- Solana price today holds $193, with buyers defending the $186 support zone in a volatile week.

- Fidelity adds SOL access for $5.8 trillion in brokerage accounts, fueling optimism in long-term adoption.

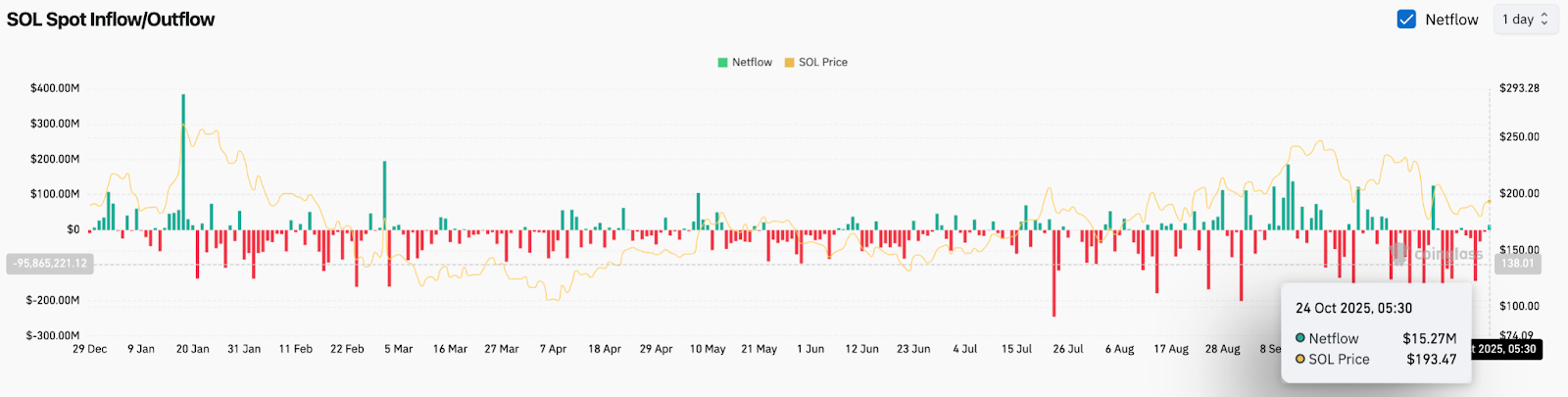

- Exchange flows show $15.27M in net inflows, but broader outflow trend keeps downside risks in play.

Solana price today trades at $193, holding a modest rebound after a volatile pullback from October highs. The token sits just above key technical support levels as traders weigh Fidelity’s move to make SOL accessible to all U.S. brokerage customers against the persistent pressure of exchange outflows.

Buyers Defend Channel Support As EMAs Converge

The daily chart highlights Solana price action consolidating within a long-term ascending channel. Price has recently tested the $186 zone, where the 200-day EMA provides structural support. The $196–$198 range, defined by the 20-day EMA and short-term cluster, now acts as an immediate pivot.

A sustained break below $186 would risk deeper downside into the $170 region, while buyers will need a close above $203 to restore confidence. The upper resistance remains formidable at $225–$230, coinciding with the Supertrend barrier and prior rejection zone.

For now, the Solana price prediction shows a balanced risk profile, with traders eyeing both a breakdown test and a potential channel rebound.

Fidelity’s $5.8T Access Opens New Door For Solana

News that Fidelity has added SOL trading access for its $5.8 trillion client base has energized market sentiment. The listing opens exposure to millions of U.S. brokerage accounts, a milestone for Solana adoption at the institutional level.

The announcement sparked social media buzz and provided a psychological lift, with Solana price today bouncing back toward the $193 area after briefly dipping below $190. This catalyst could help counteract near-term selling pressure, though technical resistance remains firm.

Exchange Flows Send Conflicting Signals On Solana Price Action

On-chain data reveals a nuanced backdrop for Solana price action. Exchange flow data shows $15.27 million in net inflows on October 24, hinting at renewed accumulation. Yet, the broader picture reflects weeks of persistent outflows, which have pressured Solana price volatility throughout October.

For traders, the flow trend remains critical. Sustained positive inflows could validate the Fidelity-driven narrative and support a push toward $203 and $214. A return to heavy outflows, however, may reinforce selling momentum and leave Solana vulnerable to a breakdown toward $170.

Outlook: Will Solana Go Up?

The Solana price prediction for October 25 hinges on the battle between fresh institutional access and technical fragility. Bulls need to defend $186 and reclaim $203 to set up a move toward $214 and $225. Inflows shifting positive would provide the conviction needed for a broader rally.

If buyers fail to hold the $186 floor, Solana could slide toward $170 before finding stability, with the channel uptrend at risk. The Fidelity listing offers a strong long-term catalyst, but near-term momentum still depends on reclaiming resistance.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.