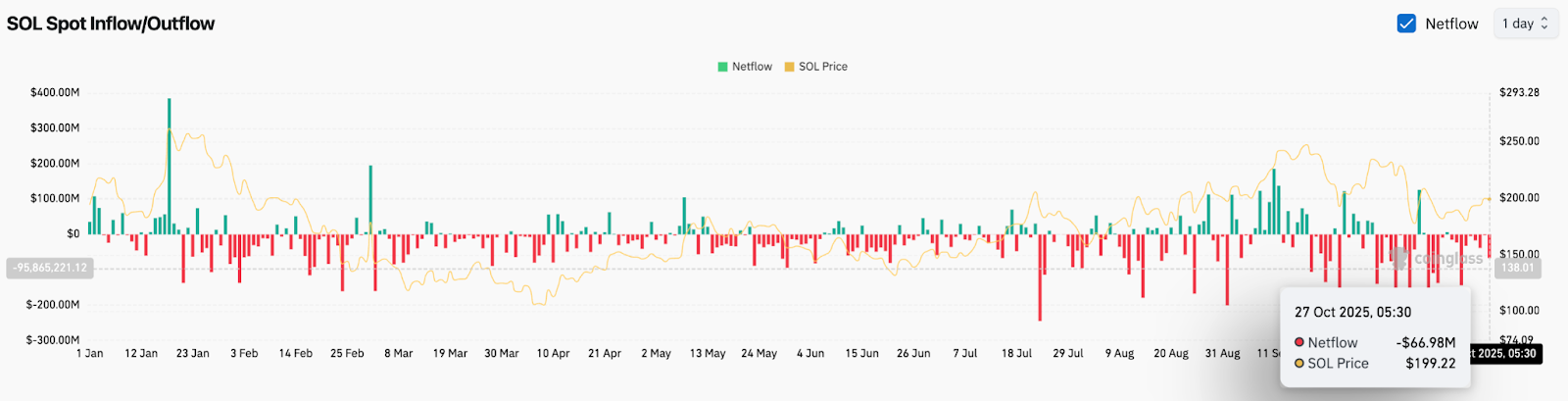

Solana’s spot netflows recorded $66.98 million in outflows on October 27, signaling that some traders are booking profits after the recent bounce. This marks one of the largest single-day net outflows in weeks, consistent with the pause seen around the $200 handle.

Despite this, longer-term accumulation patterns remain intact. Since mid-September, outflows have generally declined in magnitude, suggesting that while short-term traders are active, larger holders are not aggressively exiting positions. Sustained price action above $195 could stabilize sentiment and entice sidelined buyers to re-enter.

Short-Term Chart Holds Uptrend Amid Pullback

On the 30-minute chart, SOL price remains supported by a rising trendline extending from the $185 region. The Parabolic SAR dots continue to trail just above the current price, showing a short-term correction phase.

The VWAP at $202.99 and SAR resistance near $204.60 align with the immediate intraday ceiling. Reclaiming these levels would confirm a renewed bullish push toward $210. A failure to defend the ascending trendline around $198, however, could invite quick tests toward $193 before intraday buyers regroup.

Outlook: Will Solana Price Go Up?

For now, the Solana price prediction remains cautiously bullish. The structure of the market favors a potential breakout above $214, which could open the path to $225 and later $240, provided that leverage and volume align with spot inflows.

Related: Shiba Inu Price Prediction: SHIB Aims Higher as Buyers Regain Control

Conversely, a drop below $187 would indicate momentum loss, likely sending SOL back toward $173, where long-term support could be retested.

With derivatives activity surging and spot data showing mixed sentiment, Solana appears to be coiling ahead of a significant move. The direction will likely depend on whether bulls can defend the $195–$197 range while absorbing short-term profit-taking.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.