- Solana trades near $185 after rebounding from $180, defending its ascending channel base.

- Exchange inflows of $25M show accumulation as buyers step back in at discounted levels.

- Network stability at 6,000–10,000 TPS reinforces long-term confidence despite market volatility.

Solana price today is hovering around $185, stabilizing after a volatile session that saw a retest of its ascending channel support. The sharp intraday recovery from $180 highlights that buyers are defending key structural zones despite recent pressure across the crypto market.

Trading volumes have normalized after Friday’s 12% selloff, while the Solana Foundation’s latest update on network throughput helped restore confidence following the flash crash.

Solana Price Defends Channel Support

The daily chart shows Solana maintaining its long-term ascending channel pattern, with the lower boundary now acting as crucial support near $180. The 200-day EMA sits close at $186, reinforcing this demand zone. Overhead, resistance is stacked between the 20-day and 50-day EMAs at $212 and $216, respectively.

Momentum indicators have cooled off but remain constructive. The RSI at 35 shows near-oversold conditions, suggesting that sellers may be losing strength after the steep correction. If SOL holds above $180, a relief bounce toward the $200–$210 region remains likely.

A decisive close above $216 could flip near-term sentiment bullish, targeting the mid-channel resistance around $235. Conversely, losing $180 would expose the $165 area as the next major defense level.

On-Chain Flows Show Renewed Accumulation

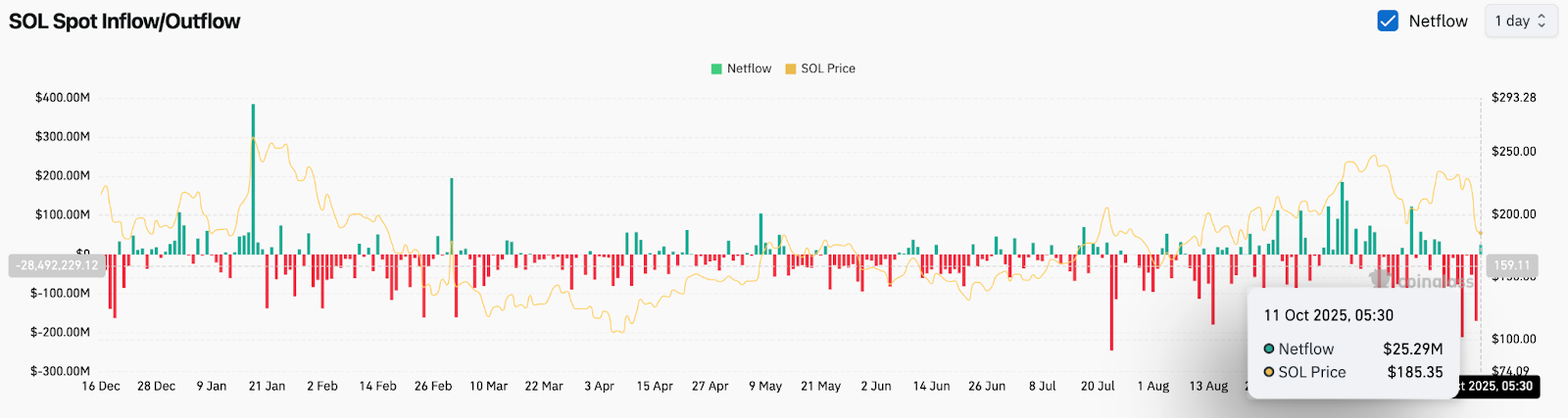

Coinglass data shows Solana recorded a $25.29 million net inflow on October 11, a notable shift from the previous week’s persistent outflows. This indicates that spot buyers are stepping back in at discounted prices.

The data also suggests that long-term holders are accumulating, with the inflows arriving as price tests the lower band of its channel. While overall sentiment remains cautious after the market-wide drawdown, this positive inflow trend offers a hint of rebuilding confidence.

Analysts note that if daily inflows continue above $20 million, Solana could see liquidity-driven support helping sustain price above $185 through the week.

Network Strength Reinforces Market Confidence

In a recent post on X, the Solana team highlighted that the network maintained performance during extreme demand, processing between 6,000 and 10,000 transactions per second while keeping median fees low. Utilization rates also reached near 60 compute units per block, demonstrating scalability under stress.

This operational stability reassured investors after a volatile week, contrasting with previous outages that had occasionally rattled sentiment. The ability to handle such spikes efficiently underscores Solana’s growing technological maturity and could serve as a long-term bullish signal.

Technical Outlook For Solana Price

Solana’s structure remains constructive as long as the channel base at $180 holds. The immediate resistance zone lies at $199–$212, where multiple EMAs cluster. Breaking through $216 would likely trigger momentum-driven buying, targeting $235 and $245.

If the price slips below $180, downside extensions could reach $165 and $150 — levels corresponding to prior liquidity zones and Fibonacci retracements. RSI recovery above 45 would strengthen the case for a near-term reversal.

Outlook. Will Solana Go Up

Solana’s short-term recovery depends on whether bulls can sustain support above $180 and reclaim the $200–$210 range. The combination of positive on-chain inflows, technical support alignment, and strong network performance points to improving conditions after last week’s liquidation-driven drop.

Analysts maintain a cautiously optimistic stance, projecting a potential rebound toward $230 if buying momentum returns. However, losing $180 would invalidate the bullish setup and shift focus to deeper support near $165.

For now, Solana’s resilience — both on-chain and on its network — gives buyers a reason to stay engaged while the broader market stabilizes.

Short-Term Technical Outlook For SOL Price

- Resistance: $199–$212, $216, $235

- Support: $180, $165, $150

- Bias: Cautiously bullish above $180

- Breakout trigger: Close above $216

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.