- SOL stabilizes near $85, but momentum remains weak and trend is still corrective.

- Bulls must reclaim $90 to target $98.76–$108.33 Fibonacci resistance zones.

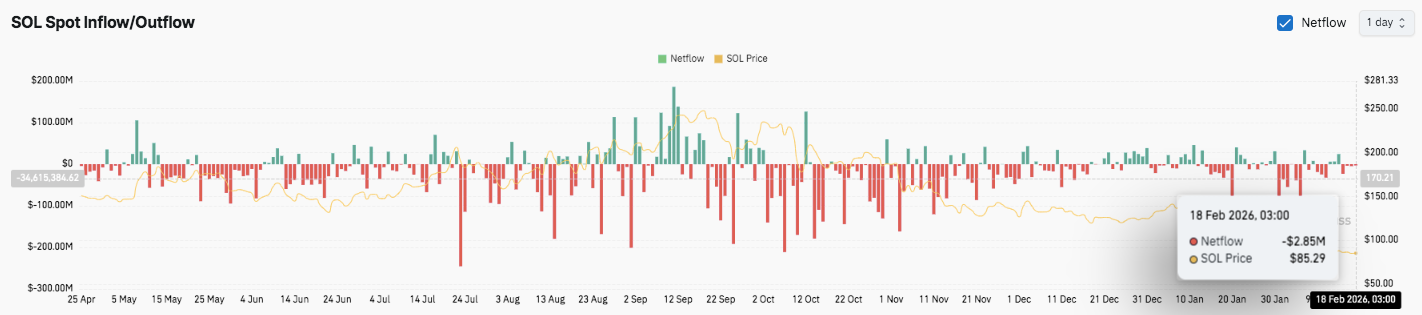

- Open interest contraction and cautious spot flows signal reduced speculative pressure.

Solana trades near $85 after a sharp correction from $148.88 to $67.78. The recovery on the 4-hour chart shows stabilization, yet momentum remains fragile. Price now hovers above short-term support between $83 and $85. Traders monitor whether this base can fuel a stronger rebound. However, broader structure still reflects a corrective phase rather than a confirmed trend reversal.

Trend Structure Signals Consolidation

The 4-hour trend shows gradual recovery from the $67.78 swing low. However, directional strength remains limited. ADX near 16 reflects weak trend momentum and favors range-bound action.

Besides, price struggles to establish higher highs above $90. Consequently, the market continues to compress inside a tight structure.

The $90 level acts as a psychological pivot. A decisive close above that zone could shift short-term sentiment.

Moreover, Fibonacci resistance at $98.76 and $108.33 forms the next upside targets. These align with the 0.382 and 0.5 retracement levels from the broader decline. Hence, bulls must reclaim $90 to open a path toward $100.

Support Zones and Liquidity Risks

Immediate support stands between $83.40 and $82.60. This zone aligns with recent mid-band structure and short-term demand. A breakdown below $82 would likely trigger renewed selling pressure. Consequently, price could revisit the $77–$78 liquidity sweep region.

Related: Bitcoin Price Prediction: BTC Consolidates Near $68K as Analyst Warns ETF Ownership is Hedged

Below that, $67.78 remains the macro swing low. A move toward that level would invalidate the current stabilization narrative.

However, buyers previously defended that zone aggressively. That reaction suggests long-term participants still view sub-$70 levels as value.

Derivatives and Flow Data Reflect Caution

Open interest expanded sharply into early 2026 before peaking above $10 billion. That surge accompanied aggressive long positioning and high volatility. However, open interest has now declined toward $5.1 billion. This contraction signals deleveraging and reduced speculative pressure.

Spot flow data also reveals persistent distribution since late September. Large exchange inflows aligned with prior pullbacks. Additionally, accumulation attempts lacked consistency. Recent net outflows remain modest, reflecting cautious positioning near $85.

Related: World Liberty Financial Price Prediction: WLFI Consolidates After January Spike in Open Interest

Technical Outlook for Solana (SOL) Price

Key levels remain clearly defined for Solana as price consolidates above recent swing support. After completing a full retracement toward $67.78, SOL now trades around the $85 region, holding above short-term structure.

Upside levels: $90 stands as the immediate psychological hurdle. A confirmed breakout could open the path toward $98.76 (0.382 Fib) and $108.33 (0.5 Fib). A sustained move above $108 would shift medium-term momentum back in favor of buyers.

Downside levels: $83.40–$82.60 acts as dynamic support. A breakdown below this zone may trigger a retest of $77–$78, the prior liquidity sweep region. Below that, $67.78 remains the macro swing low and critical structural support.

Resistance ceiling: The $90 pivot remains the key level to flip for renewed bullish continuation. Failure to reclaim it keeps SOL range-bound and vulnerable to pullbacks.

The technical structure suggests consolidation within a corrective phase rather than a confirmed trend reversal. Low trend strength readings reflect compression, which often precedes volatility expansion.

Will Solana Go Up?

Solana’s near-term trajectory depends on whether buyers can defend $83 while building momentum toward $90. Strengthening open interest alongside positive spot inflows would reinforce a bullish breakout scenario. In that case, SOL could challenge the $98–$100 cluster and potentially extend toward $108.

However, failure to hold $82 risks exposing the $77 liquidity pocket. A deeper breakdown would shift focus back to the $67 macro base.

For now, SOL remains at a decision point. The structure favors patience, while conviction flows will determine the next directional move.

Related: Ethereum Price Prediction: ETH Holds $2,000 As BlackRock Reveals 18% Staking Fee

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.