- Solana price today trades at $202, holding above $200–$194 support after rejection at $218–$220 resistance.

- Fidelity updates its Solana ETF filing, adding a strong institutional narrative despite fragile on-chain flows.

- $21.97M in net outflows and falling derivatives volume highlight cautious sentiment amid ETF-driven optimism.

Solana price today is trading near $202, struggling after losing the $218–$220 resistance zone. Buyers are defending the $200 support, but momentum remains fragile after the sharp September pullback. The market now weighs ETF optimism against mixed on-chain flows.

Solana Price Holds Rising Channel Support

The daily chart shows Solana clinging to the lower boundary of its rising channel, with immediate support at $200 and deeper demand near $194. The 20-day EMA sits at $218, acting as the first major ceiling, while the 50-day EMA at $209 adds layered resistance.

The Parabolic SAR flipped bearish earlier this week, signaling downward momentum. Still, the broader uptrend remains intact as long as SOL stays above $194 and the 100-day EMA at $196. The key battle lies at $218, where rejection could invite further downside toward $181.

Fidelity ETF Filing Adds Fundamental Catalyst

Investor sentiment improved after Fidelity updated its spot Solana ETF filing to use generic listing standards. This move strengthens the case for eventual approval and positions Solana alongside Bitcoin and Ethereum in institutional product pipelines.

Market analysts suggest that even a pending ETF application provides a narrative tailwind, attracting speculative flows and reinforcing Solana’s standing as a top-tier blockchain. If approvals advance in the U.S., demand for SOL could scale significantly.

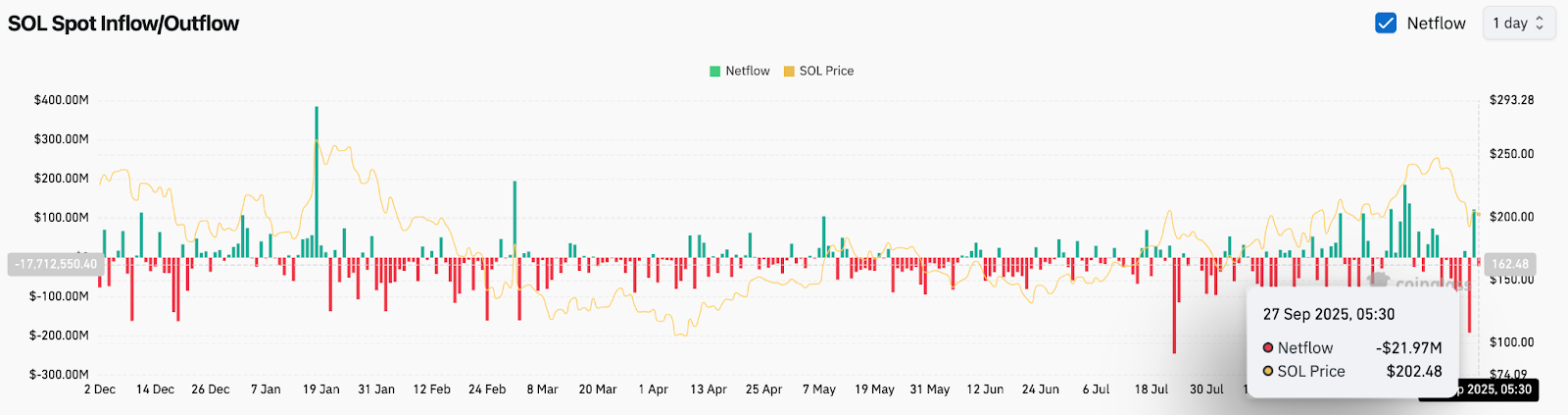

On-Chain Flows Show Renewed Outflows

Exchange data shows a $21.97 million net outflow on September 27, reflecting selling pressure at recent levels. The negative flow follows a series of mixed prints in September, underscoring fragile investor appetite.

While persistent outflows signal caution, traders argue that heavy selling may already be absorbed given the size of Solana’s summer rally. Sustained positive flows will be required to restore confidence and help SOL reclaim higher resistance zones.

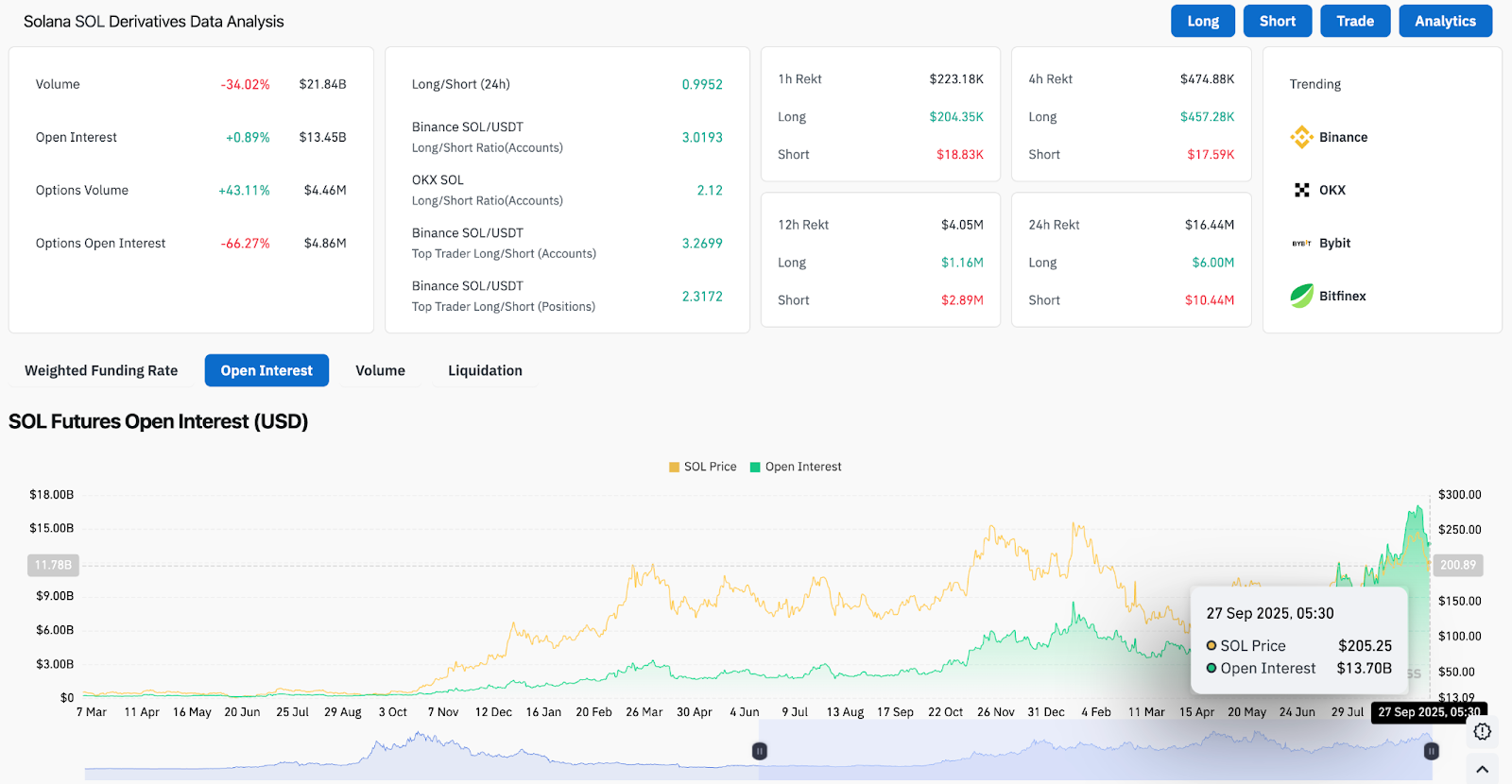

Futures Data Highlights Cautious Positioning

Derivatives data reveals a divided picture. Solana open interest rose slightly to $13.7 billion, reflecting sustained participation, but daily trading volumes dropped by 34% to $21.8 billion. Options activity surged, though open interest collapsed by more than 60%, suggesting selective hedging rather than broad speculation.

Long/short ratios tilt bullish, with Binance’s top traders holding more longs than shorts. This suggests that large accounts continue to lean optimistic, even as broader volumes decline. A shift back above $218 could invite more aggressive leverage.

Technical Outlook For Solana Price

Solana price prediction for the short term centers on the $200–$194 support band. Holding this level keeps the channel structure valid, while a breakdown risks opening the door to $181. On the upside, clearing $218 would confirm bullish continuation toward $234 and $252.

- Upside levels: $218, $234, and $252 as key resistance points.

- Downside levels: $200, $194, and $181 as critical defense zones.

Outlook: Will Solana Go Up?

The immediate path for Solana hinges on whether ETF optimism can offset fragile flows and technical rejection at $218. As long as buyers protect $200, the broader bullish cycle remains intact. A decisive breakout above $218 would shift momentum toward $234 and potentially $252.

If SOL loses $194, however, sellers could regain control and drive price toward $181, delaying the next bullish leg. For now, Solana remains in a consolidation phase where institutional headlines and spot demand will determine the direction of the next breakout.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.