- Solana price today trades near $185, defending $181 channel support as ETF optimism builds.

- SEC approval of 21Shares’ Solana Spot ETF fuels institutional demand expectations despite shutdown delays.

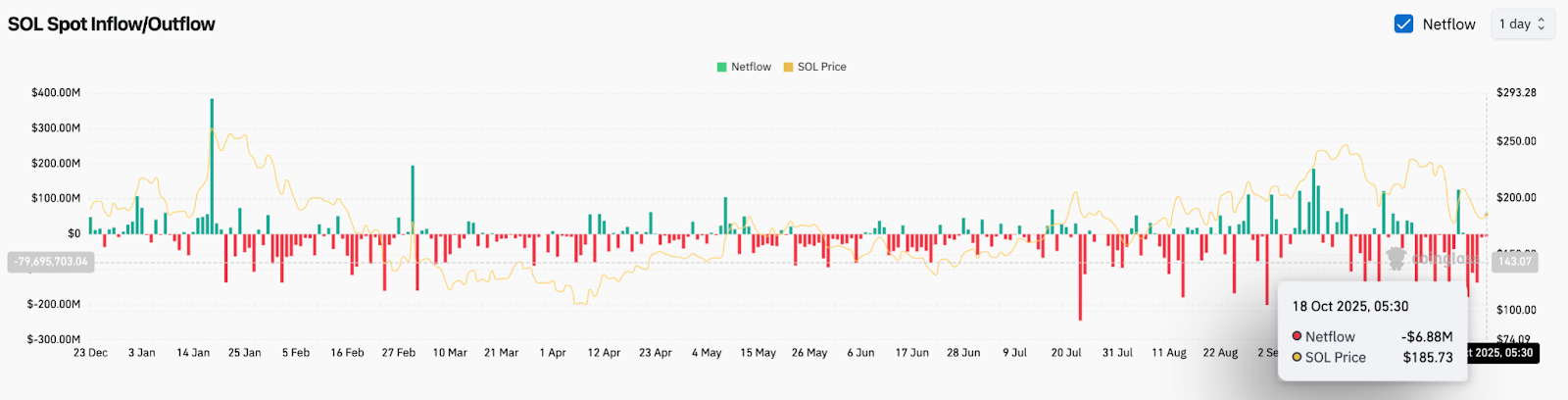

- Netflows show selling pressure easing, with analysts eyeing a breakout above $207 toward the $246–$300 range.

Solana price today trades near $185, rebounding from $181 support as buyers defend the rising channel that has guided the uptrend since March. The daily chart shows price holding above the long-term trendline even as the 20-day EMA at $203 continues to cap near-term rallies.

Analysts say the recent SEC approval of the 21Shares Solana Spot ETF could spark the next major leg higher if momentum strengthens above the $207 resistance. With the broader crypto market stabilizing, Solana is again positioned at a key technical and regulatory inflection point.

Solana Price Holds Long-Term Channel Support

The daily structure shows Solana trading within a clear ascending channel, with trendline support aligning near $180. The 200-day EMA sits close by at $186, reinforcing the same level as a crucial defense zone.

Short-term EMAs remain compressed above the market, suggesting that a sustained close above $203–$207 would flip market sentiment bullish. The 50-day EMA has acted as resistance since early October, and reclaiming it would likely confirm the start of a new upward phase.

The RSI reading of 40.59 highlights cautious momentum, but it is now near oversold levels seen in previous local bottoms. A rebound from this range could mirror prior recoveries that led to double-digit percentage gains within weeks.

ETF Approval Ignites Institutional Hopes

The U.S. SEC’s approval of 21Shares’ Form 8-A registration for the Solana Spot ETF marks the first step toward a fully tradable Solana product on the Cboe BZX Exchange. This move makes Solana the next major altcoin to cross the regulatory milestone after Bitcoin and Ethereum.

Traders view this as a landmark moment for market maturity. According to Polymarket data, odds of a full Solana ETF approval by year-end stand at 99%, while Digital Asset Treasuries (DATs) accumulated more than $2 billion worth of SOL in September, up 230% month-on-month.

However, the ongoing U.S. government shutdown has delayed the SEC’s review of S-1 filings, meaning trading may not commence immediately. Still, analysts see this delay as temporary, noting that other issuers, such as Bitwise and Grayscale, could follow 21Shares once normal operations resume.

Solana Flows Show Stabilization After Sharp Outflows

Exchange data from Coinglass reveals that Solana recorded a net outflow of $6.88 million on October 18, one of the smallest in recent sessions. The moderation in outflows follows a week of heavy selling, suggesting selling pressure is starting to ease.

Throughout 2025, Solana’s netflow profile has oscillated sharply, with multiple inflow spikes failing to hold as profit-taking emerged near each rally top. The recent decline in negative flow magnitude hints that capital is stabilizing, a necessary condition before the next major rally attempt.

Market participants say that consistent inflows above $50 million would signal renewed institutional conviction, potentially confirming that large buyers are positioning ahead of ETF market openings.

Technical Outlook For Solana Price

Immediate resistance sits at $203 and $207, where both the 20-day and 50-day EMAs converge. A decisive close above this area would confirm bullish continuation toward $246, followed by $253 and $270 as secondary targets.

On the downside, support remains firm at $181 and $170, corresponding to the rising trendline and prior liquidity zones. A failure to hold these levels would risk deeper retracement toward $160, though that scenario currently appears less likely given improving market sentiment.

Outlook: Will Solana Go Up?

Solana price prediction for the short term remains cautiously optimistic. The combination of ETF approval, steady on-chain accumulation, and technical support around $180 offers a constructive setup for recovery.

As long as Solana price today holds above the 200-day EMA near $186, the bias leans toward upside continuation. A breakout above $207 would likely confirm renewed momentum, opening the door to a test of $246–$250 and eventually the $300 psychological target.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.